Image Source: Oracle Corporation – September 2019 IR Presentation

By Callum Turcan

On Monday October 7, Reuters reported that Oracle Corporation (ORCL) planned to hire an additional ~2,000 workers to support the tech giant’s cloud expansion strategy. These new jobs would be centered around San Francisco, Seattle, and India. As of May 31, 2019, Oracle had 136,000 full-time employees located around the world with 18,000 of those employees supporting the firm’s cloud computing division. Most importantly, Oracle plans to launch another 20 cloud regions by the end of 2020 that would complement its existing 16 cloud regions, vastly augmenting its ability to cater to international customers (and to US-based clients as well). We continue to like Oracle in our Dividend Growth Newsletter portfolio and shares of ORCL yield 1.8% as of this writing.

Enhancing the Cloud Growth Story

Oracle defines cloud regions as areas that are directly supported by its existing data centers (in those regions), meaning these are regions that Oracle can better compete in. The firm has opened roughly a dozen of these cloud regions over the past year. Going forward, Oracle plans on expanding into Chile, Japan, South Africa, the United Arab Emirates and elsewhere. Adding cloud regions in Chile, South Africa, and the UAE will support growth in neighboring markets as those nations are widely considered home to the major business hubs of their respective regions (i.e. many multinationals set up shop in the UAE when seeking to grow across the Middle East by building up the necessarily relationships and knowledge of local business needs first before expanding physical operations across the region). In Japan, Oracle is targeting cloud computing sales growth in one of the largest IT markets in the world.

By expanding its international reach and bulking up its workforce, Oracle hopes to gain a larger slice of the lucrative cloud computing market. So far, Oracle’s peers including Amazon Inc (AMZN) and Microsoft Corporation (MSFT) have done a better job securing and growing their cloud computing market share on a global basis.

As an aside, Amazon appeared slated to win the ~$10 billion decade-long Joint Enterprise Defense Infrastructure (“JEDI”) cloud contract from the US Department of Defense, but now that doesn’t necessarily appear to be the case as the contract award process has been put on hold. Part of this was likely due to maneuvering on Oracle’s end as Oracle alleged the bidding process was unfair, launching a widespread legal and (presumably) lobbying effort to highlight this allegation.

During the first quarter of Oracle’s fiscal 2020 (period ended August 31), the firm reported that its “cloud ERP businesses, including both Fusion ERP and NetSuite ERP, grew 33% in Q1” according to CEO Mark Hurd (who recently took a medical leave of absence, news that we covered in this article here). Additionally, the CEO mentioned Oracle “now [has] over 6,500 Fusion ERP customers and over 18,000 NetSuite ERP customers. This continued strong growth has solidified our number one market leader position in cloud ERP worldwide, and our number one position in the overall applications business in North America.” Oracle appears confident in its North American performance, and now the company wants to expand overseas to keep the momentum going.

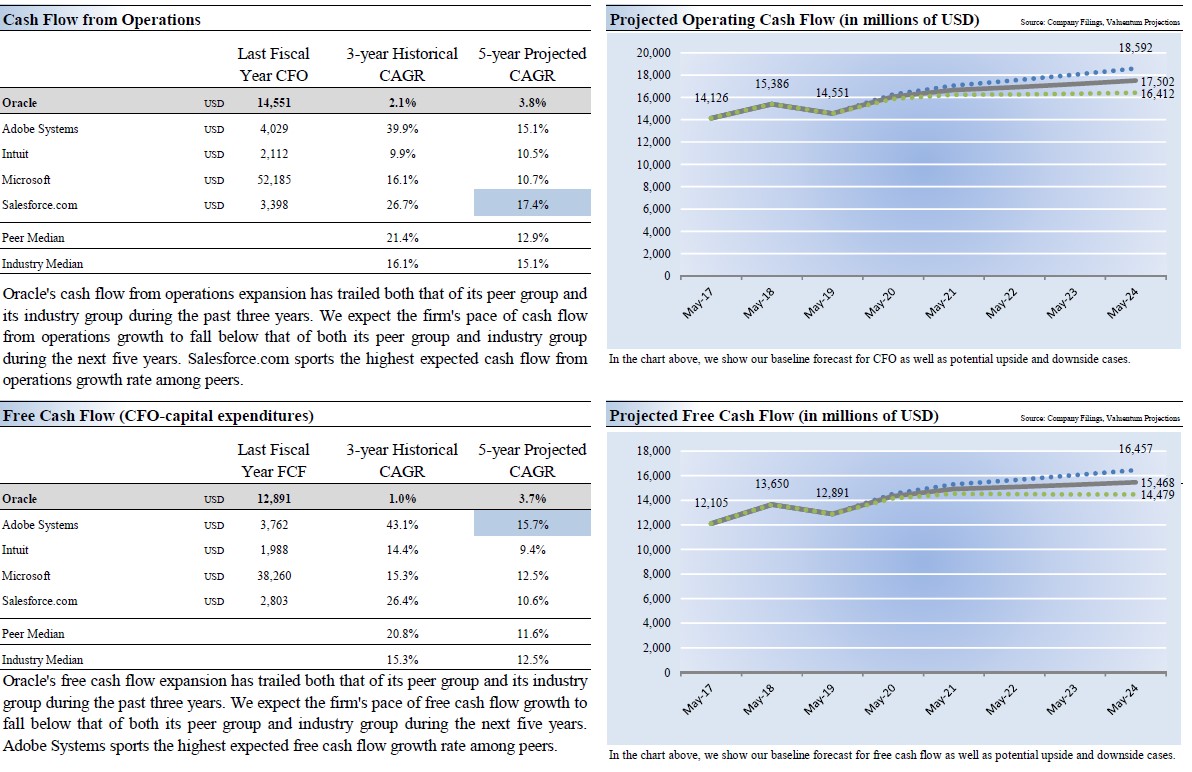

We really like Oracle’s consistent free cash flows and want to highlight its rock solid 2.7x Dividend Cushion ratio. Oracle’s net operating cash flows are very stable, and its business model is relatively light on capital expenditures, two things we like to see when evaluating potential dividend growth opportunities. The stability of Oracle’s historical free cash flows and its expected free cash flows can be seen in the graphic down below, sourced from our 16-page Stock Report covering the name which can be accessed here—->>>>

Image Shown: Oracle’s net operating cash flows are very stable, and we see those cash flows steadily growing over the next five years. That trajectory is aided by the firm’s aggressive push into the cloud computing space both domestically and overseas.

At the end of August 31, Oracle had $35.7 billion in cash, cash equivalents, and marketable securities on hand versus $54.4 billion in total debt. Its strong free cash flows make Oracle’s net debt position very manageable and support a nice dividend growth story. Should Oracle’s push into the overseas cloud computing space prove effective, the firm’s free cash flows could test the upper bounds of our forecasted range.

Concluding Thoughts

We continue to like Oracle as a holding in our Dividend Growth Newsletter portfolio and are excited to see how its push into new international cloud computing markets will pan out. Our fair value estimate stands at $55 per share, roughly where ORCL is trading at as of this writing, with the top end of our fair value estimate range sitting at $66 per share (Oracle could test the upper bounds of our range should its cloud computing growth story pick up steam).

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

Related – AMZN

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Oracle Corporation (ORCL) and Microsoft Corporation (MSFT) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.