Image Shown: Walt Disney Company recently reported earnings and provided an update as to what investors should expect going forward given the ongoing novel coronavirus epidemic in China.

By Callum Turcan

On February 4, Walt Disney Company (DIS) reported earnings for the first quarter of its fiscal 2020 (period ended December 28, 2019). While Disney beat both consensus top- and bottom-line estimates, shares sold off modestly the next trading day over fears concerning the ongoing novel coronavirus epidemic (abbreviated as ‘2019-nCoV’) in China, and how that would impact its financial performance going forward.

On January 13, 2020, we added shares of DIS to our Best Ideas Newsletter portfolio (link covering our portfolio changes here) with a modest weighting given that shares were trading close to our fair value estimate at the time. However, we view Disney’s free cash flow growth outlook as very promising, which could see shares of DIS approach the high end of our fair value estimate range which sits at $168 per share. Additionally, we like its dividend coverage as its Dividend Cushion ratio sits at 3.1x, which supports a nice dividend growth trajectory as well. Shares of DIS yield ~1.2% as of this writing.

Streaming Update

Disney’s GAAP revenues surged 36% year-over-year in the first quarter of fiscal 2020 but please note that Disney closed its ~$71 billion purchase of 21st Century Fox in March 2019. Where Disney found organic strength was with its Hulu streaming service, as its subscription video on demand (‘SVOD’) and ‘SVOD + Live TV’ subscriber base grew by 29% and 88% year-over-year, respectively. The strength of Hulu’s Live TV package is key as the average monthly revenue per paid user came in at $59.47 last quarter, up 14% year-over-year due to a series of price increases. After closing the 21st Century Fox deal, Disney now owns 67% of Hulu and Comcast Corporation (CMCSA) owns the rest.

Hulu’s SVOD average monthly revenue per paid user fell 9% year-over-year to $13.15, as Disney started offering a streaming bundle service with the launch of its new streaming service Disney+. For reference, that $12.99 per month bundle includes streaming services Hulu SVOD (but not Live TV), ESPN+, and Disney+. Furthermore, please note that advertising revenue is also at play here. The company appears to have had a meaningful amount of success with its streaming bundle strategy, as the subscriber base of ESPN+ (includes sports related shows and some select live games) surged by almost five-fold year-over-year. Due to the bundle streaming strategy, ESPN+ saw its average monthly revenue per paid user drop by 5% year-over-year.

Pivoting to the Disney+, that service had 26.5 million paying subscribers (for refence, ESPN+ had 6.6 million, Hulu SVOD had 27.2 million, and Hulu SVOD + Live TV had 3.2 million) as of December 28, 2019. Please note Disney+ launched back on November 12, 2019. Disney is betting a lot on its streaming strategy, and management had this to say during the firm’s latest quarterly conference call (emphasis added):

“Of course, the high point of the quarter was the highly anticipated launch of our streaming service Disney Plus. Thanks in large part to our incredible portfolio of great brands, the outstanding content from our creative engines and a robust technology platform, the launch of Disney Plus has been enormously successful exceeding even our greatest expectations.

As we reported previously, we had more than 10 million sign-ups for Disney plus by the end of day 1 and we ended the quarter with 26.5 million paid subscribers. Since then, consumers have continued to sign up for the service, directly at disneyplus.com through Verizon (VZ), which offers a free year of Disney Plus to many of its customers at no additional cost. As well as through other distributors including Apple (AAPL), Google (GOOG) (GOOGL), LG (LPL), Microsoft (MSFT), Samsung (SSNLF), Sony (SNE) and Roku (ROKU). We recognize there’s a lot of interest in this new business and we wanted to give you some additional context. So, I’m pleased to say that as of Monday [February 3, 2020], we were at 28.6 million paid subscribers.”

The Disney+ subscriber base appears to have continued to grow since then; however, management was prodded during the call to provide an update on its guidance that Disney+ will have 60 million to 90 million global paid subscribers by 2025. Management maintained that guidance and noted that since Disney+ has yet to launch in major international markets, there wasn’t a way to provide greater clarity on what to expect going forward. Here’s additional commentary:

“The next big priority is launching Disney Plus in numerous international markets, starting in Western Europe on March 24 when we will launch in the U.K. and Ireland, France, Germany, Spain, Italy, Switzerland and Austria.

Additional markets including Belgium, the Nordics and Portugal will follow this summer. In December, we signed a deal with Canal Plus, the leading pay-TV provider in France. We’re currently in talks with several other potential distribution partners throughout the region.

We’re also excited to announce that we will be launching Disney Plus in India through our Hotstar service on March 29, at the beginning of the Indian Premier League Cricket season.”

We intend to keep members informed on the success of Disney’s streaming strategy going forward now that shares of DIS are included in our Best Idea Newsletter portfolio.

Financial Overview

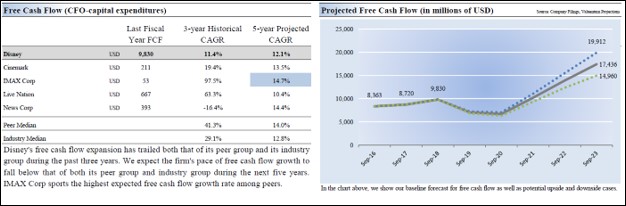

At the end of December 28, 2019, Disney had $6.8 billion cash and cash equivalents on the books versus $10.0 billion in short-term debt and $38.1 billion in long-term debt. We see its net debt load, while sizable, as very manageable given the strength of its cash flow profile. In the graphic below, from our 16-page Stock Report (can be accessed here), we highlight our projections for Disney’s free cash flows over the coming years.

Image Shown: We like the trajectory of Disney’s free cash flow growth.

Coronavirus Update

Due on the ongoing novel coronavirus outbreak in China, Disney closed its Shanghai and Hong Kong theme parks temporarily. That will put a dent in Disney’s financial performance going forward as its theme parks operations are quite profitable; however, we view the company’s caution as prudent given the severity of the situation. Here’s what management had to say on the issue during Disney’s latest quarterly conference call (emphasis added):

“At Shanghai Disney Resort, we currently estimate the closure of the park could have an adverse impact to second quarter operating income of approximately $135 million, assuming the park is closed for two months during Q2.

At Hong Kong Disneyland, we currently estimate the closure of the park could have an additional adverse impact to operating income of about $40 million for the second quarter. As I discussed last quarter, we were already seeing a significant decrease in visitation to Hong Kong Disneyland from China, and other parts of Asia.

So in aggregate, we estimate these two factors could result in a decline in Hong Kong Disneyland’s Operating income of about $145 million for the second quarter. Again, this assumes the resort is closed for two months.”

That indicated Disney is expecting to take at least a ~$0.2 billion hit from the novel coronavirus outbreak in the second quarter of its fiscal 2020, and it isn’t clear how long the epidemic will last (which is the nature of all epidemics at this stage in the crisis). Furthermore, please keep in mind management’s guidance assumes the resorts are closed for two months and not three during the second quarter of Disney’s fiscal 2020.

There have been tens of thousands of reported cases, and hundreds of people who got infected with the novel coronavirus have died. Our thoughts go out to those effected, and we hope the situation reaches a favorable conclusion, but want to stress that as of this writing, this situation remains very much in flux and could get worse before it gets better.

However, there is some good news coming through with Gilead Sciences Inc (GILD) issuing a statement on January 31 highlighting that the company is working with Chinese, US and global authorities to potentially utilize its “investigational compound remdesivir” to treat the novel coronavirus. As mentioned previously, the formal abbreviation of this virus is 2019-nCoV. Remdesivir has been used in the past, in small instances, to treat Ebola and has been found to potentially be effective at treating SARS and MERS. Here’s what the company had to say (emphasis added):

Remdesivir is not yet licensed or approved anywhere globally and has not been demonstrated to be safe or effective for any use. At the request of treating physicians, and with the support of local regulatory agencies, who have weighed the risks and benefits of providing an experimental drug with no data in 2019-nCoV, Gilead has provided remdesivir for use in a small number of patients with 2019-nCoV for emergency treatment in the absence of any approved treatment options.

Gilead is working with health authorities in China to establish a randomized, controlled trial to determine whether remdesivir can safely and effectively be used to treat 2019-nCoV. We are also expediting appropriate laboratory testing of remdesivir against 2019-nCoV samples.

While there are no antiviral data for remdesivir that show activity against 2019-nCoV at this time, available data in other coronaviruses give us hope. Remdesivir has demonstrated in vitro and in vivo activity in animal models against the viral pathogens MERS and SARS, which are coronaviruses that are structurally similar to 2019-nCoV. There are also limited clinical data available from the emergency use of remdesivir in the treatment of patients with Ebola virus infection.

China has reportedly applied for a new patent on Gilead’s experimental treatment and seeks to do whatever it can to get the epidemic under control. Quarantines are a reactionary measure meant to limit the spread of the virus, which have been heavily utilized in China and other parts of the world. Now China, and the rest of the world, want to get ahead of the epidemic with a cure or at least some sort of treatment. We hope for the best.

Significance for Disney

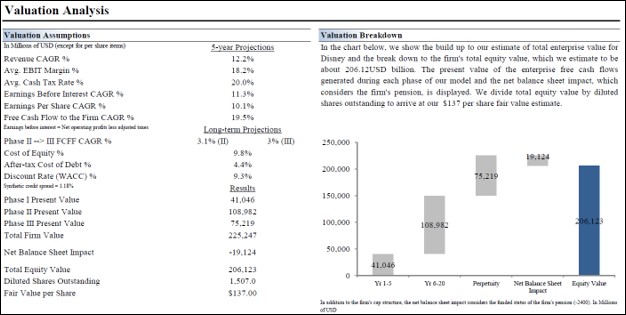

As it relates to Disney, there’s not much the company can do beyond pursue a policy of abundant caution, and that includes shutting down its theme parks in China. We expect the firm’s near-term financial performance will come under pressure; however, please note that generally speaking, most of the value of equities comes from the mid-cycle and perpetuity business periods. At most, usually the immediate business period (defined here as Year 0 to Year 5) represents just ~25% of an equity’s total value (meaning roughly a quarter of the firm’s forecasted discounted free cash flows are generated during this period, keeping balance sheet considerations in mind).

In the graphic below, we highlight our base-case valuation assumptions used in our models covering Disney, which is from our 16-page Stock Report. As you can see, the mid-cycle and perpetuity business periods are by far the most important in terms of total equity value.

Image Shown: A look at our base case scenario covering Disney, keeping in mind that if Disney exceeds these assumptions (a scenario that could arise due to its streaming strategy outperforming expectations), shares of DIS could approach the high end of our fair value estimate range which sits at $168 per share.

While near-term headwinds are meaningful, we don’t view these headwinds as derailing Disney’s promising growth outlook.

Concluding Thoughts

Disney runs a high-quality business, and we see plenty of reasons to like the firm. Back on January 14, 2020, we wrote a note highlighting some of the reasons why we added shares of DIS to our Best Ideas Newsletter portfolio that interested members can read here—->>>>

Media Entertainment Industry – CNK DIS IMAX ISCA LYV MSG NFLX NWSA SIRI

Media (CATV) Industry – AMCX CMCSA DISCA DISH VIAC

Pharmaceuticals (Big) Industry – ABT ABBV AMGN AZN BMY LLY GSK MRK NVS NVO PFE SNY

Pharmaceuticals (Biotech/Generic) Industry – ALXN AGN BHC BIIB BMRN GILD MYL REGN TEVA VRTX ZTS

Related: XLV

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Alphabet Inc (GOOG) (GOOGL) Class C shares, the Health Care SPDR ETF (XLV), and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Microsoft Corporation (MSFT) and the Health Care SPDR ETF are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.