We’re reiterating the large range of fair value outcomes for Amazon. We’re staying far away from General Electric and Kraft-Heinz. Netflix may have its back against the ropes with Disney Plus. CVS Health and Gilead were two setbacks in the newsletter portfolios in the past, but we kept losses to a minimum and new ideas more than offset the weakness. The Best Ideas Newsletter portfolio continues to do very well.

By Brian Nelson, CFA

Amazon (AMZN)

Image Shown: Amazon has a large range of fair value outcomes, and shares are trading roughly in line with our fair value estimate.

The e-commerce powerhouse’s shares have come in aggressively since it reported second-quarter results July 25. We get a lot of questions about Amazon, and yes, we do like the company. In the context of a very tech-heavy Best Ideas Newsletter portfolio, however, we feel more comfortable with equity ideas that have a comparatively smaller range of fair value outcomes such as Apple (AAPL) or even Facebook (FB). For example, even just a one percentage-point change in our mid-cycle operating-margin expectation for Amazon results in big change to the fair value estimate. You’re not going to see us adding Amazon to the newsletter portfolios anytime soon. Our fair value estimate range stands at $1,540-$2,560; shares aren’t for the faint of heart, despite robust free cash flow generation and a solid balance sheet.

General Electric (GE)

Image Shown: The combination of the free cash flow to the firm process (enterprise valuation) and technicals helps to avoid value traps.

What more can we say about General Electric. We notified members that we were removing shares of the industrial conglomerate May 15, 2017, “Newsletter Alert: Title Withheld – Members Only.” Shares were removed from both newsletter portfolios at $28+ per share, and now they reside less than $10 each. We’re not interested in shares at the moment, and we don’t think anything will change our mind in the coming quarters. General Electric’s story is “broken,” — it is no longer the company it once was after shedding its financials operations, doubling-down on energy, working through government investigations, and buying back its stock at the worst possible prices. Our fair value estimate stands at ~$11, and we don’t see much upside.

Kraft-Heinz (KHC)

Image shown: The rating history of Kraft-Heinz. Valuentum members were warned in advance of this pricey equity in 2016/2017, and the VBI rating never advanced past 5 since then after registering a 1, the worst rating, on two separate occasions.

Our good friend Warren Buffett is still struggling with his Kraft-Heinz stake, with shares falling to the mid-$20s from north of $60+ each. The reality is that when shares were trading in the high-$80s and low-$90s during late 2016 and through 2017, we couldn’t come anywhere close to its price with our discounted cash-flow infrastructure. Shares were ridiculously overvalued at the time and registered the worst rating on two separate occasions, in September 2016 and June 2017. The company’s second-quarter report, released August 8, was muddied with impairment charges, and the firm suffered from cost inflation. Management said it best in its second-quarter report:

The level of decline we experienced in the first half of this year is nothing we should find acceptable moving forward. We have significant work ahead of us to set our strategic priorities and change the trajectory of our business. We have a lot to work with and build upon, and our team is motivated by the opportunity to drive the next phase of growth and profitability for Kraft Heinz and our shareholders. — Kraft Heinz CEO Miguel Patricio

We’re not interested in Kraft-Heinz. When a stock’s price is declining, it generally means that the market believes shares should be valued less. When shares were trading at levels in the high-$80s and low-$90s, it was easy to say shares were overpriced. However, in the mid-$20s, we’d only wait until shares start to rebound before considering them. Plus, there are so many other good companies out there. Forget about Kraft-Heinz. We might see a dead-cat bounce with Kraft-Heinz like we witnessed with GE through the course of its fall, but we’re putting this one in the “too-hard” bucket.

Disney (DIS)

Image Shown: Disney’s shares have outpaced Netflix’s since the company announced the launch of Disney Plus in April this year.

Disney has been in the news a lot of late. The company seems to be launching an all-out attack on Netflix (NFLX). It may have only been a matter of time before the content creators start to demand more of the value pie from the largely content distributors, and Disney is doing just that. The firm’s Disney Plus “will stream movies and originals from Marvel, Star Wars and its own studio – and unlock a discount that bundles Hulu and ESPN Plus for the same price as Netflix.” We think Netflix is in a world of trouble, and while many customers may just add Disney Plus to their entertainment suite that may also include Netflix and Amazon Prime, for those having to choose between Disney or Netflix, the choice is not an easy one given the mega-hits at the former. Shares of Disney are fully priced, in our view.

CVS Health (CVS)

Image shown: CVS Health has significantly underperformed the Healthcare Select Sector SPDR ETF (XLV) since the beginning of 2017.

CVS Health was a rare idea in the newsletter portfolios that didn’t quite live up to our expectations a couple years ago. In the context of 15-20 ideas (or a total of 40 or so in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio in the premium membership), we’re going to get a few wrong. But we didn’t dwell on our mistake. We removed CVS Health from the newsletter portfolios February 2018, more than a year ago now, and we didn’t look back (in fact, we added a couple months later what turned into a big winners, Chipotle and Xilinx). In case you missed it, here’s what we said more than 12 months ago about CVS, on February 8, 2018:

We think we’ve seen enough with the myriad risks that have found their way into the CVS “story.” From the Amazon-Whole Foods scare to Amazon teaming up with Berkshire Hathaway (BRK.B) and JP Morgan (JPM) to form a new healthcare company, the long-term outlook for CVS has become even more cloudy. Its purchase of Aetna may have been the straw that broke the camel’s back to our thesis, and we can neither see relief with respect to the structural dynamics of the industry in which it operates, nor can we see its increased leverage and competitive environment a positive for the dividend. We are removing CVS from both the simulated Dividend Growth Newsletter portfolio and the simulated Best Ideas Newsletter portfolio.

We can’t look back, and importantly, had we held on to CVS Health, we never would have capitalized on new ideas. For example, a couple months after we removed CVS Health, in the Best Ideas Newsletter portfolio, we added Chipotle (CMG), which was a huge winner, and in the Dividend Growth Newsletter portfolio, we added Xilinx (XLNX), which ended up delivering a huge “gain.” Readers should expect us to get an idea wrong every now and then, but what’s important is how we respond to that idea, and how we can turn a losing situation into a winning one with subsequent idea generation.

Gilead Sciences (GILD)

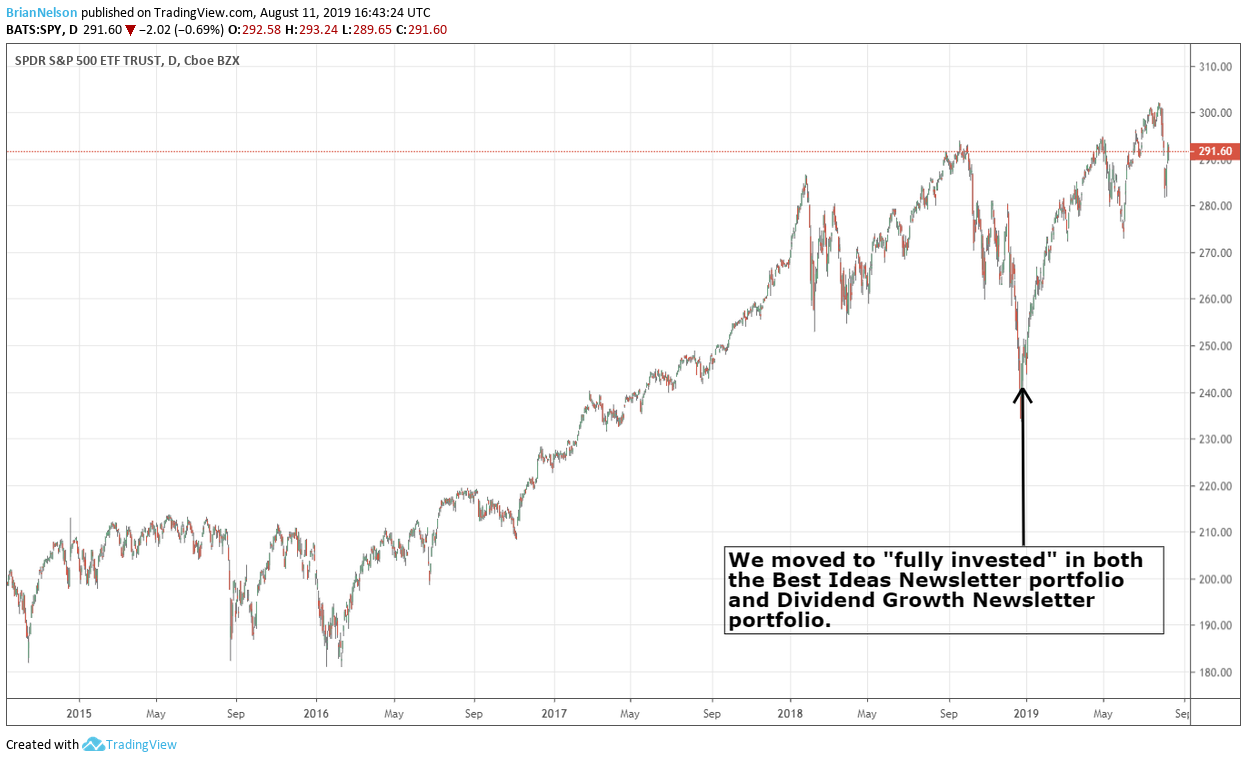

Image Shown: In our December 26 note to members, we moved the simulated Best Ideas Newsletter and simulated Dividend Growth Newsletter portfolio to “fully invested” from a cash “allocation” of 30% and 20%, respectively at the high end of the range. It has worked out wonderfully as we keep our finger on the put option trigger in case price-agnostic trading and heightened volatility rears its ugly ahead again, as it did in December 2018.

Here’s what we said when we removed Gilead from the newsletter portfolios February 2019, less than a couple months after we went to “fully-invested” in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio shortly after Christmas December 2018:

We’re removing Gilead from both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. This idea was highlighted in July 2017 in the $76 range, but the story simply has not panned out as its strength in the HIV market has not offset significant weakness in HCV and its diversified pipeline has disappointed. The most recent disappointment came February 11 when a highly anticipated Phase 3 clinical trial of its NASH treatment solensertib failed to meet its primary endpoint. We’ve been counting on some big news in its pipeline.

The global NASH (nonalcoholic steatohepatitis) drug market is estimated at $35 billion, and the National Institutes of Health estimates that as high as 12% of US adults are afflicted by the fatty liver disease. There is currently no FDA-approved treatment available, and a number of pharma companies are racing to be first to market, which is what makes Gilead’s disappointing result all the more painful.

Gilead’s recent acquisition of Kite Pharma was targeted at expanding its product pipeline into the rapidly-growing area of oncology, and it has high hopes for recently-launched Yescarta. However, an impairment charge in the fourth quarter of 2018 related to a multiple myeloma drug being developed by Kite highlights the difficulties the company is having advancing other treatments acquired in the deal. We’re just not seeing too much upside potential given its recent pipeline disappointments.

We know a lot of members made a lot of money on Gilead during its meteoric rise in 2012-2015, but we were late to the game on this one. We caught the firm as the market was digesting its long-term gains, and while our calling the near-term bottom in December 2018 was a huge value add to our membership, Gilead has worked against us (on two separate occasions); it hasn’t been a holding in either portfolio for some time now, however. In any case, the Best Ideas Newsletter portfolio continues to do very well for members, especially in an environment where ~90% of active management are underperforming benchmarks.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.