Image Source: ASML Holding NV – 2021 Annual Report

By Callum Turcan

The Dutch firm ASML Holding NV (ASML) makes the photolithography systems used by semiconductor foundries to produce “chips” that power the modern economy. In part due to its immense technological lead over its competitors, ASML Holding effectively has a monopoly at the high end of its industry, meaning its photolithography systems are required to produce the most advanced semiconductor components. The company also offers semiconductor equipment services and stands to gain immensely from ongoing growth in its installed equipment base. We’re huge fans of the company.

ASML Holding is a firm that we provide ongoing valuation coverage of in our periodic financial statements webinar. Be sure to sign up to the next webinar soon (more info on the last financial statements webinar here).

ESG Considerations

We include ASML Holding as an idea in the ESG Newsletter portfolio (more here), and there is a lot to like about this company. ASML Holding has “moaty” characteristics, giving it ample pricing power to offset inflationary headwinds (to a degree), and is backed up by its pristine balance sheet (nice net cash position). The firm’s capital expenditure requirements to maintain a given level of revenues are relatively modest, supporting its free cash flow generating abilities.

ASML Holding’s outlook is supported by incredibly powerful secular tailwinds that we will cover in a moment. We give ASML Holding an ESG rating of 94 (on a scale of 1-100, with 100 being the best) as the company scores well across all three categories (environmental, social, and governance).

ASML Holding is focused on recycling efforts to eliminate waste in its supply chain, with the goal being able to achieve net zero waste by 2030. It notes it had a 77% “material recycling rate” in 2021. Energy efficiency initiatives and pivoting towards renewable energy to power its operations represent how ASML Holding aims to achieve net zero carbon emissions at its own operations by 2025.

In 2021, renewable energy represented 92% of its energy mix at its global operations (that number stood at 100% for its Netherlands and US operations). By 2040, the firm aims to achieve net zero supply chain emissions (under more expansive definitions of attributable greenhouse gas emissions). These efforts are why ASML Holding scores well on the environmental side of things.

ASML Holding’s social score is decent due to the negligible risks its operations and products pose to consumers and its workforce, though its leadership team could be more diverse. The firm scores well on the governance side of things due in part to its executive compensation packages (pdf) taking return on average invested capital (‘ROAIC’) and sustainability measures into account.

Image Shown: We appreciate that ASML Holding’s executive compensation packages take ROAIC and sustainability measures into account. Image Source: ASML Holding – 2021 Renumeration Report (pdf)

Before getting into ASML Holding’s latest financials, it is important to lay out the powerful secular growth tailwinds the firm is capitalizing on.

Vast Growth Runway

Looking ahead, we expect demand for chips to grow at a robust pace in the coming years if not decades for several reasons. Modern cars require greater amounts of computing power to enable assisted- and self-driving technologies and new appliances are increasingly getting connected to the internet as part of the Internet of Things (‘IoT’) trend.

Rising data consumption worldwide supports the need for additional data centers and networking equipment to support that growth trajectory. Demand for greater computing power from laptops, PCs, smartphones, tablets, videogame consoles, and other consumer electronics will likely continue going forward to improve functionality and to support new technologies.

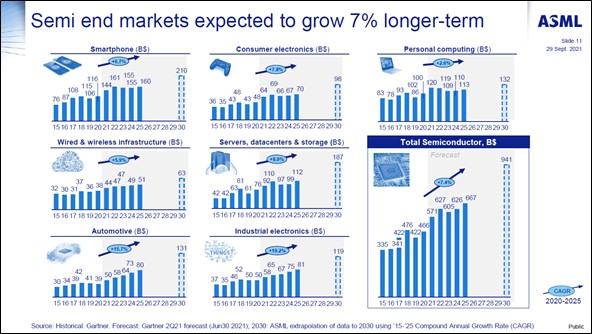

ASML Holding, citing third-party data, expects semiconductor component demand growth to be robust through 2030 as one can see in the upcoming graphic down below.

Image Shown: Demand growth for semiconductor components is expected to be widespread across many industries through the end of this decade. Image Source: ASML Holding – 2021 Investor Day Presentation -Corporate Strategy

In turn, forecasted growth in semiconductor component demand is expected to drive up demand for ASML Holding’s photolithography systems. Investments in semiconductor fabrication operations have been surging higher of late and that will likely continue going forward as the industry’s production capabilities are racing to catch up with robust demand.

Additionally, there is a desire from governments to shore up their domestic supply chains. Bringing new chip fabrication sites online and expanding existing facilities often requires those operations to acquire photolithography systems from ASML Holding, particularly if the facility is going to produce high-end chips. Furthermore, the company benefits from growing demand for its services concerning its installed equipment base.

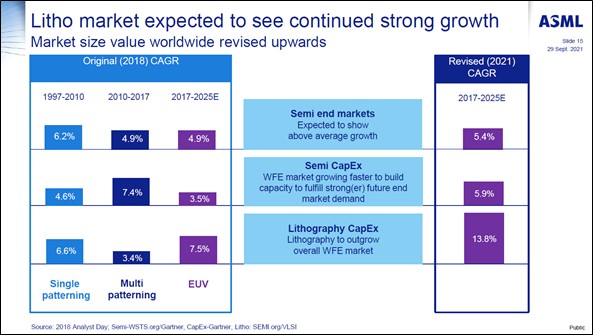

Image Shown: The demand outlook for ASML Holding’s photolithography systems is quite bright. Image Source: ASML Holding – 2021 Investor Day Presentation -Corporate Strategy

Since 2020, the world has been gripped by the shortage of semiconductor components. In response, companies that operate semiconductor fabrication sites have made big announcements that they would develop new facilities and expand existing facilities. [For reference, companies that do not design chips themselves and only operate the semiconductor fabrication sites are referred to as foundries. Chip fabrication sites refers to semiconductor production facilities.]

Taiwan Semiconductor Manufacturing Company Limited (TSM) is the world’s largest foundry and is another idea in the ESG Newsletter portfolio. This company intends to spend $40-$44 billion on its capital expenditures in 2022 developing new fabrication sites including in Arizona (construction started in 2021) and Japan (the project was announced in November 2021) to keep up with brisk chip demand. Its fabrication site in Japan represents a joint-venture between Taiwan Semi and Sony Semiconductor Solutions Corporation, a unit of Sony Group Corporation (SONY).

Additionally, Taiwan Semi is developing a new fabrication site in Taiwan while expanding the capabilities of its operational facilities. Steep pricing increases are helping offset the cost of Taiwan Semi’s big expansion plans, which in total are expected to cost around $100 billion in the medium-term (a three year target announced in 2021).

Many other semiconductor firms are racing to catch up with Taiwan Semi to meet their own needs and to grow their presence in the contract chipmaking (foundry) space. In March 2021, Intel Corporation (INTC) announced its ‘IDM 2.0’ strategy that aims to put its manufacturing problems behind it (in short, Intel was quickly falling behind its peers on this front).

This strategy along with Intel’s other initiatives will see the company develop new fabrication sites and expand existing facilities in the US (including in Arizona, Ohio, New Mexico, and Oregon), Europe (including in Germany, Italy, and Ireland), and Israel. Additionally, Intel is developing a new R&D hub in France and is expanding the assembly capacity of its operations in Costa Rica. These all represent major capital investments.

To put things into perspective, Intel intends to spend more than $20 billion initially developing a new fabrication site in Ohio and another $20 billion on expanding its presence in Arizona. Furthermore, Intel committing to spend up to EUR€80 billion in the European Union over the next decade, including EUR€17 billion on a new fabrication site in Germany. Intel intends to use these investments to enter the contract chipmaking business while also better enabling its internal production capabilities to meet the needs of its chip design business. The company is still turning to third-parties to meet an increasing amount of its chip fabrication needs in the medium-term.

Samsung Electronics Co Ltd (SSNLF) announced it would develop a new fabrication site in Texas in November 2021 which represents an estimated investment of $17 billion. This is by no means an exhaustive list.

Pivoting back to ASML Holding, all of these big announcements mean demand for its photolithography systems and related services should continue to increase going forward. Secular tailwinds combined with ASML Holding’s large technological lead underpins its bright growth runway. Many of the new fabrication sites planned by Taiwan Semi, Intel, and Samsung are geared towards producing the cutting edge chips that require ASML Holding’s latest photolithography systems.

Latest Earnings

In 2021, ASML Holding grew its GAAP revenues by 33% year-over-year to reach EUR€18.6 billion. That included just under EUR€13.7 billion in ‘net system sales’ and just under EUR€5.0 billion in ‘net service and field option sales’ as the company benefited from its growing installed equipment base. ASML Holding spent EUR€2.5 billion on its R&D expenses last year, equal to ~14% of its revenues.

Sales of its new lithography systems rose 21% year-over-year to reach 286 in 2021, with strong growth seen at its state-of-the-art extreme ultraviolet (‘EUV’) systems. Additionally, sales of its used lithography systems rose by one to hit 23 last year. ASML Holding refurbishes its photolithography systems when possible and also strives to recycle as many parts from its old systems as possible, which helps eliminate waste in its supply chain and highlights why ASML Holding complies with rigorous ESG investing standards.

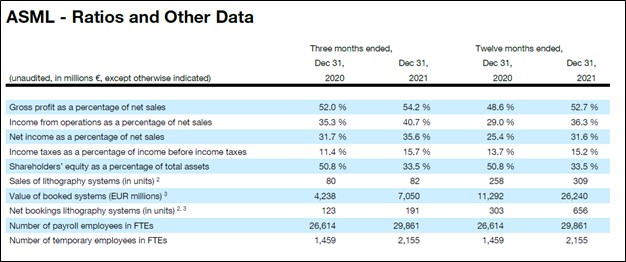

The company had net bookings worth EUR€26.2 billion in 2021 covering 656 photolithography systems. That was up sharply from net bookings worth EUR€11.3 billion in 2020 covering 303 photolithography systems, highlighting the positive impact industry-wide fabrication site expansion plans have had on ASML Holding’s business. Management forecasts ASML Holding will grow its net revenue by around 20% this year.

Image Shown: ASML Holding’s net bookings growth supports its growth outlook. Image Source: ASML Holding – 2021 US GAAP Financial Statements Package

The company’s GAAP gross margin came in at 52.7% in 2021, up from 48.6% in 2020, as ASML Holding benefited from its immense pricing power. Please note that management forecast the firm’s gross margin will hit 49% in the first quarter of 2022 due to shipment timing considerations and reduced upgrading activities, according to recent management commentary.

Going forward, growth at its EUV system sales (represented about a third of ASML Holding’s total revenues last year) should support its margin performance over the long haul as the firm scales up this business. Revenue growth and gross margin expansion helped ASML Holding to grow its GAAP operating income to EUR€6.8 billion in 2021, representing 67% year-over-year growth.

By 2025, ASML Holding expects to grow its annual revenues to EUR€24-€30 billion with a gross margin of roughly 54%-56%, which would represent stellar performance if realized. We are confident ASML Holding is up to the task.

At the end of December 2021, ASML Holding had a net cash position of