Image Shown: Shares of The Walt Disney Company have performed well over the past year, and we see room for additional upside.

By Callum Turcan

Media and entertainment giant The Walt Disney Company (DIS) was just added to our Best Ideas Newsletter portfolio (article link here announcing recent portfolio changes). Though the firm does not register the typically high Valuentum Buying Index rating that we would prefer with new additions (sometimes we have to relax criteria to achieve newsletter portfolio goals), we like Disney’s business model and its future free cash flows are underpinned by: a top quality intellectual property (‘IP’) portfolio that’s practically impossible to replace, the immense profitability of its theme parks (which benefit from its strong and ever-growing IP portfolio i.e. adding Star Wars-themed rides), its strength in streaming (Disney owns ~67% of Hulu and Disney+ has reportedly been a big hit initially), its position in live sports (one of the few reasons why households keep cable, or choose higher priced streaming packages) is top notch (ESPN, which Disney owns ~80% of, now has ESPN+ to offer incremental upside), and the company should be able to wring out synergies after buying 21st Century Fox (the deal closed in March 2019) through a ~$71 billion cash-and-stock deal.

We value DIS at $168 per share at the high end of our fair value range estimate, significantly above where shares of Disney are trading at as of this writing. If this market continues to surge ahead, we would expect Disney to participate heartily. Shares of DIS yield ~1.2% as of this writing, and that payout is supported by a solid 3.1x Dividend Cushion ratio. Please note Disney pays out a semi-annual dividend ($1.76 per share on an annualized basis as of December 2019). Looking ahead, we think shares of DIS could test the upper bounds of our fair value range estimate, especially if management provides promising updates on Disney’s streaming strategy (Hulu, Disney+, and ESPN+). Please note Disney’s fiscal year ends around the end of September (fiscal 2019 ended September 28, 2019).

Financial Overview

At the end of Disney’s fiscal 2019, the company was sitting on $5.4 billion in cash and cash equivalents versus $8.9 billion in short-term debt and $38.1 billion in long-term debt. We aren’t worried about Disney’s net debt load, which is sizable, given the size of the company’s free cash flows and management’s ongoing deleveraging strategy.

From fiscal 2016 to fiscal 2018 (before the 21st Century Fox deal closed), Disney generated ~$9.0 billion in annual free cash flow on average. In fiscal 2019, due to a large cash income tax payment (~$6.6 billion, whereas that figure came in no longer than +/- $0.6 billion from fiscal 2016 to fiscal 2018), that dropped down to $1.1 billion. We expect Disney’s free cash flow will rebound substantially going forward, and under our base case scenario, we forecast that Disney’s free cash flow will grow to ~$17.4 billion in fiscal 2023.

Dividend obligations stood at $2.9 billion in fiscal 2019 and share buybacks have been suspended as Disney delevers. In August 2019, Disney sold its stake in the YES Network through a deal worth $3.5 billion by enterprise value. Additionally, Disney also sold its interest in 21 regional sports networks last calendar year in a deal worth $10.6 billion by enterprise value. Please note as part of its agreement to acquire 21st Century Fox, Disney agreed to divest some of its sports network assets.

While bringing down its net debt load is a priority, and we think Disney posses the financial capacity to both delever and boost its payout.

Theme Parks

What makes Disney’s theme parks appealing is that the company is capturing as many synergies as it can conceive of when it comes to leveraging the money making possibilities of its IP portfolio. These resorts attract visitors from all over the world given Disney’s legacy and brand power, which provides the company with a nice way to capitalize on the growing global middle class (especially when considering its resorts in East Asian markets). Here’s a summary of its ‘Parks and Resorts’ segment (a segment that’s since been modified, we’ll cover that later on):

The Company owns and operates the Walt Disney World Resort in Florida; the Disneyland Resort in California; Disneyland Paris; Aulani, a Disney Resort & Spa in Hawaii; the Disney Vacation Club (‘DVC’); the Disney Cruise Line; and Adventures by Disney. The Company manages and has effective ownership interests of 47% in Hong Kong Disneyland Resort and 43% in Shanghai Disney Resort, both of which are consolidated in our financial statements. The Company licenses our intellectual property to a third party to operate the Tokyo Disney Resort in Japan. The Company’s Walt Disney Imagineering unit designs and develops new theme park concepts and attractions as well as resort properties.

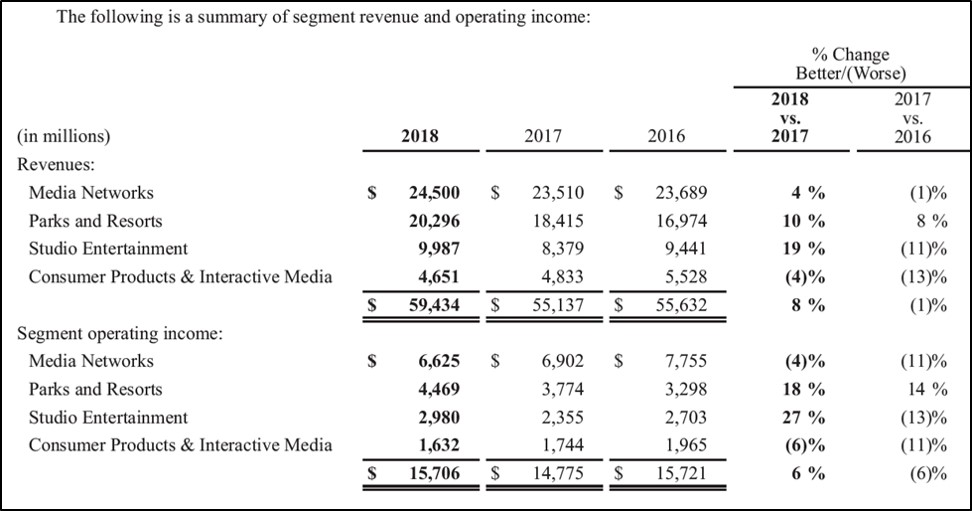

As you can see in the graphic below, Disney’s ‘Parks and Resorts’ revenues and operating income on a segment basis surged from fiscal 2016 to fiscal 2018.

Image Shown: Disney generated over a quarter of its fiscal 2018 segment operating income from its ‘Parks and Resorts’ operations. Image Source: Disney – Fiscal 2018 Annual Report

While the acquisition of 21st Century Fox makes segment-level comparisons across recent fiscal years a tricky task, Disney’s new ‘Parks, Experiences and Products’ segment continued to perform well in fiscal 2019. This segment helped offset weakness elsewhere that fiscal year, as you can see in the graphic below.

Image Shown: The strong performance seen at Disney’s ‘Parks, Experiences and Products’ segment continued throughout fiscal 2019 after the 21st Century Fox deal closed. Image Source: Disney – Fourth Quarter Fiscal 2019 Earnings Report

Going forward, Disney can bank on the recent opening of the Star Wars: Galaxy’s Edge theme park addition (which is now available at Walt Disney World Resort and Disneyland Resort in the US) to drive this segment’s revenues and operating income higher. Pivoting to East Asia, Shanghai Disneyland Park opened back in 2016 and while that operation is exposed indirectly to the US-China trade war, this resort should directly benefit from the emerging middle class in East Asia (and longer term, South Asia and Southeast Asia). Rising disposable incomes allows more households to take trips to places like a Disney-themed resort (vacations that aren’t cheap but aren’t incredibly expensive either) for the first time and many times after that.

Manageable Risk

Disneyland Hong Kong opened back in 2005, an operation which has been contending with the ongoing situation in the city-state of late. The expected declines in Disney’s operating income from the venture is manageable given the strong performance at Disney’s other theme park operations (both domestically and internationally). Management had this to say on the ongoing situation in Hong Kong during Disney’s fourth quarter fiscal 2019 earnings call:

“Results at our international operations were comparable to the fourth quarter last year, as operating income growth at Disneyland Paris and Shanghai Disney Resort was largely offset by about a $55 million decline at Hong Kong Disneyland, as circumstances in Hong Kong have led to a significant decrease in tourism from China and other parts of Asia. And based on the trends we saw in Q4 and what we are seeing so far in Q1, we expect operating income at Hong Kong Disneyland to decline by about $80 million for Q1. If the current trends continue, we could see a full year decline of approximately $275 million versus fiscal 2019.”

On a more positive note (with an eye towards Disney’s domestic theme park operations):

“At Parks, Experiences and Products, operating income was up 17% in the quarter [fourth quarter of fiscal 2019] driven by higher results at Consumer Products and at our domestic parks and experiences business. Consumer Products operating income was up 36% due to growth in merchandise licensing, as a result of strong revenue growth from sales of Frozen and Toy Story merchandise.

At Parks, our strategy of managing yield to drive greater profitability and enhance the guest experience continues to pay off. Operating income at domestic parks and experiences was up 13% driven by growth at Disneyland on higher guest spending and an increase at Disney Vacation Club… Per room spending at our domestic hotels was up 2%, and occupancy of 85% was comparable to the fourth quarter last year…

On the domestic front, we expect Q1 revenue growth at our domestic parks and resorts to benefit from a full quarter of Star Wars Galaxy’s Edge at Walt Disney World and the December opening of Rise of the Resistance at Walt Disney World.”

The new Star Wars additions created incremental operating costs, as did a new collective bargaining agreement, but the forecasted incremental revenues are expected to cover that and then some according to management (incremental revenues will be just “partially offset” by these factors going forward). Disney also mentioned that some of its potential theme park customers may have put off their trip until the new Star Wars additions were ready, and this pent up demand could behoove Disney’s near-term results.

Even when including the disruptive impact of Hurricane Dorian (August 2019 – September 2019), Disney’s “domestic parks and experiences margins were up 70 basis points in the quarter” which we find impressive. Per capita guest spending was up 5% (on what appears to be a year-over-year basis) according to management, which helped drive up Disney’s segment-level margins.

Strong Value Generator

The global success of Disney’s IP portfolio highlights the “moaty-ness” of its business model. Historically, Disney has consistently earned a return on invested capital (‘ROIC’) excluding goodwill that exceeded its estimated weighted-average cost of capital (‘WACC”), usually by wide margin. We rate the firm’s Value Creation as EXCELLENT, and on a forward-looking basis, rate Disney’s Economic Castle as ATTRACTIVE given we expect its ROIC (ex-goodwill) to continue outperforming its estimated WACC. In the graphic down below, from our 16-page Stock Report (can be accessed here), we highlight Disney’s historical ROIC (ex-goodwill) and its forecasted ROIC (ex-goodwill) versus its estimated WACC.

Image Shown: Disney is a quality generator of shareholder value, in our view.

Concluding Thoughts

Though we’d like to see a higher VBI rating upon entry, we see shares of DIS as a great fit for the Best Ideas Newsletter portfolio given the potential for meaningful capital appreciation. The company also pays out a modest dividend, and payout growth should resume in earnest once the deleveraging program is complete. Members interested in reading more about Disney’s streaming ambitions should check out this article here—->>>>

Media Entertainment Industry – CNK DIS IMAX ISCA LYV MSG NFLX NWSA SIRI

Media (CATV) Industry – AMCX CMCSA DISCA DISH VIAC

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. The Walt Disney Company (DIS) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.