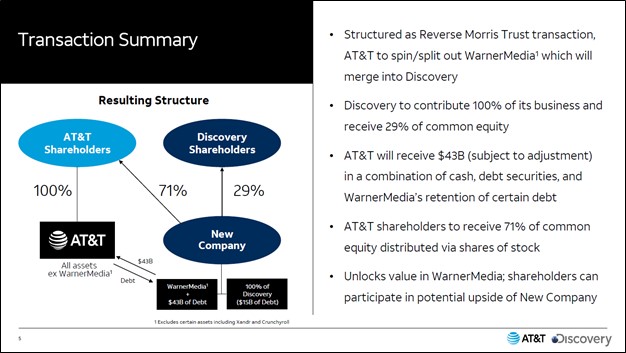

Image Shown: Announced back in May 2021, the blockbuster merger of AT&T Inc’s WarnerMedia unit with Discovery Inc is expected to close in the second quarter of 2022. Image Source: AT&T Inc & Discovery Inc – May 2021 IR Presentation

By Callum Turcan

The blockbuster merger of WarnerMedia, currently a part of AT&T Inc (T), with Discovery Inc (DISCA) (DISCB) (DISCK) is getting closer to completion. On March 11, Discovery shareholders voted on whether to proceed with the transaction. AT&T does not need to secure shareholder approval through a vote to close the transaction. If everything goes as planned, WarnerMedia and Discovery are set to close their merger during the second quarter of 2022. Let’s dig more into the details of this deal.

Overview

Shareholders of Discovery will own ~29% of the equity of the enlarged entity, dubbed Warner Bros. Discovery (‘WBD’), and AT&T will own the remaining ~71%. AT&T plans to conduct a tax-free spinoff to its shareholders of its equity in WBD, distributing 0.24 share of WBD for each share of AT&T. We appreciate that Discovery plans to consolidate its share structure into one class of common stock as part of this process.

AT&T intends to reduce its annualized dividend to $1.11 per share ($0.2775 per share on a quarterly basis) down from $2.08 per share currently ($0.52 per share on a quarterly basis) after the merger closes. This pending payout cut has stung investors, as has AT&T’s deal making over the past decade. AT&T pivoted from “empire building” (acquiring DirecTV in 2015 and Time Warner in 2018) to streamlining its operations in less than a decade.

The firm sold a 30% equity stake in DirecTV and other US video businesses in 2021 through a transaction that effectively split that operation from its core telecommunications businesses. In our view, this move set the stage for AT&T to potentially further wind down or even exit its DirecTV position in the coming years. Now, AT&T is getting close to parting ways with the assets of Time Warner.

AT&T

Though AT&T is a cash flow generating powerhouse, the company is contending with several hurdles that ultimately led management to decide to cut its dividend, despite reiterating its commitment to the payout as early as last year.

At the end of December 2021, AT&T had $178.6 billion in total debt (inclusive of short-term debt) which was moderately offset by $21.2 billion in cash and cash equivalents on hand. While the Discovery deal is expected to generate ~$43 billion in proceeds for AT&T (cash, debt securities, and WarnerMedia retaining certain debt), its net debt load would remain onerous and its annual financing expenses will continue to eat up cash flow.

AT&T spent $6.9 billion covering its interest expenses in 2021, down from $8.4 billion in 2019 but clearly still a major cash flow drain. Interest rates have been steadily climbing higher in recent months, which is putting upward pressure on the outlook for AT&T’s future annual financing expenses.

Last year, AT&T generated over $25.4 billion in free cash flow as $42.0 billion in net operating cash flow easily exceeded $16.5 billion in capital expenditures. However, AT&T expects that in order to support the ongoing development of 5G wireless networks in the U.S. along with efforts to aggressively grow its fiber internet service provider business in various domestic markets, it will need to boost its capital investments in the coming years.

AT&T had this to say in a press release when first announcing the merger in May 2021:

Expected increased capital investment for incremental investments in 5G and fiber broadband. The company expects annual capital expenditures of around $24 billion once the transaction closes. AT&T expects its 5G C-band network will cover 200 million people in the U.S. by year-end 2023. And the company plans to expand its fiber footprint to cover 30 million customer locations by year-end 2025.

Rising capital expenditure expectations at its core operations combined with the pending loss in cash flow from its spinoff of WarnerMedia and other recent divestments (such as selling a sizable stake in DirecTV) forced AT&T to make a decision. As its balance sheet is bloated, AT&T is clearly cutting the dividend to preserve its financial flexibility.

Companies with large net cash positions can use their balance sheet to help cover their dividend obligations. On the other hand, companies with large net debt positions effectively have financing concerns competing with their dividend programs for capital, which can slow the pace of dividend growth, or even worse lead to dividend cuts.

In 2021, AT&T spent $15.1 billion covering its dividend obligations and its payout was fully covered by its free cash flow. The company expects to generate $20.0 billion (or more) in annual free cash flow when the deal closes, and its smaller dividend is expected to consume ~40% of its annual free cash flow (roughly $8.0 billion per year). AT&T is freeing up the financial capacity to step up its annual capital expenditures to ~$24 billion, a sharp increase from the $16.5 billion spent in 2021.

Looking ahead, growth at its wireless services and Internet provider services businesses are expected to drive AT&T’s revenues higher by a low single-digit CAGR while its non-GAAP adjusted EBITDA and adjusted EPS are expected to grow by a mid-single-digit CAGR in the coming years.

When the merger of WarnerMedia and Discovery closes, AT&T forecasts it will have a net debt to adjusted EBITDA ratio of 2.6x, which is expected to drop down below 2.5x by the end of 2023. AT&T noted that when its leverage ratio is below 2.5x, share buybacks could enter the picture, though such a move would compete for capital against its dividend program and much needed deleveraging efforts.

In our view, AT&T should continue to prioritize investing in the business and deleveraging efforts. Share buybacks can be a solid use of capital, though not when the company does not have the financial capacity to do so without putting its future in jeopardy.

Warner Bros. Discovery

For Warner Bros. Discovery, the deal is expected to unlock $3.0 billion in annualized cost synergies. The firm will be a juggernaut in the video streaming services space with HBO Max and Discovery+ representing its two leading services. When the deal was first announced, AT&T and Discovery noted that WBD would generate ~$52 billion in revenue, adjusted EBITDA of ~$14 billion, and would have a free cash flow conversion rate of ~60%.

Within the relevant press releases, presentations, and transcripts of management commentary, the calculations of the forecasted free cash flow conversion rate were not explicitly laid out, though usually it is as a percentage of net income for a given period. In any event, WBD is expected to be a very free cash flow positive entity.

By 2023, WBD aims to generate around $15.0 billion in revenue per year from its direct-to-consumer (‘D2C’) business, made possible through expected paid subscriber growth at its video streaming services and potential price increases. When the deal closes, WBD will have a bloated balance sheet with a net debt to adjusted EBITDA ratio of roughly 5x that is expected to fall down to around 3x within 24 months after closing.

The enlarged firm’s promising growth outlook and targeted cost synergies should support its free cash flow generating abilities going forward. WBD can use those free cash flows to delever its balance sheet in the medium term, which is the stated goal. Discovery does not currently pay a dividend and that is unlikely to change after the merger.

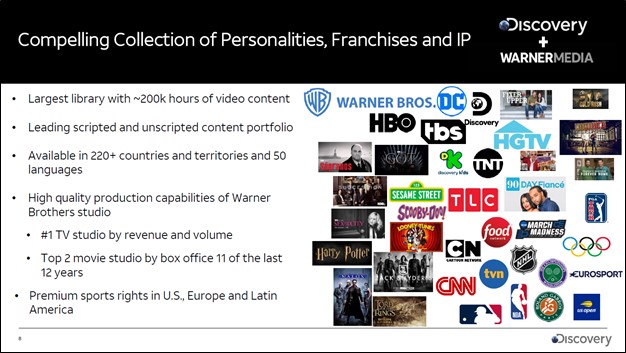

WBD will need to invest heavily in original content to support growth at its video streaming services businesses. Both WarnerMedia and Discovery are already major entertainment content producers and should be able to continue delivering on that front. One of the big properties of WarnerMedia is CNN, which is reportedly getting ready to launch its own streaming service CNN+ sometime in Spring 2022.

Image Shown: Warner Bros. Discovery will be an entertainment content producing powerhouse with a large stable of IP and media properties that it can leverage to grow its video streaming services while supporting the performance of its other operations. Image Source: AT&T & Discovery – May 2021 IR Presentation

Concluding Thoughts

As of this writing, roughly $6-$7 of AT&T’s per share stock price is represented by the value of the pending 0.24 share in ‘Warner Bros. Discovery’ that stockholders are set to receive (0.24 share of Discovery multiplied by the current stock price of DISCA). That implies the value the market is currently placing on AT&T’s remaining operations is ~$16-$18 per share as of this writing (removing the value of the pending Discovery share spinoff from this picture).

In our view, there are likely investors out there that are waiting for the WarnerMedia-Discovery merger to close before considering AT&T as an income generating investment and the new firm WBD as a capital appreciation opportunity.

When the deal closes, assuming it does, AT&T will be better able to communicate its new strategy to shareholders. AT&T is set to hold its big 2022 Analyst Day Event on March 11, which will mark the beginning of a new era. The company will likely have more to say on its guidance and overall corporate strategy during the event.

Our fair value estimate for T sits at $35 per share, significantly above where shares of AT&T are trading at as of this writing, though the low end of our fair value estimate range sits at $28 per share. AT&T has a lot of work to do to win back income seeking investors, and it may take years and years for the firm to repair its reputation.

We are keeping a close eye on the deal, but we are not interested in either company at this time.

—-

Telecom Services Industry – CMCSA, LUMN, DISH, T, TMUS, VZ, SBAC, AMT, CCI, VIAC

Related: AMZN, DIS, FUBO, NFLX, ROKU, DISCA, DISCB, DISCK, SONY, PARA, PARAA, CNK, CNNWF, IMAX, MCS, RDI, CPXGF, NCMI, FOX, FOXA

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of FB and XLE and is long call options on FB. The Walt Disney Company (DIS) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. American Tower Corporation (AMT) and Crown Castle International Corp (CCI) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.