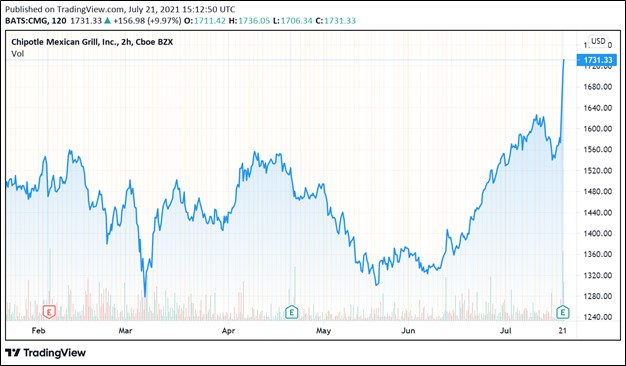

Image Shown: We include Chipotle Mexican Grill Inc an as idea in the Best Ideas Newsletter portfolio. On July 21, shares of CMG surged higher after the firm reported a stellar earnings report after the market close on July 20.

By Callum Turcan

On July 20, Chipotle Mexican Grill Inc (CMG) reported second-quarter 2021 earnings that beat both consensus top- and bottom-line estimates. The company’s comparable store sales boomed higher by over 31% year-over-year as Chipotle’s customer base returned to its in-store dining offerings in the wake of coronavirus (‘COVID-19’) containment efforts getting eased across the US.

Its digital sales were up almost 11% year-over-year and represented a little under half of its total revenues. Chipotle’s momentum is expected to continue going forward as management guided for Chipotle’s comparable store sales to grow in the low-to-mid double-digit range during the third quarter of this year within the firm’s latest earnings report.

We include shares of Chipotle as an idea in the Best Ideas Newsletter portfolio and the top end of our fair value estimate range sits at $1,793 per share. Shares of CMG rocketed higher in the wake of its latest earnings report, and we may finetune our enterprise cash flow models accordingly as Chipotle fundamentals continue to run better than our expectations.

Earnings Update

The company’s GAAP revenues were up 39% year-over-year last quarter, hitting $1.9 billion. Its ‘delivery service revenue’ grew 59% year-over-year, albeit off a low base (these sales only represented a little over 1% of Chipotle’s total revenues in the second quarter). Chipotle went from running at a marginal GAAP operating loss in the second quarter of 2020 to generating nice GAAP operating income of approximately $0.25 billion in the second quarter of this year.

Past pricing increases had a favorable impact on Chipotle’s margins and apparently did not have much of an impact on demand for its offerings. Additionally, the company noted it ran reduced promotional activity last quarter versus the same period in 2020. We appreciate the strong underlying demand for Chipotle’s offerings and its pricing power. However, Chipotle noted it did experience headwinds from “higher costs associated with new menu items, wage inflation for one month of the second quarter, and avocados” last quarter, though lower beef prices last quarter offered some reprieve.

However, please note that higher beef prices and logistics expenses will weigh on Chipotle’s performance in the third (current) quarter according to management commentary given during the firm’s latest earnings call (emphasis added):

“Given the current environment, it shouldn’t be a surprise to anyone that Q3 is going to be challenged by several industry-wide issue, most notably beef and freight costs, as well as staffing shortages at our suppliers.

We anticipate these commodity headwinds will negatively impact the quarter by an additional 60 basis points to 80 basis points, essentially offsetting the benefit of menu price increases. This will result in food cost for Q3 being at or slightly above the percentage we saw in Q2. Over the next few quarters, we’ll have greater visibility on how much of this inflation is permanent versus transitory, and we can take the appropriate actions as needed to help offset any lasting impacts.” — Jack Hartung, CFO of Chipotle

Considering Chipotle has ample pricing power and continues to innovate, we expect the company will be able to adeptly navigate inflationary headwinds over the coming quarters. Strong demand for its offerings and a resumption of in-store dinning activities should support Chipotle’s ability to push through additional menu price increases in the future. The firm added customizable quesadillas to its menu earlier this year, as we covered in our March 2021 article (link here), and there is a learning curve as it concerns fitting the new offerings into its existing operations.

During the first half of 2021, Chipotle’s free cash flows came in a little under $0.4 billion, more than double year-ago levels. Chipotle repurchased $0.2 billion of its common stock during the first half of this year and exited June 2021 with over $1.1 billion in net cash on hand (inclusive of short- and long-term investments, exclusive of restricted cash) and no debt on the books. The company authorized an additional $0.2 billion in share buyback authority last quarter. However, please note Chipotle has sizable operating lease liabilities on the books to be aware of. That said, we like the company’s pristine balance sheet.

Drive-Thru Upside

Chipotle opened 56 new restaurants last quarter, including one relocation, while closing five. Its total restaurant count sat at ~2,850 at the end of June 2021. Out of those 56 new restaurants opened last quarter, 45 had “Chipotlanes” which is its version of drive-thru operations, though please note that vast majority of its restaurants do not have drive-thru options. Chipotle noted in its latest earnings press release that “these formats continue to perform very well and are helping enhance guest access and convenience, as well as increase new restaurant sales, margins, and returns.” Adding drive-thru options to its restaurants is a solid move and one that offers ample long-term upside

During Chipotle’s latest earnings call, management noted that “the best returns we can generate are by investing in more Chipotlanes” and later in the call management stated that (emphasis added):

“For the full year, we now expect to be at or slightly above our prior 2021 guidance of 200 new restaurant[s], with more than 70% including a Chipotlane. As of June 30th, we had a total of 244 Chipotlanes, including eight conversion and six relocations, and they continue to enhance access and convenience forecast while demonstrating superior performance.

New Chipotlanes are opening with about 20% higher sales compared to the non-Chipotlanes opened during the same time period. Over the trailing 12 months, Chipotlanes restaurant[s] continues to drive about a 15% higher overall digital sales mix compared to non-Chipotlanes, and it’s skewed heavily towards order ahead, our highest margin transaction.

In the two-year geometric comp, at the 88 Chipotlane restaurants that have been opened more than a year continues to outperform the non-Chipotlane restaurants from the same period.” — CFO of Chipotle

Based on recent management commentary, a little under 9% of Chipotle’s restaurants had a Chipotlane at the end of June 2021. We appreciate that these restaurant formats are both generating higher sales overall and greater order ahead digital sales that have higher margins, versus traditional formats with no drive-thru options. As Chipotle continues to add drive-thru operations across its asset base, there is ample room for upside, in our view. The company’s growth outlook is bright and getting brighter.

Concluding Thoughts

In our April 2021 article covering the company (link here), we highlighted how Chipotle’s management team sees room for the firm to more than double its restaurant unit count in the coming years. Chipotle’s growth runway is immense. The company’s second-quarter earnings report was stellar, and the market continues to warm up to Chipotle’s promising long-term growth story. We are big fans of Chipotle and expect that the firm’s free cash flows will continue to grow at a steady clip over the coming years.

Chipotle’s 16-page Stock Report >>

—–

Discretionary Spending Industry – ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, DNKN, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM, DKS, TJX, ROST, WHR, KMX, AZO, RL

Tickerized for CMG, YUM, YUMC, QSR, MCD, WEN, DASH, WTRH, GRUB, APRN, TKAYF, HLFFF, NDLS, EATZ

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Chipotle Mexican Grill Inc (CMG), Dollar General Corporation (DG), Domino’s Pizza Inc (DPZ) and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Dick’s Sporting Goods Inc (DKS) and Home Depot Inc (HD) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.