Image Shown: Shares of Berkshire Hathaway Inc Class B have been on a nice upward climb over the past year.

By Callum Turcan

On November 6, the industrial and insurance conglomerate Berkshire Hathaway Inc (BRK.A) (BRK.B) reported third-quarter 2021 earnings. We liked what we saw in its latest earnings update as most of its business segments reported strong results, save for some of its insurance businesses which took a hit from major weather events and headwinds resulting from more drivers being on the road. Shares of Berkshire Hathaway Class B (ticker: BRK.B) are included as an idea in the Best Ideas Newsletter portfolio.

Earnings Update

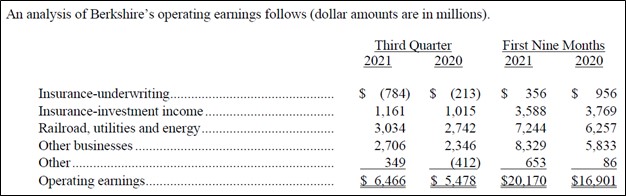

The company prefers to highlight its underlying financial performance via its operating earnings metric as compared to its GAAP net income metric due to the enormous impact changes in its investment portfolio can have on its financial statements. During the third quarter of this year, Berkshire Hathaway’s operating earnings were up 18% year-over-year. Berkshire Hathaway’s industrial and other business segments continued to stage a robust recovery from the worst of the coronavirus (‘COVID-19’) pandemic.

Image Shown: An overview of Berkshire Hathaway’s underlying financial performance, which improved on a year-over-year basis in the third quarter of this year. Image Source: Berkshire Hathaway – Third Quarter of 2021 Earnings Press Release

The conglomerate’s cash-pile has swelled higher in recent years, reaching $149.2 billion at the end of September 2021 (defined as cash, cash equivalents, and short-term investments in US Treasuries bills). Please note this does not include Berkshire Hathaway’s sizable ‘investments in fixed maturity securities,’ ‘investments in equity securities,’ or ‘equity method investments’ line items. The ~$149 billion figure is the amount of cash-like assets Berkshire Hathaway has just “sitting around” on the books earning a paltry yield in the current low interest rate environment.

With that kind of cash hoard, historically Berkshire Hathaway would be out looking for major deals. However, management does not view the current environment as conducive to acquisitions that could generate substantial shareholder value. In the view of Berkshire Hathaway, the proliferation of investment vehicles such as special purpose acquisition companies (‘SPACs’) has driven up valuations for potential takeout targets to arguably unreasonable levels. Due to its size, Berkshire Hathaway needs to find relatively large, undervalued companies as potential takeout targets to have a needle-moving effect on its business, a difficult task in the current environment.

Primarily for that reason, Berkshire Hathaway has opted to return cash to shareholders via share repurchases as the company remains a free cash flow generating powerhouse. The company does not pay a common dividend at this time and is unlikely to do so given the tax implications of that capital allocation decision (among other reasons).

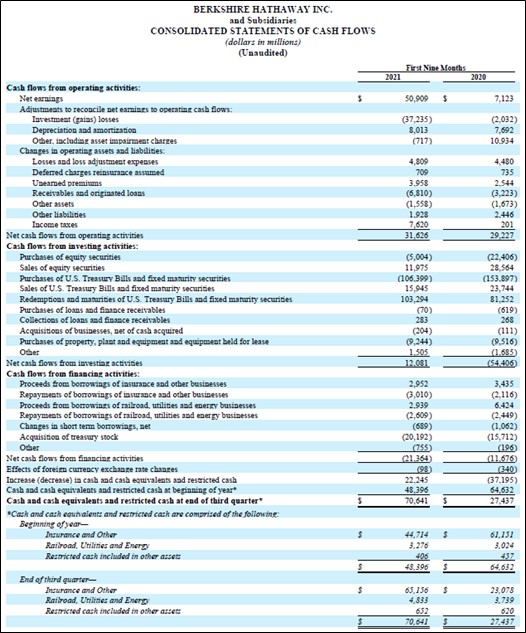

During the first nine months of 2021, Berkshire Hathaway generated $22.4 billion in free cash flow (up from $19.7 billion in the same period the prior year) and spent $20.2 billion buying back its stock. That includes $7.6 billion worth of share repurchases during the third quarter of 2021, according to Berkshire Hathaway’s latest earnings press release. Berkshire Hathaway will likely continue buying back gobs of its stock going forward, activities that can be funded via its sizable free cash flows.

Image Shown: Berkshire Hathaway is a free cash flow generating powerhouse. Image Source: Berkshire Hathaway – 10-Q SEC filing covering the third quarter of 2021

Concluding Thoughts

We continue to be big fans of Berkshire Hathaway. The company’s various cost control measures (such as major workforce reductions at Precision Castparts, an aerospace supplier) that were enacted last year in the face of the COVID-19 pandemic should steadily lead to meaningful cost structure improvements going forward as its businesses rebound (with an eye towards its industrial and retail operations).

Berkshire Hathaway’s free cash flow generating abilities continue to impress with ample room for upside given its improving outlook. Eventually investors will want to see some activity materialize on the acquisition front as that represents a core part of Berkshire Hathaway’s longer term growth strategy, even if the deal is relatively small. In the meantime, patient investors will be steadily rewarded via sizable share repurchases.

—–

Banks & Money Centers – AXP, BAC, BBT, BK, C, DFS, FITB, GS, HBC, JPM, KEY, MS, NTRS, PNC, RF, STI, TCF, USB, WFC

Tickerized for BRK, BRK.A, BRK.B, and holdings in the KIE.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Berkshire Hathaway Inc Class B shares (BRK.B) are included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.