Aside from dominating the global revenue pools for investment banking and trading, Goldman is doing other things right. The firm has rapidly gathered deposits in the US and UK over the past year, bringing in a lower cost of funds to help facilitate its balance sheet. Goldman has also built up Marcus, Apple Card, and the bank is in the process of growing its asset management business to better serve institutional clients.

By Matthew Warren

Goldman Sachs (GS) posted mixed fourth-quarter results, released January 15, beating consensus revenues but missing on the bottom line by a substantial amount as a result of a $1.24 billion charge related to the ongoing 1MDB (1Malaysia Development Berhad) scandal potential upcoming resolution. 1MDB is the name of a state investment fund in Malaysia where billions of dollars were stolen in one of the biggest frauds in recent times.

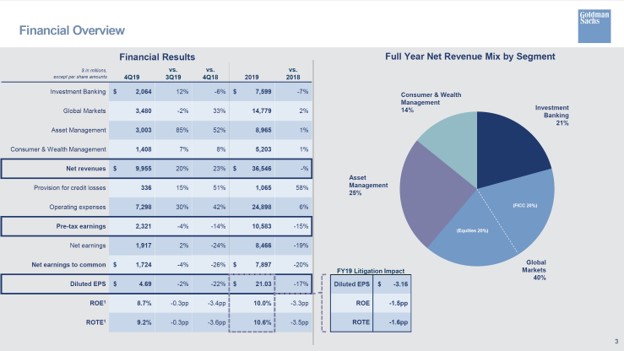

For the year, Goldman’s revenues were flat and diluted earnings per share were down 17%. The 1MDB litigation-impact hit annual EPS by $3.16 and return on tangible equity by 1.6 percentage points, resulting in a 10.6% ROTE for 2019. Simply put, we are not impressed by this figure. Goldman claims number-one position in many investment banking and trading categories, but it clearly struggles to convert that into returns on capital above the cost of capital, which is pretty damning 11 years into a bull market cycle.

Below are the new segment breakdowns in the graphic (Investment Banking, Global Markets, Asset Management, Consumer & Wealth Management), divisions that will be discussed in more detail later in January at Goldman’s first investor day. At that time, we expect management to shed more light on their strategies with the newer businesses like Marcus, as well as putting out more concrete efficiency ratio and return on capital targets. This will make them more accountable to improving these key metrics, and we fully expect the street to hold them to their new targets.

Image Source: Goldman Sachs Earnings Presentation

Aside from dominating the global revenue pools for investment banking and trading, Goldman is doing other things right. The firm has rapidly gathered deposits in the US and UK over the past year, bringing in a lower cost of funds to help facilitate its balance sheet. Goldman has also built up Marcus, Apple Card, and the bank is in the process of growing its asset management business to better serve institutional clients. As these businesses have been in heavy investment mode and should theoretically be scalable, we think Goldman has room to improve its return on capital in coming years, if the economy and markets cooperate.

All things considered, while we are still disappointed in Goldman’s economic returns, we are raising our fair value estimate to $225 to reflect the potential for current returns to roughly equal mid-cycle returns in coming years. [This fair value estimate change will be reflected in Goldman’s table upon the regular data update at the end of this upcoming weekend.]

—–

Bank of America Gaining Share >>

Citigroup Succeeding at Cross-Selling >>

Wells Fargo Remains an Inefficient Bank Despite Regulatory Overhang >>

JPMorgan’s Quarter Shows Higher Sustainable Growth Potential >>

Related: XLF, VFH, XFO

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Matthew Warren does not own shares in any of the securities mentioned above. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.