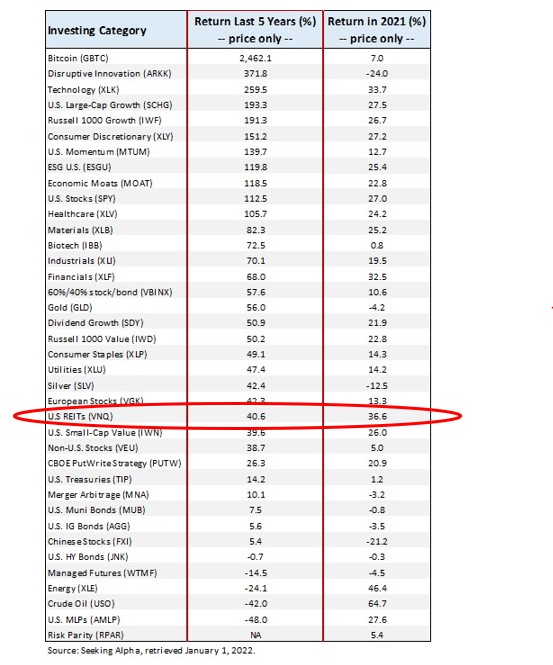

Image Shown: REITs have struggled relative to other investing areas during the past 5 years. Absent the areas of crypto tokens, speculative disruptive innovators and technology, the most prudent area has been large cap growth the past five years, an area that we have been materially overweight in the newsletter portfolios.

By Brian Nelson, CFA

REIT returns haven’t been that great the past several years (as shown above), but that may be no reason to fret. Some of the top yielding REITs across our coverage include Arbor Realty Trust (ABR), Iron Mountain (IRM), LTC Properties (LTC) and Omega Healthcare (OHI). These REITs come with significantly elevated risk, however. There’s one REIT that may not yield quite as much, but it really hits the ball out of the park with respect to all of the things we like to see in REIT idea considerations. That REIT is self-storage player Public Storage (PSA).

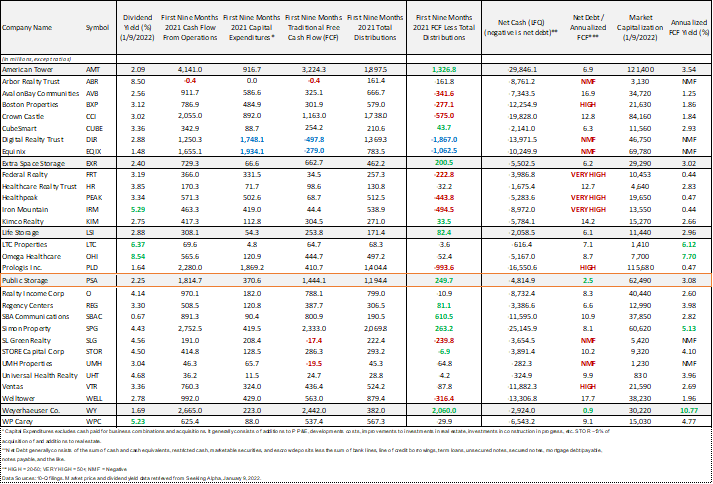

Image Shown: We examine the traditional operating metrics of the REITs with a focus on traditional free cash flow, dividends paid, and traditional balance sheet analysis where we assess net debt positions. Most REITs fail to cover their dividends with traditional free cash flow and boast huge net debt positions. Public Storage remains one of our very favorite REITs, however. Its free cash flow coverage of the payout and manageable financial leverage are exactly what we’re looking for.

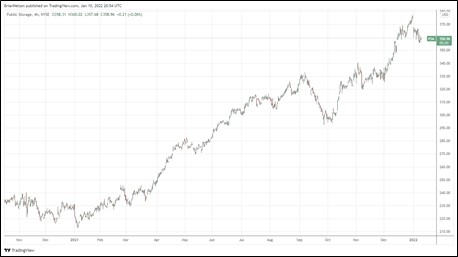

Shares of Public Storage have advanced more than 60% during the past year, excluding dividends, and we think the company has earned every bit of that return and more. For those that don’t know Public Storage, the REIT is “the world’s largest owner, operator and developer of self-storage facilities,” with ~2,500 locations across the United States. Founded in 1972, the REIT has staying power, and with 1.6 million customers, the firm’s operations speak to durability.

Aside from its long operating experience, Public Storage has a number of advantages, including consumer awareness and marketing cost advantages, and while these may not be as durable as other competitive advantages (i.e. the network effect), we do think the ‘Public Storage’ brand name is better known than some of its peers, though we also note that we like the fundamental economic profiles of its self-storage peers, too.

Public Storage pretty much dominates the 15 markets in which it operates, and we continue to be fans of the operating leverage inherent in a self-storage operator’s business model. A few things that PSA has been working on to bolster profitability levels, too, include leveraging its unmatched scale while pursuing payroll cost savings as well as solar and LED light (utility) cost savings. Its operating (net operating income) margin is best-in-class and stands at ~76%.

Image Source: Public Storage.

Public Storage’s third-quarter 2021 results for the three months ending September 30, released November 1, were solid. Reported core funds from operations (FFO) advanced 30% in its third quarter of 2021 relative to the same period a year ago, while same store direct net operating income leapt nearly 21%. On a per share basis, core FFO came in at $3.42 per diluted common share, as compared to $2.63 in last year’s quarter. Its core FFO numbers came in better than expected.

Most importantly, Public Storage hits on the key dynamics we like with respect to traditional operating, non-REIT equities, and this achievement is a rarity, as one can see per the comparable REIT statistical analysis table. For starters, Public Storage has been significantly traditional free cash flow positive (cash flow from operations less capital spending) after paying distributions through the first nine months of 2021, and as one can see, not every REIT can say that.

We also like that Public Storage’s net debt is much more manageable than that of many of the other players across the REIT sector. For example, its net debt to annualized free cash flow is a modest 2.5, while others’ are much higher than that–and some leverage measures from Dividend Aristocrat Federal Realty (FRT), Healthpeak (PEAK), Iron Mountain, Boston Properties (BXP), and Prologis (PLD) have been astronomical through the first nine months of 2021. Public Storage covers its dividends with traditional free cash flow, and it has significant borrowing capacity like no other, in our view.

As noted before, we’re huge fans of the operating dynamics of the self-storage space, and Extra Space Storage (EXR), Life Storage (LSI), and CubeSmart (CUBE) have similar economic profiles, all with strong traditional free cash flow generation in excess of their cash dividend obligations and comparatively more attractive net debt burdens relative to some of the aforementioned leveraged players. The two REITs with the biggest net debt positions are tower REIT American Tower (AMT) and retail REIT Simon Property (SPG), but these two entities generate traditional free cash flow in excess of dividends paid, so leverage may not be their biggest concerns.

We’re not too big of fans of the retail REITs, in general, given waning trends in brick-and-mortar retail and the proliferation of e-commerce, though we note that Simon Property and Regency Centers (REG) had healthy free cash flow coverage of the payout during the first nine months of 2021, while monthly dividend payer Realty Income (O) and Federal Realty remain much more capital-market dependent to keep growing their payouts as one might not have expected. We define capital-market dependency risk with respect to REIT dividends as ones in which traditional free cash flow is not in excess of cash dividends paid. Many REITs remain capital-market dependent, and players in the self-storage arena are the least capital-market dependent, in our view.

Two other strong REITs that we’re keeping a close eye on are SBA Communications (SBAC) and Weyerhaeuser Co. (WY). Both of these REITs have slam-dunk economics with substantial traditional free cash flow generation in excess of cash dividends paid, and their net debt positions are very manageable, especially Weyerhaeuser’s. These REITs also have low capital-market dependence risk. However, both have comparatively lower dividend yields than we’d prefer, so it’s hard to stretch to include them in either the Dividend Growth Newsletter portfolio or High Yield Dividend Newsletter portfolio at this time.

Concluding Thoughts

Image Shown: Public Storage’s shares rallied significantly in 2021.

There are a number of industry-specific metrics that REITs use including funds from operations (FFO) and adjusted funds from operations (AFFO), but we think more traditional analysis helps to offer incremental insights while adding considerable informational value when used in conjunction with industry-specific REIT analysis.

The REIT with the best combination of dividend yield, free cash flow generation in excess of cash dividends paid, and leverage (as measured by net debt divided by annualized traditional free cash flow) is Public Storage. The company’s self-storage peers are runners up with respect to our favorites, followed by the tower stocks American Tower and SBA Communications, and then timber REIT Weyerhaeuser.

We plan to replace recently bought out CyrusOne (CONE) in the High Yield Dividend Newsletter portfolio in the coming days with most likely Life Storage and American Tower, both of which yield north of 2% at the time of this writing. We also may have a few other tweaks in store. Stay tuned!

———-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.