Image Source: First Quarter 2019 Financial Presentation Materials

Rayonier Advanced Materials has seen better days, but has the market overreacted? We don’t think there are many businesses that have poorer industry structure, but if the company can get things back on track, normalized free cash flow indicates substantial upside potential. Commodity prices and tariffs remain big wild cards to this story, and the Valuentum investor always waits for technicals and momentum indicators to turn decidedly positive first.

By Brian Nelson, CFA

Rayonier Advanced Materials (RYAM) was spun out of Rayonier (RYN) a few years ago. The company is a leader “of cellulose-based technologies, including high purity cellulose specialties, a natural polymer commonly found in cell phone and computer screens, filters and pharmaceuticals (10-K).” Its products are used to make cigarette filters, LCDs, cosmetics, food casings, and paints.

In November 2017, it bought Tembec and put together a business that now has leadership across a number of cellulose specialties (e.g. acetate, ethers, high-strength viscose, and filtration specialties). Management is working aggressively to pursue cost transformation as it rolls out new products, but deleveraging remains a key strategic pillar as business challenges mount.

The First-Quarter 2019 Bust

In May 2019, Rayonier Advanced Materials reported first-quarter 2019 results that sent shares tumbling aggressively. The quarter had some one-time items, including unplanned downtime at its Temiscaming plant (boiler issues), but it did face a significant increase in hardwood costs at its Jesup plant. There wasn’t much good in the report, from what we could see.

Revenue dropped more than 7% in the quarter, while total operating income swung to a loss of $18 million from +$46 million in the year-ago period. Profit weakness was across the board, declining materially in all of its major operating segments: high purity cellulose, forest products, pulp, paper, while corporate expenses actually increased. The quarter was a complete bust.

Looking to the back half of 2019, the company expects EBITDA margins to return to the high teens in its high purity cellulose division, but there are other dynamics at play. Commodity prices and tariffs are big question marks, and management believes that cellulose specialties prices and volumes will be “stable” for 2019, which could be optimistic. Weaker-than-expected lumber, pulp and paperboard markets continue to weigh.

Cyclicality and Pricing Weakness

Though we generally agree with management that its “first quarter operating and financial results were disappointing and not reflective of the earnings potential of the company (1Q PR),” the cyclicality of lumber, pulp and paperboard markets remains, and the commodity nature of its products makes pricing power elusive (lumber prices fell 19% in the first quarter of 2019). From its first-quarter press release regarding trends in its high purity cellulose segment (~60% of first-quarter sales and adjusted EBITDA):

Operating income decreased $24 million compared to March 31, 2018 resulting in a $3 million operating loss for the three month period ended March 30, 2019. The decrease was driven by a 7 percent decline in cellulose specialties sales prices as a result of duties on products sold into China and higher average prices in the 2018 comparable quarter due to higher priced 2017 shipments which were recognized as sales in the 2018 quarter.

The company can fix the issues related to downtime at its plants and take action to mitigate cost increases, but we think Rayonier is lacking any “moaty” characteristics, and the first quarter put this on display. Rayonier Advanced Materials is a price taker and tied to demand trends that will ebb and flow, with some in permanent decline. Newsprint volumes fell 27% in the first quarter of 2019, for one. It also makes acetate tow, which is used in the filter component of cigarettes, another area where declines are more secular in nature. During 2018, it had $361 million of products shipped to customers in China. Tariff uncertainty is a huge part of this story.

The Business Model May Not Be Resilient

Rayonier Advanced Materials has a business model that we don’t find very attractive. Though one quarter a trend (and company) does not make, during the first quarter of 2019, it used operating cash flows of $27 million, while it sent $31 million out the door in capital spending, good enough for -$58 million (negative $58 million) in free cash flow.

Making matters worse is that the company now has an adjusted net debt position of $1.16 billion (up from $1.08 billion at the end of 2018) and just $250 million of liquidity (~$180 million on its revolver). Needlessly, the firm shelled out $14 million in the first quarter on dividends and buybacks. Net debt stood at 3.9x EBITDA at the end of the first period, well above its 2.5x target.

The ultimate challenge for Rayonier Advanced Materials to right the ship over the long haul rests in the structure of the industry in which it operates, and this just isn’t great (and out of its hands). There is significant competition around the globe in all areas of operation, and many rivals have increased lower-cost capacity. When it comes to commodity products, the low-cost provider wins. Even without the production issues that came home to roost during the first quarter, we don’t think Rayonier Advanced Materials is the low-cost provider. Here is a key except from the firm’s 10-K:

Competition, demand fluctuations and cyclicality are the most significant drivers of sales volumes and pricing for our products. We face significant competition from domestic and foreign producers in virtually all of our businesses. For example, our cellulose specialties product line has seen increased cellulose specialties production capacity from our competitors, some of whom have lower raw material, wood and production costs than us, combined with demand weakness, particularly in the acetate grades, which have collectively driven cellulose specialties sales prices down substantially over the past several years. Likewise, volumes have declined meaningfully over the past two years due to these factors. There can be no assurance these declines will not continue into the near future.

There are more risks to this story, too. Its top 10 customers account for about 35% of revenue, and as the top line moves with the cycle and pricing dynamics, raw material and energy costs, which are largely beyond its control, will impact profitability. Caustic soda is a big input cost in high purity cellulose, and it has been considerably volatile in recent years. Roughly 75% of workers around the globe are unionized, and its business has pension considerations.

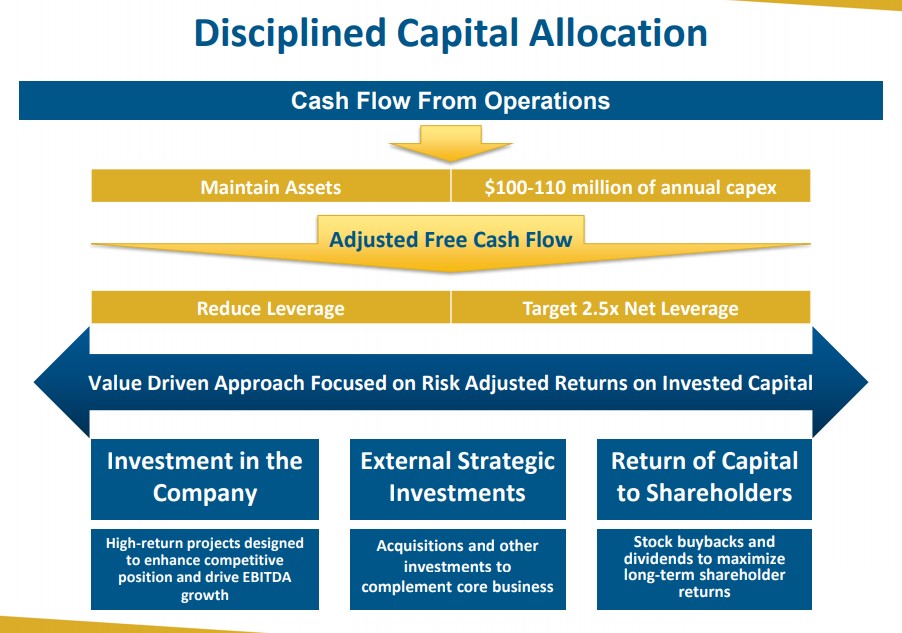

Rayonier Advanced Materials is also quite capital intensive, targeting $100 million in maintenance capital spending across its segments in 2019. By comparison, its market capitalization is just shy of $325 million. That’s a lot of capital each year just to keep things going, and from what we can tell, some of the assets from its Tembec acquisition have considerable deferred maintenance. Rayonier Advanced Materials may have acquired a lot of trouble with this deal, and we think the road ahead will be a long and rough one for investors.

Shares Look Cheap But We Don’t Like the Business at All

Though we’ve made the case that Rayonier Advanced Materials may be among the most challenged businesses out there, if it’s able to right the ship over the long haul, shares could be opportunistic. Adjusted free cash flow has been somewhat choppy during the past couple years, but during the past five years, it has averaged ~$120 million (not bad).

If we capitalize that at a 10% cost of capital and 3% standard long-term growth rate, we’re looking at a company that could garner a market capitalization of ~$550 million, implying considerable upside from today’s levels. At the heart of the Valuentum process is patience, however. We’d much rather wait for technical and momentum indicators to improve before we consider this one. In sum: Terrible business, potentially cheap stock.

Building Materials: CSL, LPX, MAS, MHK, MLM, OC, OSB, VMC

Chemicals – Broad: APD, ASH, CE, DWDP, ECL, EMN, FUL, HUN, LYB, PPG

Chemicals – Mid/Small: ALB, FMC, GTLS, IPHS, IFF, NEU, OLN, ROL

Related: DEL, EXP, KOP, MLI, PKB, TILE

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum‘s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.