Image Source: Nucor Corporation – June 2019 IR Presentation

By Callum Turcan

Steel and steel product producer Nucor Corporation (NUE) bills itself as North America’s largest recycler, using scrap metal at its mills in the US to maintain its status as a low cost producer of anything from steel beams to precision castings. The company has 25-scrap based steel mills that can produce 27 million tons of steel per year. Our fair value estimate for Nucor stands at $53 per share after our recent industry update, and we like the firm’s dividend coverage as well. Shares of NUE yield 2.8% and trade just north of our fair value estimate as of this writing.

Strong Free Cash Flows

On October 22, Nucor reported its third-quarter earnings for 2019 (period ended September 28). Shares of NUE have steadily climbed higher over the past month largely due to growing optimism regarding a US-China trade deal, albeit likely a narrow one if an agreement does materialize. Nucor’s outgoing CEO John Ferriola (retiring at the end of this year) noted that investors shouldn’t expect a material pickup in North American steel demand during the remainder of 2019 in a recent interview. Additionally, Nucor’s CEO mentioned that the 2020 outlook for North American steel demand remained tough to gauge given ongoing geopolitical considerations (such as a US-China trade deal or ultimately lack thereof, whether the USMCA passes Congress, etc.).

During the first three quarters of 2019, Nucor generated $2.1 billion in net operating cash flow while spending $1.0 billion on capital expenditures. We caution that Nucor’s capital expenditures are expected to rise materially in 2019 versus 2018 levels and are up roughly 58% year-over-year during the first nine months of the year. Dividends during this period came in just under $0.4 billion, and Nucor allocated $0.2 billion towards share buybacks. Nucor’s impressive free cash flow profile, given the problems facing the industry, is largely a product of its focus on recycling scrap metal to keep costs contained while making capital investments that seek to generate meaningful operational efficiencies over time.

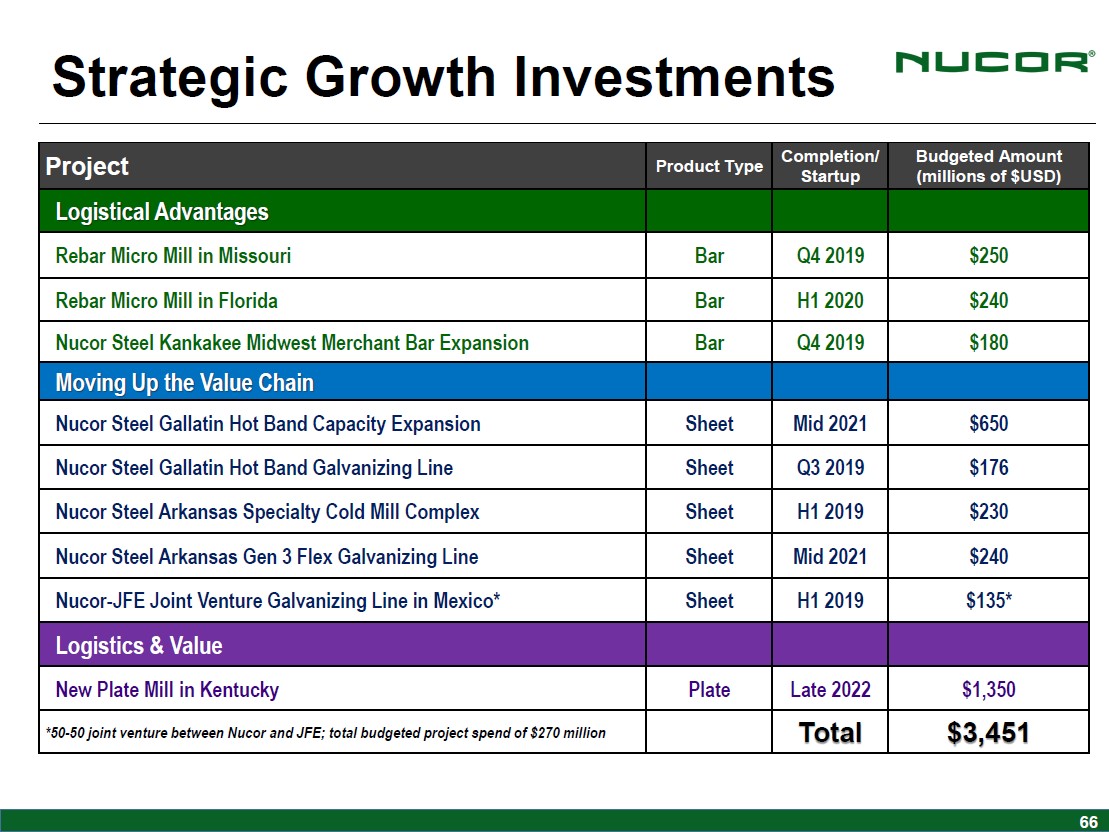

In the graphic down below, Nucor highlights the various projects the firm is developing. Moving into higher-value products and pursuing logistical efficiencies represent two key ways management seeks to improve Nucor’s margins and profitability levels in any environment.

Image Shown: Nucor seeks to upgrade several of its facilities to produce higher-value products and to unlock efficiency gains across its logistical networks. Image Source: Nucor – June 2019 IR Presentation

Terrible Industry

While Nucor is the leading North American steel producer, not just in terms of volume produced but also taking its low cost operations into account, we still really dislike the industry. Consistently decent returns are hard to come by as exogenous shocks (i.e. the recent slowdown in global industrial activity) often derail even the best of plans and intentions. Here’s how we view the steel industry, from our recently updated 16-page Stock Report covering Nucor that can be accessed here—->>>>

Firms in the steel industry face strong international competition, especially from China, which can often produce steel at rock-bottom prices thanks to lower-cost operations and structural advantages. Steel producers operate at the whim of the prices of volatile raw materials used in production, namely iron ore, coal, natural gas and scrap. Products are sold on the spot market, while other shipments can often be sold under agreements that do not allow for recovery of changes in input costs. Labor unions and the threat of structural overcapacity add more uncertainty. We think the industry structure is very poor.

Here’s how we see that influencing Nucor’s dividend strength, from our recently updated two-page Dividend Report with additional commentary that can be accessed here—->>>>

The biggest threat to Nucor’s dividend safety, and overall financial health, is the poor structural characteristics of the steel industry. Global overcapacity and lower-cost foreign producers have pressured Nucor’s business and should be expected to continue to do so, even as the US works to combat the detriments of low-cost foreign imports through the use of tariffs and bilateral trade agreements (such as the quotas established with South Korea in 2018, limiting steel exports to the US).

The firm’s balance sheet health could be better; net debt was ~$2.4 billion as of the end of its third quarter of 2019 which ended on September 28 (consisting of over $1.9 billion in total cash, cash equivalents, and short-term investments versus just under $4.4 billion in total short-term and long-term debt and finance lease obligations). Nucor reduced its net debt load by ~$0.5 billion during the first three quarters of 2019 versus year-end 2018 levels. Nucor’s investment grade credit ratings (A-/Baa1) are indicative of its financial strength.

Competing uses of capital have the potential to impact the pace of dividend expansion moving forward (capital expenditures are expected to rise, particularly in the form of growth investments in its business and share repurchases). Despite the cyclical nature of the steel industry, the company’s dividend appears to be on solid ground seen through its Dividend Cushion ratio of 1.6x, earning Nucor a GOOD Dividend Safety rating.

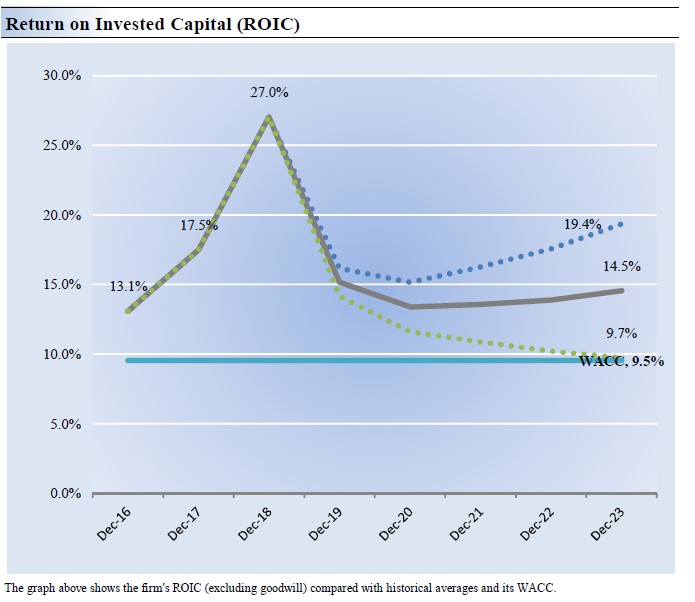

Nucor has done a great job over the past few fiscal years earning a return on invested capital (ex-goodwill) that consistently exceeded its estimated weighted-average cost of capital, given the numerous structural hurdles facing the North American steel industry in a highly globalized world. We like Nucor’s ability to generate shareholder value over the coming years and rate its Economic Castle rating as ATTRACTIVE. However, under more pessimistic assumptions, we forecast Nucor’s ROIC (ex-goodwill) would converge with its estimate WACC over the medium-term as you can see in the graphic below, from our 16-page Stock Report.

Image Shown: Exogenous shocks could materially hamper Nucor’s ability to generate shareholder value.

Concluding Thoughts

We aren’t adding Nucor to any newsletter portfolio at this time given the ongoing synchronized slowdown in global economic growth, especially on the industrial side of things, as shares of NUE already trade near our fair value estimate (and risks appeared skewed to the downside). Nucor is one of the best in the business, but business can be just downright terrible during a recession or a slow growth economy given existing overseas competition and declining North American demand in the event auto sales, construction activity, and other economic activities slow down. Geopolitical and trade events will continue to loom large over the steel industry going forward.

Steel Industry – AKS MT GGB NUE PKX STLD X

Related: SLX

—-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.