After taking a fresh look at our valuation assumptions in the context that Goldman hasn’t really proven that it can earn above the cost of capital through the economic cycle, we have lowered our fair value estimate to $200 per share.

By Matthew Warren

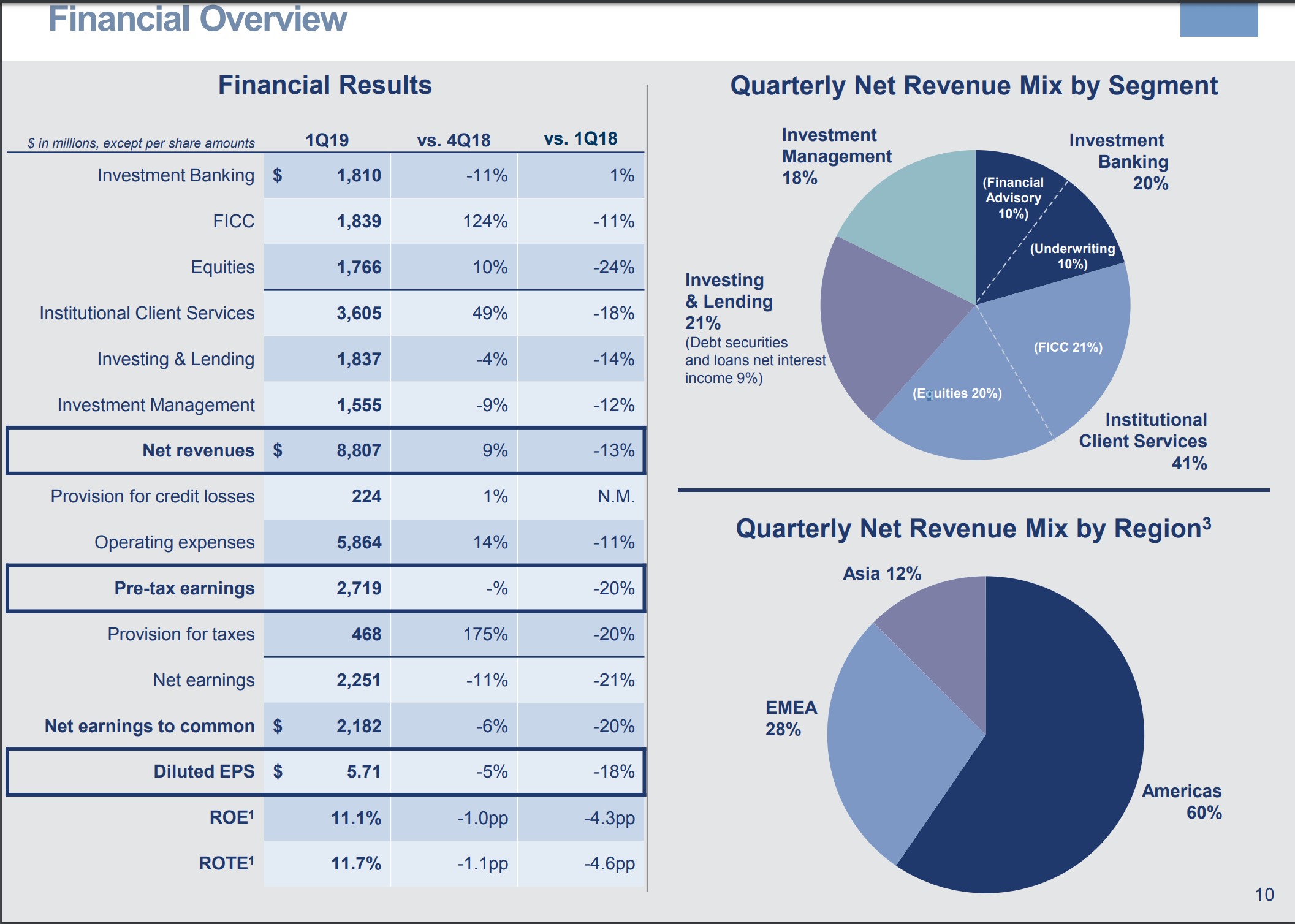

Goldman Sachs (GS) reported first-quarter 2019 results April 15 with revenue down 13%, to $8.8 billion, and diluted earnings per share down 18%, to $5.71. Return on equity was a middling 11.1% and return on tangible common equity was 11.7%. The bank’s standardized common equity Tier 1 ratio is 13.7%, well above large bank peers. This makes sense as Goldman holds substantial investment positions such as private equity holdings on its balance sheet, which have the potential for considerable volatility compared to the likes of customer loans or government securities.

The declines in revenue and earnings reflect the vagaries of Goldman’s market-oriented businesses, and the less-than-exciting return on capital metrics reflect the very competitive nature of the firm’s investment banking and trading operations. As you can see in the graphic below, the vast bulk of the firm’s earnings are directly tied to market levels and/or market activity. While Goldman is a global leader in some of its businesses, the field is extremely crowded and includes firms in Europe that are desperately seeking to scratch out cost of capital returns in order that their shares to trade closer to book value.

Image Source: Goldman Sachs 1Q19 Earnings Slides

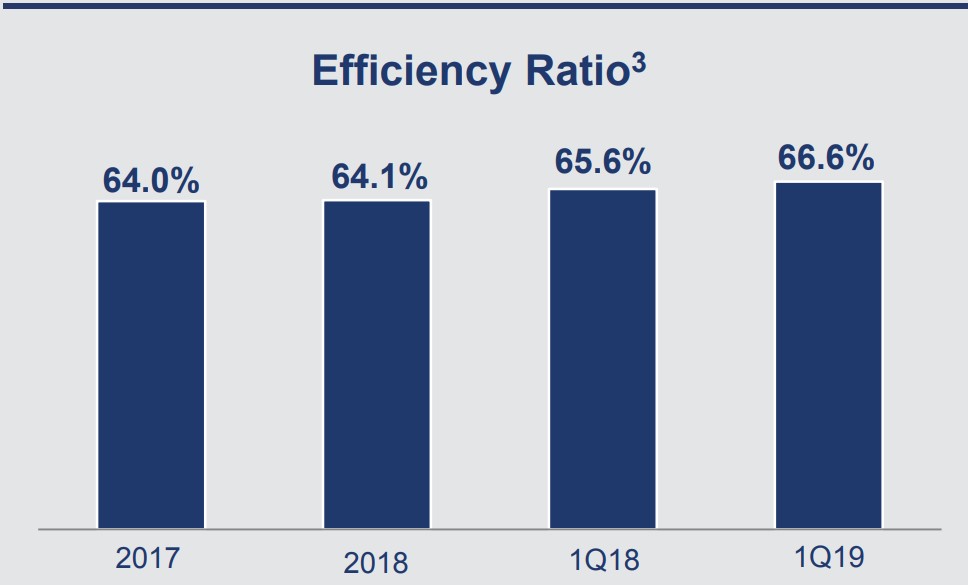

Not only did Goldman have a problem with negative growth and volatility of revenue in the most recently-completed quarter, but the bank also faced a worsening efficiency ratio as a result, as you can see below:

Image Source: Goldman Sachs 1Q19 Earnings Slides

Since late last year and through to next year this time, Goldman’s management team is undergoing a front-to-back review, searching for ways to increase revenue with new and existing clients as well as using digitalization, platforms, and simple cost cutting to improve its cost structure and return on capital metrics. It is seeking deposit growth via its Marcus platform and wants to better serve mass-wealth clients overall. While we appreciate the argument that Goldman Sachs is creating new digital platforms to enable opportunities, we think it will be difficult to pry clients away from existing banking relationships. That said, the bank has significantly grown its deposits in recent years. After taking a fresh look at our valuation assumptions in the context that Goldman hasn’t really proven that it can earn above the cost of capital through the economic cycle, we have lowered our fair value estimate to $200 per share.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Matthew Warren does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.