Image Shown: Berkshire Hathaway Inc Class B shares are on a nice upward climb of late.

By Callum Turcan

On August 7, the insurance and industrial conglomerate Berkshire Hathaway Inc (BRK.A) (BRK.B) reported second-quarter 2021 earnings. We are huge fans of the firm and its storied leader, Warren Buffett (CEO and Chairman). Berkshire Hathaway Class B shares (ticker: BRK.B) are a longtime idea in our Best Ideas Newsletter portfolio, and more recently, shares of BRK.B have regained their upward momentum.

Cash Flow and Capital Allocation Update

During the first half of 2021, Berkshire Hathaway generated $13.9 billion in free cash flow, up 23% year-over-year. Berkshire Hathaway spent $12.6 billion buying back its stock during the first half of this year, highlighting the seismic shift in Mr. Buffett’s view towards share repurchases in recent years.

Historically, Mr. Buffett has not been a big fan of share buybacks as it concerns Berkshire Hathaway (it is a different story as it concerns share buybacks at firms the conglomerate owns an equity stake in), though that opinion has shifted in large part due to the lofty valuations seen in firms in both public and private markets (according to Mr. Buffett). Finding potential buyout deals that are both needle-moving and represent significantly undervalued opportunities has become a tough endeavor for Berkshire Hathaway, according to Mr. Buffett (i.e.finding large, undervalued entities that Berkshire Hathaway could purchase outright has become increasingly difficult).

At the end of June 2021, Berkshire Hathaway retained ample cash and cash-like assets on hand ($140.7 billion in cash, cash equivalents, and short-term investments in US Treasuries combined) that could be used to fund a large deal. Please note Berkshire Hathaway also had sizable non-cancelable financial obligations on the books at the end of this period, in part due to its large insurance business.

In 2020, Berkshire Hathaway did put some of its enormous cash-like holdings to use acquiring natural gas-oriented energy infrastructure assets from Dominion Energy Inc (D), which we covered here, and acquiring equity stakes in various Japanese conglomerates, which we covered here. However, these deals were relatively small to a firm of Berkshire Hathaway’s size. We are keeping a close eye on Berkshire Hathaway’s cash-pile.

Underlying Operations Update

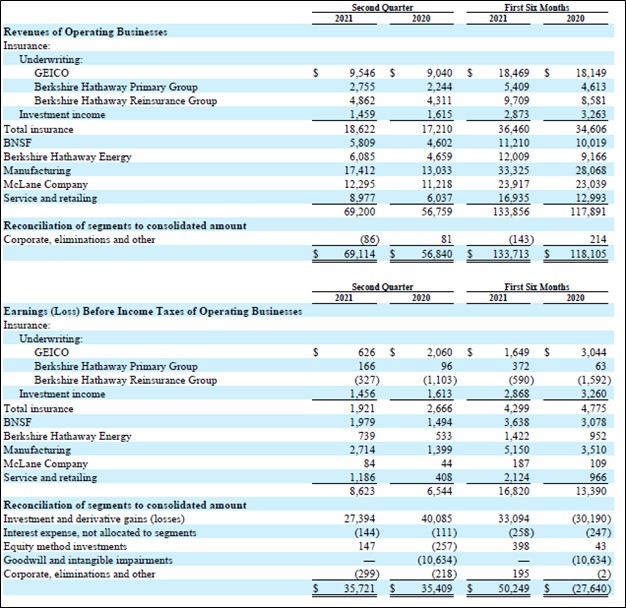

The conglomerate’s operating earnings, which provides a snapshot of the performance of Berkshire Hathaway’s underlying businesses (this metric largely excludes the outsized impact changes in the value of its investment portfolio has on its GAAP financials on a quarter-to-quarter basis), grew to $6.7 billion last quarter versus $5.5 billion in the same period a year-ago. Strength at its BNSF (railroad), Berkshire Hathaway Energy (utility and energy infrastructure), McLane Company (supply chain services), manufacturing (includes a major aerospace supplier, Precision Castparts, and other entities), and various services and retailing operations (includes auto dealers, Dairy Queen, home furnishing and jewelry businesses, and other entities) offset weakness at its insurance business (includes Geico and other entities).

As more drivers resumed their daily commute, which in turn increased the likelihood of accidents, while large parts of the world contended with massive floods and other weather-related disasters, Berkshire Hathaway’s insurance business faced significant headwinds last quarter. However, Berkshire Hathaway’s non-insurance businesses are clearly on the rebound which we appreciate. Cost cutting endeavors embarked on last year helped improve the cost structure of some of Berkshire Hathaway’s subsidiaries around the margins, including at Precision Castparts (something we covered in this article here), as did economies of scale as the conglomerate’s various businesses rebounded from the worst of the coronavirus (‘COVID-19’) pandemic.

Image Shown: An overview of Berkshire Hathaway’s financial performance across its various operating businesses during the second quarter and first half of 2021. Image Source: Berkshire Hathaway – 10-Q SEC filing covering the second quarter of 2021

Concluding Thoughts

Berkshire Hathaway’s operations are steadily covering from the worst of the COVID-19 pandemic, and the company remains a free cash flow generating cow. Shares of Berkshire Hathaway are on a nice upward climb of late, though investors are likely wondering what Mr. Buffett’s next big move(s) will be going forward as it concerns the company’s massive cash-like position. We continue to like Berkshire Hathaway Class B shares as an idea in the Best Ideas Newsletter portfolio. After the conglomerate’s latest earnings update, we may further fine-tune our valuation of the name in light of its strong financial performance of late.

—–

Utilities (Mid/Small) Industry – AEE, ALE, CNP, CMS, DTE, ES, LNT, MGEE, NI, PEG, PNW, SCG, SJI, SR, SRE, WEC

Utilities (Large) Industry – AEP, D, DUK, ED, EIK, ETR, EXC, FE, NEE, NGG, PCG, PPL, SO, XEL

Related: BRK.A, BRK.B, D, XLF, XLU

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Berkshire Hathaway Inc Class B shares (BRK.B) and Financial Select Sector SPDR Fund ETF (XLF) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. The Utilities Select Sector SPDR ETF (XLU) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.