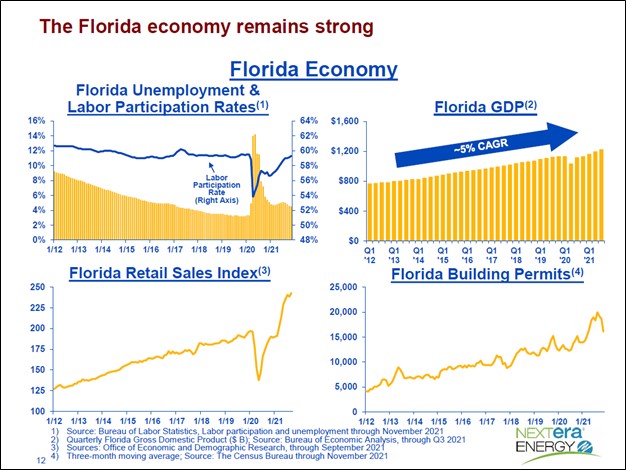

Image Shown: NextEra Energy Inc, one of our favorite utilities, owns the largest regulated electric utility in Florida and has exposure to the state’s promising population and economic growth trajectory. The utility is shifting its power generation base away from coal and towards renewable energy, leaning on natural gas and nuclear power plants to make the transition feasible. Image Source: NextEra Energy Inc – Fourth Quarter of 2021 IR Earnings Presentation

By Callum Turcan

The U.S. utility sector (XLU) is home to some high-quality income generating opportunities, especially utilities with exposure to states that are experiencing strong population and economic growth. Rising interest rates down the road may be a concern, though geopolitical headwinds as a result of the Ukraine-Russia crisis may slow the pace of interest rate increases in the US and elsewhere versus expectations at the start of 2022. Please note that at the time of this writing (March 4, 2022), we are in the process of updating our coverage of the utility sector, including our fair value estimate, VBI ratings and written report on the space.

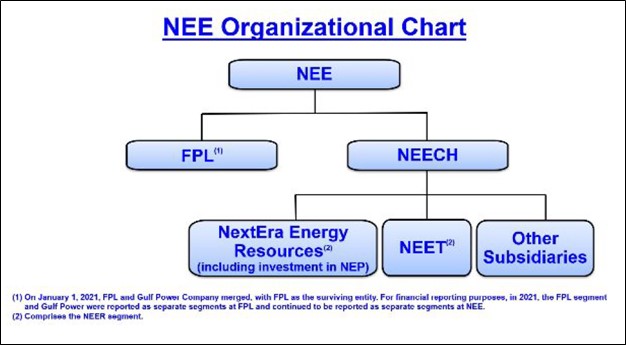

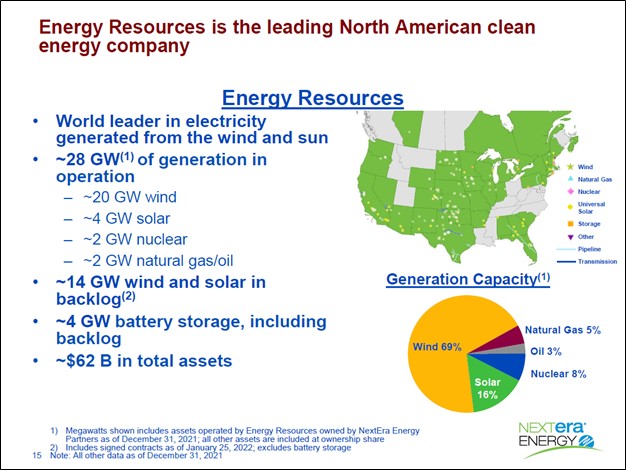

One of our favorite utilities is NextEra Energy Inc (NEE), the owner of the Florida Power & Light Company (‘FPL’), a rate regulated electric utility (the largest in Florida). NextEra Energy also owns a large merchant power business via its NextEra Energy Resources LLC subsidiary, which owns a sizable economic stake in NextEra Energy Partners LP (NEP). The utility’s merchant power spinoff has been aggressively developing renewable energy (solar, wind, battery storage) projects across the US and has built up a sizable backlog that underpins the bright growth trajectory of the NextEra Energy corporate family. Please note that NextEra Energy has a complex corporate structure.

We include NextEra Energy as an idea in the ESG Newsletter portfolio (more here) as the utility is playing a leading role in the “green energy revolution” in the U.S. and Canada. The company’s earnings growth outlook is quite bright and underpins NextEra Energy’s plans to grow its per share dividend by double-digits annually going forward. In the upcoming graphic down below, NextEra Energy provides a snapshot of its corporate structure.

Image Shown: An overview of NextEra Energy’s corporate structure. Image Source: NextEra Energy – 2021 Annual Report

Leadership Change

In January 2022, NextEra Energy announced that its then-CEO Jim Robo was stepping down from the top job and would serve a transitional role as Executive Chairman starting March 1. Though the press release noted that this was “part of a planned leadership succession process,” this came as a shock to investors, and shares of NEE initially sold off when the news broke.

John Ketchum, who has worked at NextEra Energy for roughly two decades and was previously president and CEO of NextEra Energy Resources, took over the CEO and President role at NextEra Energy and the CEO role at its merchant power spinoff NextEra Energy Partners starting March 2022. Ketchum helped turn NextEra Energy Resources into the renewable energy powerhouse that it currently is. We are confident NextEra Energy is in good hands under its current leadership team. Several other leadership changes were announced in conjunction with this news.

Green Growth

NextEra Energy Resources has a backlog of approximately 14 gigawatts (‘GW’) of solar and wind farm developments along with a sizable backlog of battery storage projects as well (these projects are in the US and Canada). That is on top of the ~24 GW of wind and solar power generation capacity NextEra Energy Resources currently has in operation, supported by ~2 GW of nuclear power generation capacity along with ~2 GW of oil- and natural gas-fired power generation capacity.

Please note that NextEra Energy Resources will often sell off economic interests in the power-generation assets it develops, including to NextEra Energy Partners. For instance, in November 2021, NextEra Energy announced NextEra Energy Resources was selling a 50% non-controlling interest in ~2.5 GW of renewable energy assets to the Ontario Teachers’ Pension Plan Board with the remaining 50% stake being sold to NextEra Energy Resources. These renewable energy assets are backed up by long-term contracts, providing significant visibility regarding their future cash flow performance. NextEra Energy retains an economic interest in these renewable energy assets via its economic interest in NextEra Energy Partners.

Image Shown: NextEra Energy, via its subsidiaries, has an extensive backlog in the realm of renewable energy projects in the US and Canada which underpins its bright growth outlook. Image Source: NextEra Energy – March 2022 IR Presentation

At the start of 2022, NextEra Energy folded Gulf Power Company (another Florida utility) into FPL. This move should generate decent operational synergies going forward by standardizing the tariffs and rates of FPL with Gulf Power, a process that will be phased in over the next several years (via transition/rider credits). Additionally, synergies can be realized by integrating the maintenance activities and development schemes of these utility operations. FPL now serves over 5.7 million customer accounts, providing electricity to over 11 million residents across the state, which has seen robust population and economic growth of late. NextEra Energy’s exposure to Florida’s promising economic growth outlook highlights one of the reasons why we are big fans of the utility.

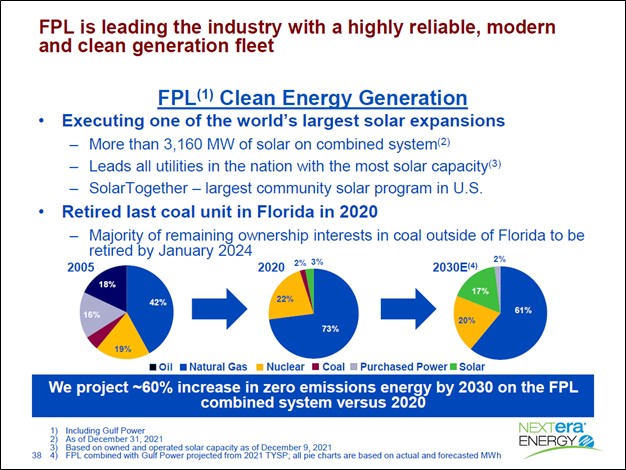

FPL is rapidly shifting away from coal-fired power and towards solar power, leaning on natural gas and nuclear power to make the transition feasible. Please note that FPL committed to installing more than 30 million solar panels by 2030 back in 2019, and as of June 2021, had installed over 12 million solar panels in the Sunshine State. During NextEra Energy’s fourth quarter of 2021 earnings call, management announced that FPL would hit its solar panel installation target by the end of 2025. We appreciate NextEra Energy’s stellar operational execution seen of late.

A combination of renewable energy sources, nuclear energy, and natural gas-fired power is expected to keep the lights on in Florida over the coming years. Near the end of 2020, FPL shut down its last coal-fired power plant. Around the same time, Gulf Power (now part of FPL) converted its Plant Crist coal-fired facility to run on natural gas and rebranded the power plant the Gulf Clean Energy Center.

Image Shown: NextEra Energy forecasts that solar power at its regulated FPL utility in Florida will represent ~17% of its power generation capacity by 2030, up from 3% in 2020. Image Source: NextEra Energy – March 2022 IR Presentation

Financial Update

In February 2022, possibly to alleviate investor concerns due to the unexpected leadership change, NextEra Energy put out a press release that announced a 10% sequential increase in its dividend (boosting its quarterly payout up to $0.425 per share or $1.70 per share on an annualized basis) while also announcing a commitment to grow its payout by 10% per year through 2024 using 2022 as a baseline. NextEra Energy’s payout growth is forecasted to remain robust over the coming years.

NextEra Energy generated $2.55 in non-GAAP adjusted EPS in 2021, up 10% versus 2020 levels. Its adjusted net income hit $5.0 billion last year, up 10% year-over-year. The utility’s payout ratio stood at ~60% in 2021 (dividend per share divided by adjusted EPS), a relatively low ratio that offers NextEra Energy ample room to continue growing its payout alongside its earnings (or at a faster rate than its earnings over a medium-term horizon).

Last year, net income at FPL rose by 11% year-over-year, hitting $2.9 billion, aided by growth in its customer base and major investments in the business. During the final quarter of 2021, FPL had ~82,000 more customers on average when compared to the fourth quarter of 2020. Additionally, FPL grew its regulatory capital employed by roughly 11% in 2021 versus 2020 as the regulated utility spent $6.8 billion on its capital expenditures last year. FPL also received a favorable base rate case decision in 2021 that will enable the utility to continue modernizing its power generation assets and power grid while keeping a lid on prices for customers.

FPL turned ~670 megawatts (‘MW’) of solar power online and commissioned the ~410 MW Manatee Energy Storage Center (a battery storage facility powered by solar power) in 2021. Looking ahead, FPL plans to commission its Dania Beach Clean Energy Center this year, which involves a project that is replacing older equipment at the facility with modern natural gas-fired combined-cycle units. FPL is also pursuing the North Florida Resiliency Connection development which is set to be commissioned this year, a project that involves building a transmission system that will connect the former Gulf Power’s operations with FPL’s operations to optimize solar power development schemes. The regulated utility also intends to continue growing its solar power generation capacity this year.

Net income at Gulf Power (before it folded into FPL) grew 14% year-over-year in 2021, hitting $0.3 billion, aided by improvements in its operations and maintenance (‘O&M’) expenses and past growth in its regulatory capital employed. We are intrigued by the upside that merging FPL with Gulf Power could generate. Pivoting to NextEra Energy Resources, this unit generated $2.2 billion in adjusted net income in 2021, up 13% year-over-year. Growth in this division’s asset base, namely by bringing new power generation facilities online, was key here.

Due to its complex corporate structure, NextEra Energy’s cash flow statement is a messy read. On a consolidated basis, NextEra Energy generated $7.6 billion in net operating cash flow in 2021, though its capital expenditures where quite sizable during this period. At the end of December 2021, NextEra Energy had $54.8 billion in total debt (inclusive of short-term debt) on the books on a consolidated basis, which was only modestly offset by $0.6 billion in cash and cash equivalents on hand.

NextEra Energy needs to retain access to capital markets, ideally at attractive rates, to refinance its maturing debt while making good on its dividend obligations and investing in its growth ambitions. We expect that will continue being the case going forward. NextEra Energy has a rock-solid investment grade credit rating (Baa1/A-/A-) with stable outlooks from each of the ‘Big Three’ rating agencies.

Guidance

When NextEra Energy reported its fourth quarter 2021 earnings report, the firm increased its medium-term financial guidance while extending the period covered by its longer term forecasts. Its fourth quarter earnings press release noted that (emphasis added):

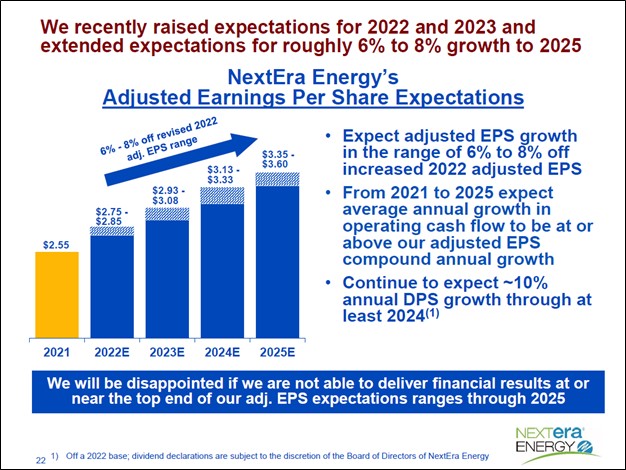

NextEra Energy today [on January 25, 2022] announced increased financial expectations for 2022 and 2023 and extended its long-term outlook of roughly 6% to 8% compound annual growth in adjusted earnings per share by two years, through 2025. For 2022, NextEra Energy now expects adjusted earnings per share to be in the range of $2.75 to $2.85, up from its prior range of $2.55 to $2.75. For 2023 through 2025, NextEra Energy expects to grow roughly 6% to 8% per year off the expected 2022 adjusted earnings per share. For 2023, this translates to a new range of $2.93 to $3.08, up from the prior range of $2.77 to $2.97. The new adjusted earnings per share expectations for 2024 are $3.13 to $3.33, and for 2025 are $3.35 to $3.60.

NextEra Energy’s adjusted earnings growth outlook is impressive and underpins its internal expectations that the utility will steadily grow its per share dividend by low double-digits annually over the coming years.

Image Shown: NextEra Energy is targeting strong annual adjusted EPS growth over the coming years, aided by expected growth in its company-wide asset base including at its rate regulated utility operations and merchant power businesses. That in turn is forecasted to drive NextEra Energy’s dividends per share higher by ~10% annually in the medium-term. Image Source: NextEra Energy – March 2022 IR Presentation

Concluding Thoughts

We are big fans of NextEra Energy. The utility is a cash flow generating powerhouse with a bright adjusted EPS and dividend growth outlook, underpinned by its rapidly growing renewable energy division and exposure to Florida’s promising economic growth trajectory. Shares of NEE yield ~2.2% as of this writing.

—–

Utilities (Mid/Small) Industry – AEE, ALE, CNP, CMS, DTE, ES, LNT, MGEE, NI, PEG, PNW, SCG, SJI, SR, SRE, WEC

Utilities (Large) Industry – AEP, D, DUK, ED, EIK, ETR, EXC, FE, NEE, NGG, PCG, PPL, SO, XEL

Related: NEP, XLU

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of FB and XLE and is long call options on FB and XLE. Utilities Select Sector SPDR ETF (XLU) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. NextEra Energy Inc (NEE) is included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.