Image Source: Johnson & Johnson

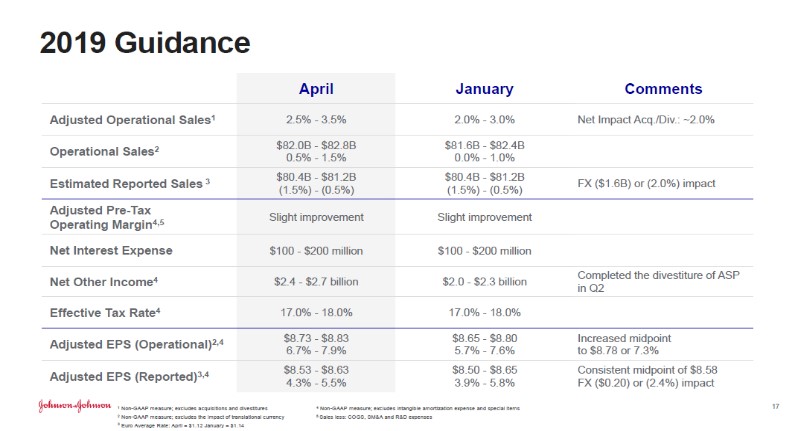

Johnson & Johnson issued updated guidance for 2019 that called for stronger adjusted sales and EPS growth than previously expected, which along with earnings that beat low expectations was enough to send shares up over 1% on the day, April 16.

By Callum Turcan

Embattled medical giant Johnson & Johnson (JNJ) posted first quarter earnings for 2019, which the market clearly liked as shares of JNJ were bid up by 1.1% on April 16. We include the company in both the simulated Dividend Growth Newsletter portfolio and the simulated Best Ideas Newsletter portfolio. The medical giant is active in the pharmaceuticals, medical device, and packaged consumer goods segments of the healthcare world. As of this writing, J&J yields 2.6% with a promising dividend growth trajectory ahead of it even in the face of legal and foreign currency-related tailwinds. J&J has increased its dividend for the past 56 consecutive years (as of 2018), placing it firmly in the Dividend Aristocrat category.

Report Better Than Expected

J&J generated $20 billion in revenue during the first quarter of 2019, which was broadly flat with the same period last year. Stronger performance at its pharmaceuticals business offset weaker performance at its consumer and medical devices segments. The firm’s GAAP gross profit margin also remained flat at just under 67% during that period. A favorable one-time price adjustment at its US pharmaceuticals business helped prop up J&J’s gross margins, as its baby care sales dropped by 14% globally which likely depressed gross margins at the unit. The company is still dealing with lawsuits over J&J allegedly selling talc products (including baby powder) that the company knew may have contained asbestos, a situation that is currently playing out in the courts. We think liabilities will be contained.

On the one hand, J&J’s top line growth stalled out but on the other hand, the company handily beat expectations that called for just $19.6 billion in sales. Low expectations are likely a key reason why the market bid J&J’s shares up on April 16. When investors are expecting sales to tank, that usually implies the market is factoring in the high probability that the company’s margins will also come under pressure. As J&J’s GAAP gross margins held up during what was expected to be a tough quarter, that signals to investors that J&J may be more resilient than previously thought.

When removing the impact of foreign currency adjustments, which were quite negative during the first three months of 2019, J&J posted 2.2% revenue growth at its consumer segment, 7.9% revenue growth at its pharmaceuticals segment, and saw its medical device sales decline by 1% on a year-over-year basis. Combined, J&J would have generated 3.9% in annual sales growth during the first quarter of this year if it weren’t for negative foreign currency movements.

That said, J&J’s GAAP operating margin weakened materially due in part to legal costs. During the first quarter of 2019, J&J’s GAAP operating margin dropped by over 500 basis points, ending up just north of 22%. Note that was largely due to a $423 million litigation expense, which primarily had to do with J&J and its partner Bayer AG (BAYRY) settling more than 25,000 lawsuits over the blood thinner Xarelto for $775 million in total (split two ways). In the same quarter last year, J&J’s litigation expense came out to zero.

The other major factor was a sharp rise in J&J’s R&D expenses, which climbed 19% annually to $2.9 billion in the first quarter of 2019. Most of that was represented by a $0.3 billion milestone payment related to its pharmaceuticals business. Also, J&J recorded a $0.9 billion in-process R&D charge last quarter, up from nothing in the same quarter in 2018. Management noted that within this expense there was “an IPR&D charge of $0.7 billion, which is related to the write-down of the IPR&D asset from the acquisition of Alios BioPharma” during the firm’s quarterly conference call. J&J bought Alios BioPharma for $1.75 billion in cash back in 2014. The company was seeking to gain exposure to Alios BioPharma’s promising treatments for infectious diseases at the time the deal was announced.

On a GAAP basis, J&J’s bottom line tanked by 14% annually to $3.7 billion during the first quarter, dragging down its GAAP diluted EPS by 13%, to $1.39. That was entirely due to J&J’s operating income diving by 19% year-over-year to $4.4 billion, offsetting the favorable impact of a 510 basis point reduction in its effective corporate income tax rate. When making a sea of adjustments, J&J highlights how its non-GAAP net income would have come in at $5.7 billion last quarter, up marginally from the same period in 2018. The company’s adjusted diluted earnings per share would have grown by 2% year-over-year to $2.10.

What We Think

Here are some of J&J’s key strengths that are worth keeping in mind when evaluating the company (from our two-page dividend report);

“Dividend Aristocrat Johnson & Johnson is in a class by itself. Founded in 1886, everybody seemingly has come into contact with its brands in one way or another; 70% of sales are generated from #1 or #2 global leadership positions across its markets. J&J has driven 30+ years of adjusted earnings increases and more than 55 years of annual consecutive dividend increases! We like its diversified presence, and generally view its consumer portfolio as the core foundation and its pharmaceutical pipeline the icing on the cake; its Oncology division is growing at a robust rate. Free cash flow has averaged ~$17.3 billion during the past three years (2016-2018), well in excess of its yearly run-rate cash dividend obligations (~$9.5 billion).”

Furthermore (from our 16-page stock report);

“J&J’s pharma portfolio is impressive. REMICADE has ~90% share of the US market for IV immunology products by volume, but the therapy’s US exclusivity expired in 2018. STELARA (exclusivity through 2023 in US) and SIMPONI (exclusivity through 2024 in US) are also key profit drivers. Biosimilars competition is accelerating, but J&J’s Oncology division is growing at a tremendous pace…

Top-line growth at Johnson & Johnson will be driven by its impressive pharma portfolio pipeline, which will be supported by its steady consumer product business. The firm has at least 10 new molecular entities it believes have $1+ billion in individual annual sales potential that it expects to launch or file for approval from 2017-2021.”

Pharmaceutical performance is a key valuation driver at J&J. Last quarter, J&J posted 4.1% annual GAAP sales growth at its pharmaceutical segment, pushing those sales up over $10.2 billion. Over half of J&J’s revenue came from its pharmaceutical segment last quarter, with strong growth seen at its DARZALEX and IMBRUVICA oncology medications and its STELARA immunology offering. This helped offset declining REMICADE sales as that immunology drug’s US exclusivity expired last year, keeping in mind “REMICADE has ~90% share of the US market for IV immunology products by volume” and represented 10.8% of J&J’s total pharmaceutical sales last quarter.

In order to take a balanced approached to investing, the good needs to be contemplated alongside the bad so here are some potential downside risks to be aware of;

“There’s a lot embedded in J&J’s expectations. Management expects to file or launch at least 10 new drugs from 2017-2021 that have potentially as much as $1 billion in annual sales, individually. Its top-notch positions across the consumer spectrum are a solid foundation for payout sustainability, but any large disappointments in its pharma pipeline could impact the pace of long-term dividend growth. R&D will eat up some profits as J&J continues to invest in its business, and it remains acquisitive. But we have no qualms with either. Share repurchases will be ongoing. Management has done a nice job deleveraging after the recent Actelion acquisition as its net debt load was $10.8 billion at the end of 2018 compared to $16.3 billion a year earlier.”

Of course, there are also legal risks to be aware of as well. As of the latest update we could find, J&J faces over 13,000 lawsuits concerning its talcum powder product sales with the plaintiffs alleging that those products gave them ovarian cancer or mesothelioma. The size of this liability is hard to pin down, but note that some juries have imposed very harsh penalties on J&J in the past. We will be closely monitoring how that situation plays out going forward. For its part, J&J has come out and strongly denied these reports and is currently aggressively defending itself in the courtroom.

Guidance Update

J&J issued updated guidance for 2019 that likely helped instill a level of certainty in market expectations of its near-term performance. When factoring in the projected impact of planned acquisition and divestment activity, J&J is now guiding it will post adjusted (for currency movements) revenue growth this year. Previously, management was expecting flat revenue growth when adjusting for currency movements. While negative currency movements are still expected to generate negative GAAP revenue growth this year, J&J is at least moving in the right direction. J&J also revised its annual EPS and adjusted EPS growth projections upwards for 2019, with projections calling for decent mid-single-digit growth.

Image Shown: J&J’s management team issued out a favorable guidance update, with the company now expected to post organic sales growth this year. Image Source: J&J – IR presentation

Management had this to say during the firm’s latest quarterly conference call:

“Now let me provide a few comments on the updates to our guidance for 2019, which we noted in this morning’s press release. Our first quarter results have elevated our confidence in our performance, strengthening the outlook for our operational sales growth. As a result, we are increasing our guidance by 50 basis points, reflecting full year adjusted operational sales growth of 2.5% to 3.5% and operational sales growth of 0.5% to 1.5%. The negative impact of translational currency, however, has increased, but we plan to absorb that impact with the strength of our operational sales outlook I just referenced. Therefore, our expectation for total reported sales in 2019 remains the same.”

Concluding Thoughts

There are still numerous uncertainties clouding over J&J’s medium-term outlook, namely ongoing foreign currency headwinds, potential legal liabilities, and the inherent risks involved with the pharmaceutical business. However, as a stalwart dividend payer with strong free cash flow potential and with signs of a turnaround beginning to emerge, we aren’t worried about J&J’s payout at all. We appreciate J&J’s strong dividend coverage, its promising dividend growth trajectory that is built on the back of its pharmaceuticals growth story, and note the company trades near the midpoint of our range of potential values.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.