Image Shown: A drill ship floating in open waters. Image Source: Exxon Mobil Corporation – 2019 IR Presentation

By Callum Turcan

We’re going to get into the potential opportunity for energy producers in Guyana, but first, one thing that often gets lost in the noise surrounding press releases and presentations announcing new upstream projects coming online is that Exxon Mobil Corp (XOM) and its peers are contending with serious base decline rates.

Decline rates are around 3-5% per year for conventional fields depending on the level of investment made in base maintenance (along with recovery rates and the quality of the rock), which includes such things as gas/water injection projects (this entails drilling injection wells to maintain reservoir pressure and often involves drilling new producing wells) and what’s known as acidizing (which entails cleaning the well with hydrochloric acid mixtures and/or injecting a solution into the formation itself depending on the situation). Should Exxon Mobil or any other company with upstream operations (the production of raw energy resources like oil and natural gas) not make these types of investments, the natural rate of decline is higher at 5-7% per year (additionally, the rate of decline is higher for oil than natural gas).

Please note that Exxon Mobil estimates “without investments, we estimate the supply of existing oil naturally declines at a rate of approximately 7 percent per year” and furthermore, that “the imperative for investment in natural gas is similar to oil, with the annual decline of natural gas from existing supplies at approximately 5 percent”. This was from Exxon Mobil’s 2018 Financial and Operating Review. For a company that produced 2.3 million barrels of liquids and 9.4 billion cubic feet of natural gas per day in 2018, equal to 3.8 million barrels of oil equivalent per day (‘BOE/d’), Exxon Mobil’s annual upstream production base (before taking its push into shale into account) is shrinking by approximately 200,000 – 300,000 BOE/d every single year from its existing operations.

Add in its growing unconventional Permian output which has much sharper decline rates (wells that are hydraulically fractured, like those seen across the US, have first year decline rates that range from 45-80% which requires new wells to be constantly turned online to maintain output), and one gets a better idea of why Exxon Mobil’s new projects haven’t yielded upstream growth in the recent past. In 2011, Exxon Mobil’s upstream production came in at 2.3 million barrels of liquids and 13.2 billion cubic feet of natural gas per day, equal to 4.5 million BOE/d. Since then, Exxon Mobil’s upstream production has fallen to 3.8 million BOE/d (as of 2018) as mentioned previously. In the third quarter of 2019, Exxon Mobil produced 3.9 million BOE/d.

The Great Guyana Oil Boom

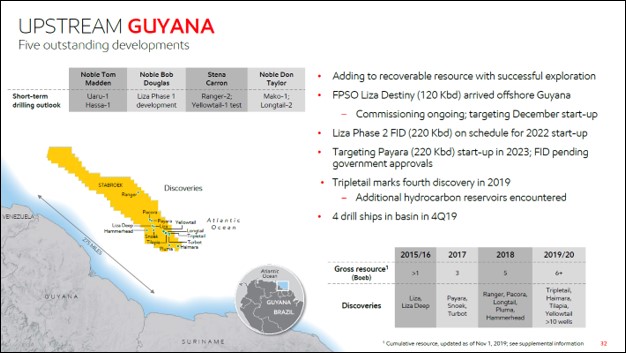

With this in mind, let’s look at Exxon Mobil’s impressive Guyana operations. Since striking liquid gold (namely crude oil) back in 2015, the Exxon Mobil-led venture has made 16 successful discoveries in the country. Those discoveries uncovered 8 billion barrels of recoverable oil equivalent, namely crude oil, and given that these are substantial conventional resources, this region is expected to be very competitive on the global cost of supply curve. By the end of 2019, Exxon Mobil and its partners Hess Corporation (HES) and CNOOC Ltd (CEO), who each own 45%, 30%, and 25%, respectively, of the 6.6 million square acre Stabroek Block in offshore Guyana that houses these resources, had achieved first-oil at the block.

Image Shown: A look at the Stabroek Block off the coast of Guyana, a small country in the northern portion of South America, where Exxon Mobil and its partners have found an enormous amount of recoverable low-cost conventional oil resources. Image Source: Exxon Mobil – 2019 IR Presentation

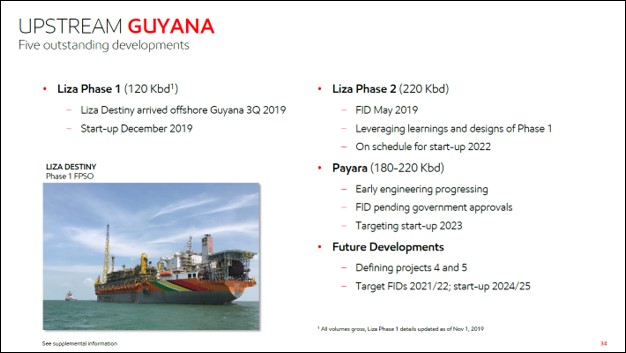

The consortium decided to develop the Liza oil field first given its immense size. By turning the Liza Phase One project online, which entailed developing a series of producing wells supported by a floating production storage and offloading (‘FPSO’) vessel, the Exxon Mobil-led group will soon be able to pump out 120,000 barrels of crude oil per day on a gross basis from the region. That FPSO is known as the ‘Lisa Destiny’ vessel. Another FPSO, ‘Lisa Unity’, is under construction and set to come online in the middle of 2022. Once operational, Lisa Unity will have the capacity to produce up to 220,000 barrels of crude oil per day and like the Liza Phase One project, this Liza Phase Two endeavor is developing the Liza oil field.

Image Shown: A look at the project timetables for the consortium in terms of existing and future developments. Image Source: Exxon Mobil – 2019 IR Presentation

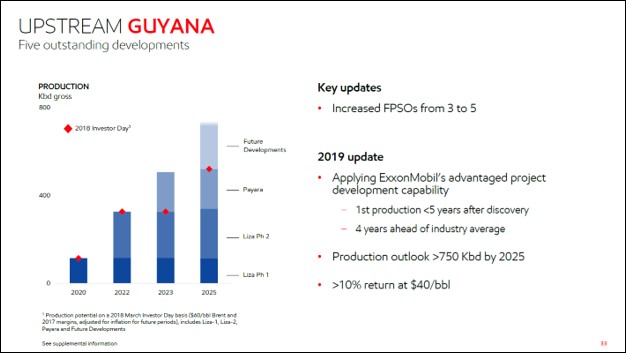

Furthermore, the consortium envisions possibly adding a third FPSO to the region, tentatively dubbed ‘Prosperity’, to develop the Payara oil field. More broadly, Exxon Mobil and its partners have their eyes set on having five FPSO vessels that will collectively produce ~750,000 barrels of crude oil per day in the region on a gross basis by 2025. As things stand today, all of those volumes will be exported given that Guyana does not possess an oil refinery or any meaningful domestic refining capacity. There are currently four drill ships operating in the Stabroek Block with another slated to join the group later this year. For a country that just five years ago didn’t even have a hydrocarbon sector to speak of (at least not one of this caliber), that’s quite the change in scenery.

Exxon Mobil and its partners are thought to be in a position to earn a very economical return on their investment, short of oil prices crashing to the floor and staying there, given the relatively favorably tax regime the consortium is operating in. Compared to other oil-rich nations, such as an Iraq (where foreign oil companies are generally sub-contractors and earn a paltry return) or Brazil (where taxes and regulations are quite onerous, however, the current administration has been more amenable to the industry) for example, the contracts and tax regimes aren’t always conducive to foreign companies seeking to earn a decent return on investment as compared to the US, Canada, or now Guyana (at the right raw energy resource price point of course, no private firm makes good money in a price taking business when prices are low).

Image Shown: A look at the upstream growth trajectory of the Exxon Mobil-led Guyana consortium, with an eye towards the very economical nature of these types of large conventional oil projects. Image Source: Exxon Mobil – 2019 IR Presentation

As Guyana’s crude oil production has access to every major oil demand center in the world, the consortium will be able to fetch Brent-linked prices for these upstream volumes. Brent trades at a premium to WTI, which is very important to note when comparing these assets to that of say, an onshore oil field in the US that doesn’t have easy access to the US Gulf Coast region. Exxon Mobil estimates these projects will earn a return north of 10% in a ~$40 Brent world, and the venture should be quite economical in a $60 Brent world.

Concluding Thoughts

Guyana’s economy of ~780,000 people is about to experience the oil boom bonanza of a lifetime, even in the relatively subdued oil price environment Exxon Mobil is currently operating in, as substantial royalties and taxes are set to fill the government’s coffers. That will allow for major public investments in healthcare, education, infrastructure, and so much more. Given the relatively small size of Guyana’s population, there will be a lot of new funds to go around.

For Exxon Mobil and its partners, turning ~750,000 barrels of gross daily crude oil production capacity online by 2025 would be quite the achievement. In less than five years, the consortium went from hitting it big on the exploration side to reaching first-oil, and in ten years, the group plans on turning Guyana into one of the world’s largest oil exporters on a net basis. However, please keep in mind that big projects like these are contending with material mature field declines across Exxon Mobil’s upstream portfolio. Guyana is just part of the puzzle for Exxon Mobil.

Oil & Gas (Majors Industry) – BP CVX COP XOM RDS.A RDS.B TOT

Independent Oil & Gas Industry – APA COG CLR DVN EOG MRO OXY PXD

Industrial Minerals: ARLP, CCJ, CNX, HCR, NRP

Refining Industry – HES HFC MPC PSX VLO

Oil & Gas Pipeline Industry – ENB ET EPD KMI MMP

Related: CEO, USO, BNO, ARMCO, XLE, XOP, VDE, AMLP, AMZA

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Kinder Morgan Inc (KMI) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. BP plc (BP), Enterprise Products Partners L.P. (EPD), and Magellan Midstream Partners L.P. (MMP) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.