Image Shown: Capitalizing on the various lucrative opportunities the aerospace industry offers PPG Industries Inc underpins its long-term free cash flow trajectory. Image Source: PPG Industries – December 2019 IR Presentation

By Callum Turcan

On January 16, maker of painting, coating, and specialty materials PPG Industries Inc (PPG) posted fourth quarter earnings for 2019 that missed consensus estimates on both the top- and bottom-lines. Shares sold off sharply initially before recovering modestly throughout the trading session January 16. Let’s walk through PPG Industries’ quarterly performance to get a feel for how broader industrial activity is trending and why economic softness may be looming. As of this writing, PPG Industries is trading in the upper bound of our fair value estimate range.

Financial Overview

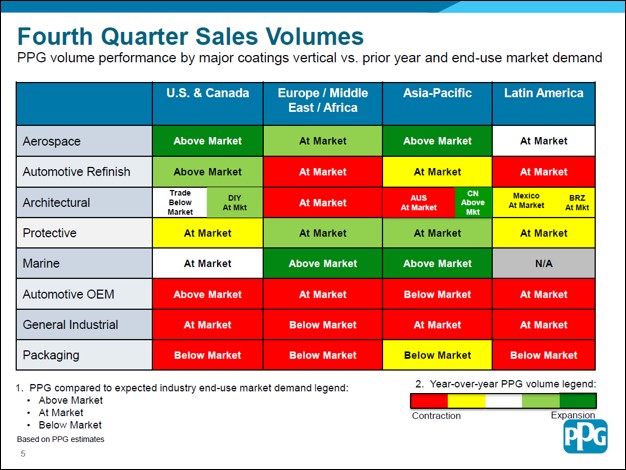

PPG Industries has performed well in the aerospace and marine industries, and we emphasize its growing exposure to the aerospace industry underpins the strength of PPG Industries’ free cash flow trajectory. The company’s goal is to grow its sales at or above market growth rates across the numerous industries PPG Industries caters to including; aerospace, automotive, marine, packaging, construction, and others.

Image Shown: A look at PPG Industries performance across numerous industries on a relative basis. Image Source: PPG Industries – Fourth Quarter 2019 Earnings IR Presentation

In 2019, PPG Industries’ GAAP revenue declined by over 1% year-over-year to $15.1 billion and its GAAP diluted EPS dropped by 5% to $5.22 (a decline that was made less severe due to its weighted-average diluted share count dropping by 3% during this period). On a GAAP basis, PPG Industries’ gross margins expanded by over 140 basis points in 2019 versus 2018 levels, however, rising SG&A expenses and significant increases in restructuring charges ate into those gains (as did its weaker top-line performance). Slowing industrial activity worldwide during the second half of 2019 weakened PPG Industries’ revenues, while synergies (including those from its acquisitions) helped support its margins.

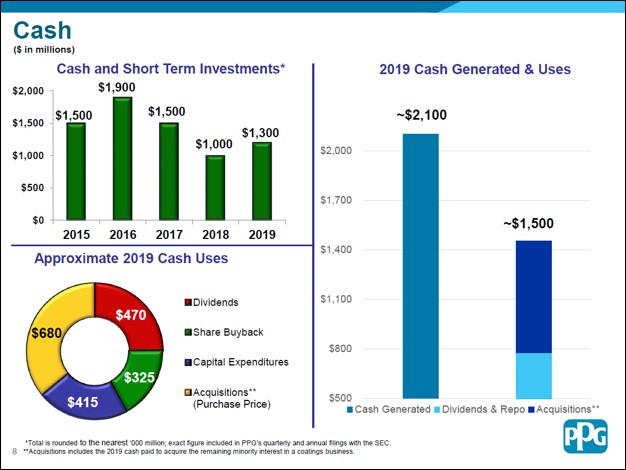

The company’s acquisitive nature and its ongoing share buyback program are largely why PPG Industries exited 2019 with a net debt load of $3.8 billion (inclusive of short-term debt and short-term investments). We will have more to say on PPG Industries when its cash flow statement for all of 2019 is published, as that wasn’t provided in its press release and its 10-K filing has yet to be published as of this writing. Management provided the graphic below to highlight the apparent cash flow profile of PPG Industries (seen through the ~$2.1 billion in “cash generated” in 2019 versus ~$0.3 billion in capital expenditures).

Image Shown: PPG Industries provided an overview of its cash flow position for 2019, keeping in mind we would prefer to see the actual cash flow statement to get a gauge of its financial status. Image Source: PPG Industries – Fourth Quarter 2019 IR Earnings Presentation

Pressures Building Ahead

As of the third quarter of 2019, PPG Industries noted it was successfully able to push through “six consecutive quarters of greater than +2% pricing” which was quite decent given the weakening macroeconomic backdrop (global GDP growth peaked in 2017, according to data and forecasts provided by the World Bank). However, during the fourth quarter of 2019, that growth rate slowed down to “almost 2%” on a year-over-year basis (hitting 1.8%). While that might appear insignificant at first, please note PPG Industries mentioned in the recent past that headwinds were building in the second half of 2019, particularly as it relates to industrial activity.

Going forward, that weakness appears likely to continue with management providing relatively soft guidance for 2020 that calls for constant-currency sales growth (non-GAAP) of 1-3% on an annual basis when including recently announced acquisitions. That implies organic sales growth is likely to be muted, making future price increases a tougher sell which indicates that the slowing growth rate of pricing increases in the fourth quarter could be part of a broader trend over the coming quarters. Constant-currency adjusted non-GAAP EPS is expected to rise by 4-9% in 2020 on an annual basis, aided by cost reductions. PPG Industries secured roughly $85 million in cost savings in 2019 from its restructuring program, a strategy that involved headcount rationalizations.

In the final quarter of 2019, PPG Industries completed its acquisition of Texstars which makes coatings and other products for the aerospace industry. Terms of the deal weren’t disclosed, but more information of the deal should become available when PPG Industries publishes its 10-K filing.

On January 8, 2020, PPG Industries announced it was acquiring automotive paints and coating company Industria Chimica Reggiana (‘ICR’) and the financial terms of the deal weren’t disclosed. PPG Industries is very acquisitive, and while the company has a great track-record of integrating new companies into its global operations, it’s clear that management’s guidance calling for modest adjusted sales growth in 2020 likely leans heavily on the uplift provided by deals such as these.

Dividend Strength

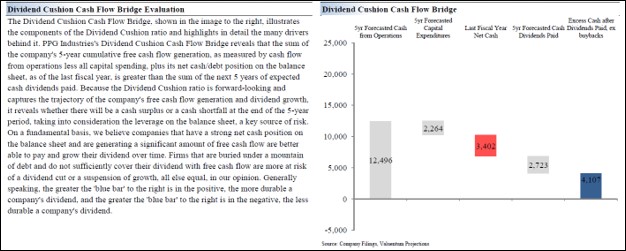

PPG Industries is a Dividend Aristocrat that’s pushed through 47 years of consecutive dividend increases, and we like its payout coverage. Its strong free cash flow profile, a product of its modest capital expenditure requirements, underpins PPG Industries’ 2.5x Dividend Cushion ratio (seen in the graphic below, from our two-page Dividend Report that can be accessed here). Furthermore, we like the trajectory of its per share payout growth. As of this writing, shares of PPG yield ~1.6% on a forward-looking basis.

Image Shown: PPG Industries may be facing rising exogenous headwinds in the near-term, but its strong forecasted free cash flows and manageable net debt position provides for good dividend coverage on a forward-looking basis.

Concluding Thoughts

While consumer spending and services industries are holding up well both in the US and around the world, the industrial side of things is a different matter. Auto sales in China are declining and auto sales in the US have plateaued, while Europe’s economy is experiencing a major slowdown, and please note that slowdown is happening before the impact of Brexit truly materializes. For a company like PPG Industries, there’s only so much the company can do when faced with rising exogenous headwinds. We’ll have to see how the nascent US-China “Phase One” trade deal pans out as it relates to business confidence and other factors.

Broad Chemicals Industry – APD ASH CE DD ECL EMN FUL HUN LYB PPG

Chemicals – Mid/Small Industry – ALB GTLS FMC IPHS IFF NEU OLN ROL

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.