Image Source: Micron Technology Inc – First Quarter of Fiscal 2022 IR Earnings Presentation

By Callum Turcan

On December 20, Micron Technology Inc (MU) reported first quarter earnings for fiscal 2022 (period ended December 2, 2021) that beat both consensus top- and bottom-line estimates. Underlying demand for Micron Technology’s DRAM, NAND, and NOR offerings (used as memory solutions in personal computers, automobiles, data centers, smartphones, and various electronics devices) remained robust last fiscal quarter. The company has done a great job navigating supply chain hurdles and semiconductor component and equipment shortages in the wake of the coronavirus (‘COVID-19’) pandemic to continue meeting booming customer demand.

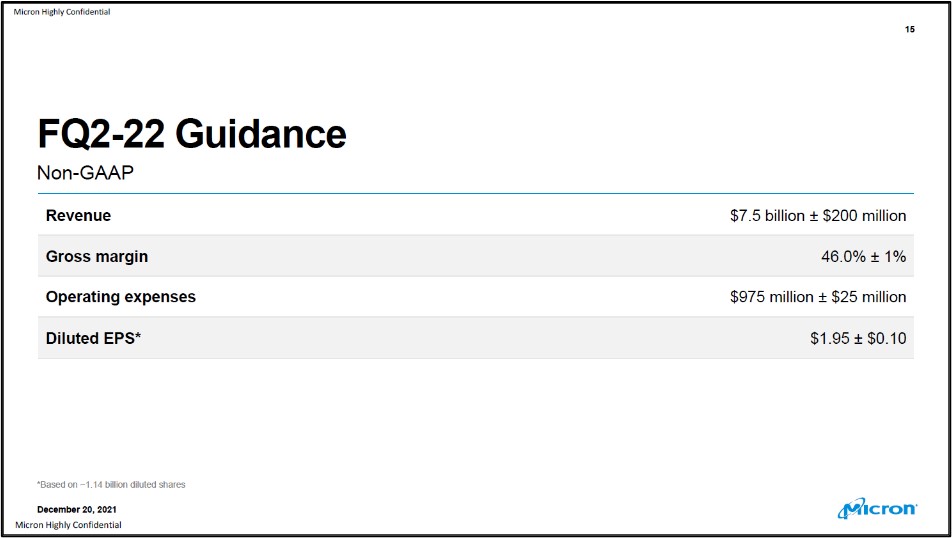

Shares of Micron Technology surged higher after it published its latest earnings report December 20 (and they are now trading in the mid-$90s at the time of this writing). In our view, the big share price increase was largely due to the memory solutions provider issuing favorable near term guidance covering the current fiscal quarter, indicating that its strong performance of late is expected to continue in the near term. Though shares may appear cheap on a forward earnings basis, we caution members that the industry Micron Technology operates within is ultra-competitive and exposed to tremendous pricing competition and cyclical swings. Though technically (its chart) looks attractive at this time, long-term investors should be careful.

Image Shown: Micron Technology issued out favorable near term guidance in conjunction with its latest earnings update. Image Source: Micron Technology – First Quarter of Fiscal 2022 IR Earnings Presentation

Operations Overview

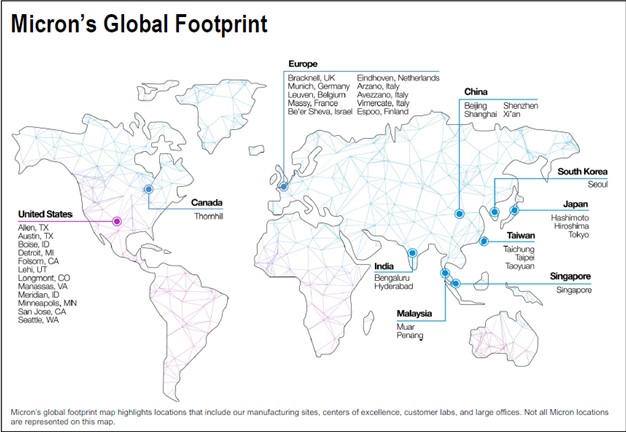

Micron Technology designs, develops, manufactures, and sells memory and storage solutions including NAND, DRAM, and NOR offerings. As of the end of fiscal 2021 (period ended September 2, 2021), Micron Technology had a dozen manufacturing sites and 14 customer labs across the world. Its manufacturing operations are primarily located in Taiwan, China, Japan, Singapore, Malaysia, and the US. The company’s manufacturing operations are supported by third-party services and its arrangements with key semiconductor component and equipment suppliers. Furthermore, Micron Technology prioritizes R&D activities to stay ahead of the curve in this incredibly competitive industry. In fiscal 2021, the firm spent ~10% of its revenues on R&D expenses and in recent fiscal years, Micron Technology has spent around ~10-12% of its annual revenues on R&D expenses.

Image Shown: A look at Micron Technology’s global operational footprint which includes its manufacturing facilities, customer labs, “centers of excellence,” and its major corporate offices. Micron Technology has a large global manufacturing footprint and R&D presence, and places a great emphasis on investing in its business to stay ahead of the curve in this incredibly competitive industry. Image Source: Micron Technology – Fiscal 2021 Annual Report

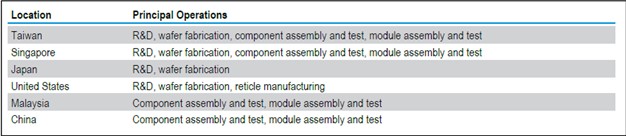

The upcoming graphic down below highlights what functions are performed where, geographically speaking, as it concerns Micron Technology’s global operational footprint. For reference, NOR and NAND flash memory solutions are considered non-volatile and do not need a continuous power supply to retain memory. DRAM is another memory solution, though it requires a continuous power supply to operate and is considered volatile memory.

Image Shown: A look at what functions are performed where geographically speaking as it concerns Micron Technology’s global operations. Image Source: Micron Technology – Fiscal 2021 Annual Report

Earnings Update

Keeping in mind that DRAM, NAND, and NOR pricing is incredibly volatile (and oftentimes under pressure), Micron Technology posted 33% year-over-year growth in its GAAP revenues last fiscal quarter, which hit $7.7 billion. Management noted that Micron Technology “delivered new solutions to data center, client, mobile, graphics and automotive customers” in the firm’s latest earnings press release which helped support the company’s financial performance in the first quarter of fiscal 2022. Longer term, management noted that 5G, artificial intelligence, and electric vehicles represent areas supported by secular growth tailwinds that Micron Technology expects will fuel its own growth ambitions.

The firm’s GAAP gross profit more than doubled year-over-year last fiscal quarter while its GAAP gross margin rose over 1,630 basis points during this period, reaching 46.4% in the first quarter of fiscal 2022. Solid cost control efforts in the face of supply chain hurdles impacting the entire semiconductor industry along with favorable memory solutions pricing were key. Micron Technology’s GAAP operating income more than tripled year-over-year in the fiscal first quarter, hitting $2.6 billion, as operating-expense growth was offset by economies of scale and immense gross profit growth.

At the end of the first quarter of fiscal 2022, Micron Technology had a $2.6 billion net cash position (inclusive of short-term debt and short-term investments), and please note that does not include the $1.8 billion in long-term marketable securities the firm had on hand at the end of this period. Historically, Micron Technology’s long-term marketable securities have been represented by cash-like assets (including corporate bonds, asset-backed securities, and government securities) that are not strategic investments, meaning its net cash position is larger than it first appears. We appreciate the company’s pristine balance sheet.

Due to its sizable manufacturing footprint and preference to invest in its business to support its growth outlook, Micron Technology’s free cash flow generating abilities are decent but limited. In the first quarter of fiscal 2022, Micron Technology generated about $0.7 billion in free cash flow while spending $0.1 billion covering its modest dividend obligations and $0.3 billion buying back its stock through its repurchase program (another $0.1 billion was spent covering ‘repurchases of common stock – withholdings on employee equity awards’ last fiscal quarter). From fiscal 2019-2021, Micron Technology generated ~$2.0 billion in free cash flow per year on average.

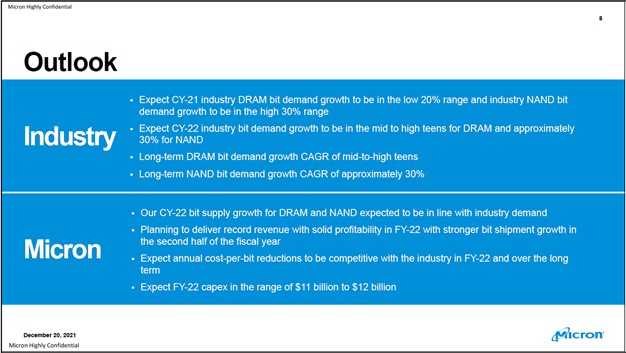

Micron Technology is a stellar generator of net operating cash flow, though its sizable capital expenditure requirements keep a lid on its free cash flow generating abilities. The company expects to spend ~$11-$12 billion on its capital expenditures in fiscal 2022. In the upcoming graphic down below, Micron Technology provides additional commentary on its outlook and the outlook for the memory solutions industry.

Image Shown: An overview of Micron Technology’s outlook for the industry and its own operations for 2022 and beyond. Image Source: Micron Technology – First Quarter of Fiscal 2022 IR Earnings Presentation

Management Commentary

Shortages of semiconductor components have negatively impacted industries all over the world. This, is turn, has prompted various companies, especially those with deeper pockets, to enter into longer term supply arrangements with firms like Micron Technology as compared to the shorter term nature of agreements seen before the pandemic. Micron Technology had this to say on the issue within its prepared remarks covering its latest earnings report:

“As a technology and quality leader and as an innovation partner with a strong global manufacturing network, we have become a strategic supplier to our customers. Amid ongoing semiconductor supply chain challenges, Micron has leveraged our deep partnerships with customers and suppliers to support DRAM, NAND and NOR supply continuity.

On the customer side, we are seeing greater commitment and collaboration on supply planning, including the use of long-term agreements. Today, over 75% of our revenue comes from volume-based annual agreements, a significant increase from five years ago when they accounted for around 10% of our revenue.

On the supplier side, we have entered into strategic agreements to secure supply of certain components that we need to manufacture our products. As a result of these agreements, the current tight supply of these components is expected to gradually improve for us throughout calendar 2022.” — Sanjay Mehrotra, President and CEO of Micron Technology

Micron Technology is actively securing deals with its customers on more favorable terms while ensuring that it has the capacity to meet robust demand by securing key deals with its own suppliers, which supports its longer term growth outlook.

Concluding Thoughts

Our fair value estimate for Micron Technology sits at $79 per share, and the high end of our fair value estimate range sits at $103 per share. In our view, shares of MU are fairly valued at this time as they are trading within our fair value estimate range. Shares of MU yield ~0.5% as of this writing as the firm prefers to invest in its business (seen through its sizable capital expenditure budgets), though Micron Technology does its best to return excess cash to shareholders.

One of our favorite semiconductor companies is Qualcomm Inc (QCOM), which we include as an idea in the Dividend Growth Newsletter portfolio. Interested members can read why we are big fans of Qualcomm’s dividend growth potential by checking out this article here.

—–

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI, SIMO

Tickerized for stocks in the SMH.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Meta Platforms, Oracle Corporation, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.