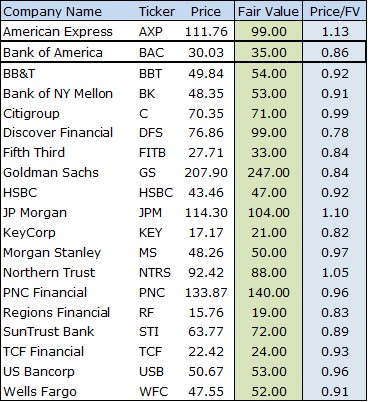

Image shown: Valuentum’s fair value estimates for its banks and money center coverage. We’ve raised our fair value estimate of Bank of America.

The only thing not to like with Bank of America is that banks are cyclical and the economy is overdue for a downturn. Everything else is going right at Bank of America. We have raised our fair value estimate for Bank of America to $35 per share.

By Matthew Warren

Bank of America (BAC) reported first-quarter 2019 results April 16, with revenue stable at $ 23 billion, pre-tax income up 4% to $8.8 billion, and thanks to 7% fewer shares outstanding, earnings-per-share was up 13% versus last year’s first quarter. It was again the crown jewel consumer banking segment that led with 25% growth in earnings. Unsurprisingly, Global Markets, where there is simply too much global competition and market-related volatility, was the laggard.

Bank of America’s return on equity was up 57 basis points, to 11.42%, while return on tangible common equity was up 75 basis points, to 16.1%. The bank is very well capitalized with a common equity Tier 1 ratio of 11.6%. The bank repurchased $6.3 billion of shares on top of $1.5 billion of common dividends, returning more than 100% of earnings to shareholders in the period.

Impressively, the bank also extended its streak to 17 quarters of positive operating leverage. When you consider that revenue was up in only 11 of those quarters and down as much as 7% back in the first quarter of 2015, it is all the more impressive that the bank has been able to manage its cost structure in such a consistent manner. Over the past year, the bank’s efficiency ratio improved substantially from 59.5% to 57%. On the earnings call, CFO Paul Donofrio stated that costs will hold flat for this year and next, so as long as revenues are up, the positive operating leverage will continue apace.

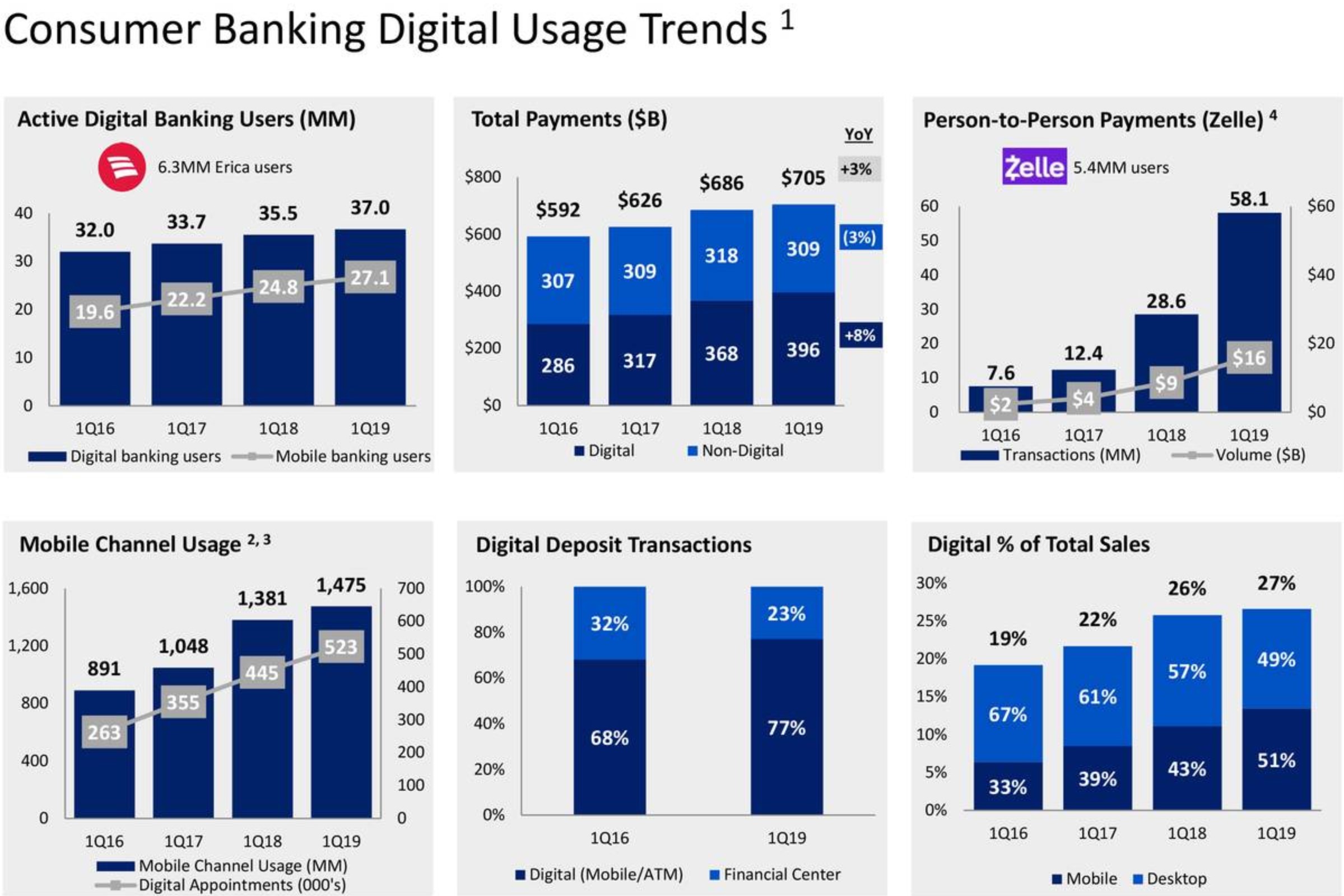

Much of this success in expense control is driven by digitalization of both the (a) front end consumer experience with websites and mobile apps becoming more capable and more utilized versus more traditional interfaces like the branch and even ATMs, but also the (b) back-end processes being streamlined via greater use of technology. The bank has been spending $3 billion annually on technology for many years now, but plans to increase that by 10% in 2019, even as it continues to benefit from positive operating leverage. Consumers want to go digital and Bank of America is a resounding success story of facilitating that demand as you can see below.

Image Source: Bank of America First-Quarter Presentation

Regarding guidance, the bank expects net interest income to grow at half of 2018’s pace of 6%, reflecting a slower growing economy, lack of further rate hikes, and the flat yield curve. While not particularly exciting, this is much better than what peer Wells Fargo (WFC) is projecting and should also allow for decent (probably double digit) earnings growth given positive operating leverage and share buybacks. Despite the positive outlook, it is best to keep in mind the cyclical nature of banks along with the overdue economic downturn. Everything else is going right at Bank of America. We have raised our fair value estimate for Bank of America to $35 per share.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Matthew Warren does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.