Let’s take a look at some of the most recent dividend-related news among companies within our coverage universe.

By Kris Rosemann

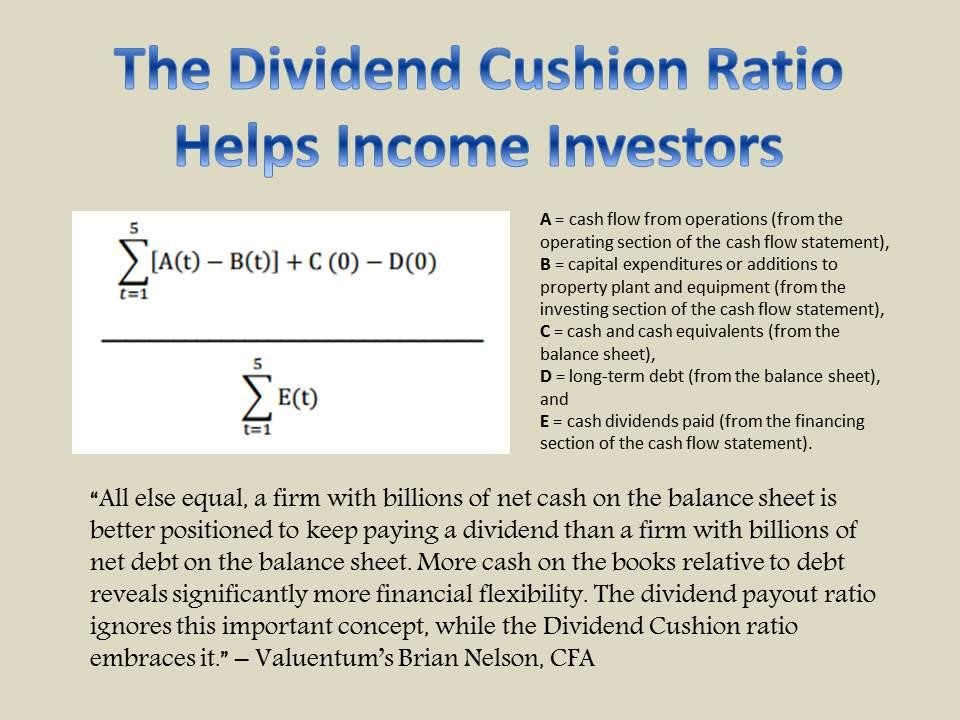

Valuentum members are familiar with our forward-looking, cash-flow based dividend analysis, which culminates in the Dividend Cushion ratio, and the measure has built an impressive track record of highlighting risks in dividend health across a large number of equities. We would be remiss if we did not once again highlight the efficacy of the Dividend Cushion ratio as the metric caught both of Owens & Minor’s (OMI) recent dividend cuts. The company’s Dividend Cushion ratio was firmly in negative territory prior to the announcement of both reductions in the payout. Investors seeking more background reading on the Dividend Cushion can find information here and here.

With the ideas that drive the Dividend Cushion ratio in mind, let’s dig in to some recent dividend news across our coverage universe, as well as take a look at the valuation distribution of these dividend-paying entities.

Coca-Cola Raises Payout Despite Stagnant Free Cash Flow Generation

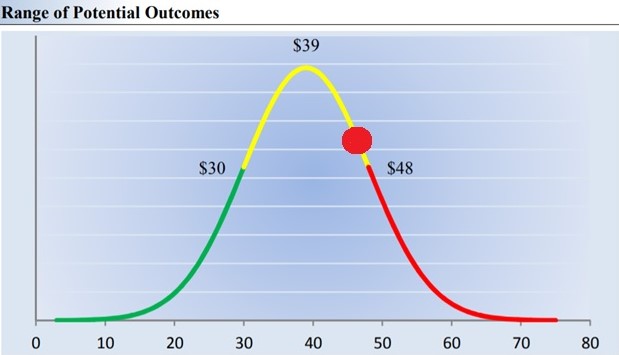

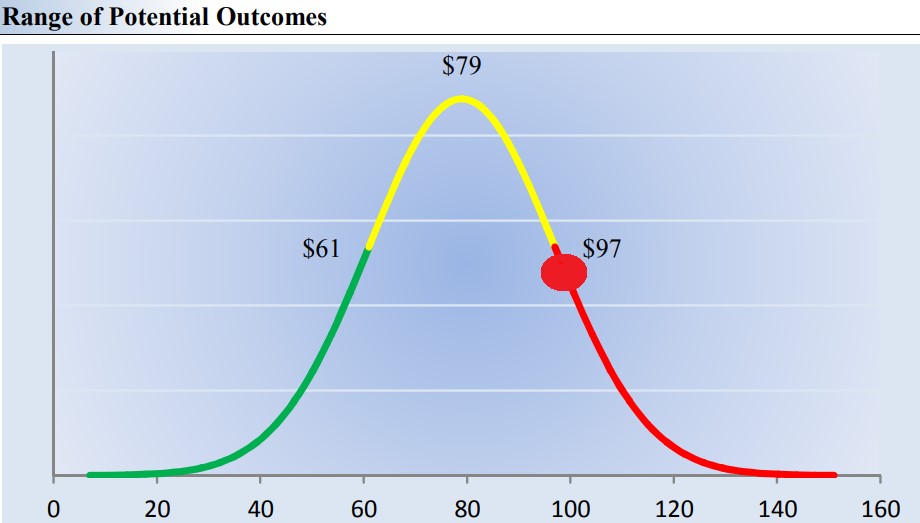

Shares of Coca-Cola are trading in the ~$46 range as of this writing, which is just below the upper bound of our fair value range for shares.

We recently highlighted the shortfall in Coca-Cola’s (KO) free cash flow coverage of its annual run-rate cash dividend obligations, “Cola Giants Fourth Quarter Earnings and Valuation Distributions.” The company declared a 2.6% increase in its quarterly payout February 21, along with the additional authorization to repurchase up to 150 million additional shares, or roughly $6.9 billion at current price levels. The dividend increase will push Coca-Cola’s streak of 55+ consecutive years of dividend hikes higher, but we note that its free cash flow guidance of ~$6 billion for 2019 is below its cash dividends paid in 2018 of ~$6.6 billion. The company’s Dividend Cushion ratio is just above parity at last check, and its forward dividend yield is ~3.5% as of this writing.

Texas Roadhouse Continues Recent Trend of Robust Dividend Growth

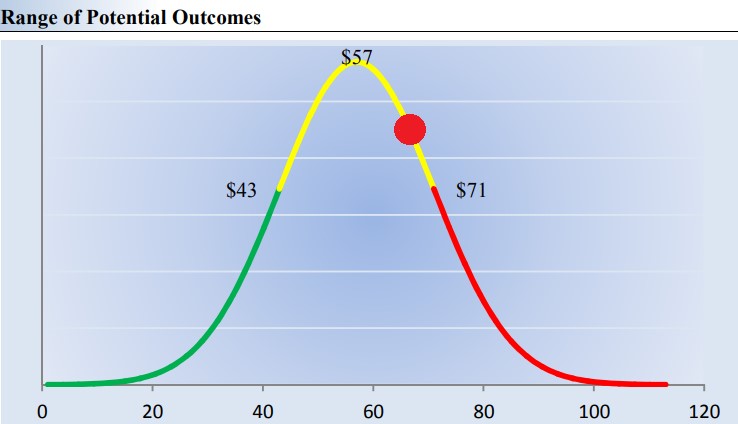

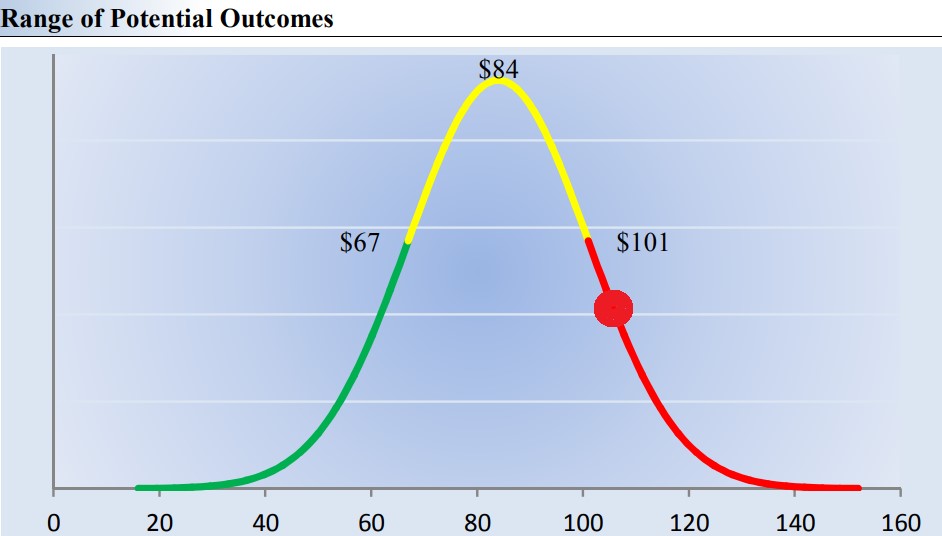

Shares of Texas Roadhouse are currently trading at ~$64, which is firmly in the upper half of our fair value range.

Texas Roadhouse (TXRH), one of our favorite dividend ideas within the restaurant space, announced a 20% increase in its quarterly dividend February 19, which marks its sixth straight year of double-digit dividend growth. Free cash flow generation averaged $138 million over the past three years (2016-2018), providing ample coverage of annual run-rate cash dividend obligations of ~$69 million, and the company boasts a solid net cash position of $208 million as of the end of 2018 ($210 million in cash and cash equivalents compared to ~$2 million in long-term debt). Texas Roadhouse’s Dividend Cushion ratio sits at a solid 2.4 at last check, and its forward dividend yield is ~1.9% as of this writing.

Domino’s Pizza Announces Big Dividend Hike; Yield Still Unappealing

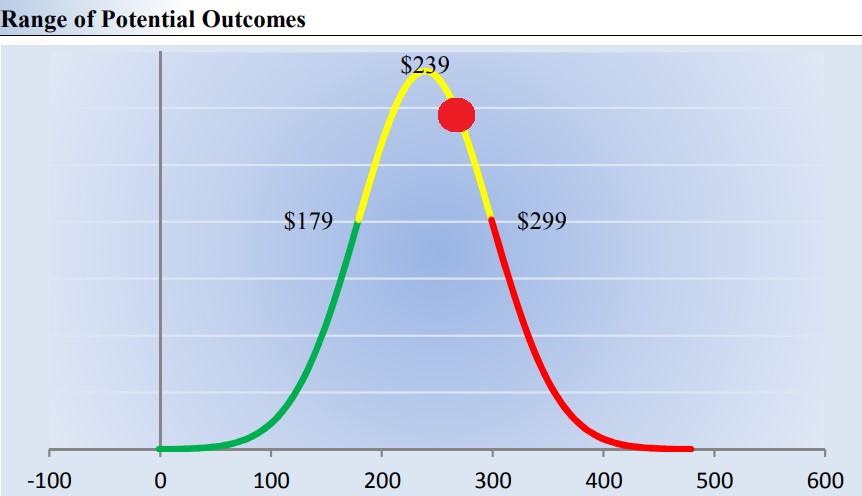

Shares of Domino’s Pizza are currently changing hands at ~$252, which is just above our fair value estimate.

Another restaurant operator, though it follows a very different (franchised) business model, Domino’s Pizza (DPZ) announced an ~18% increase in its quarterly dividend February 21, but its shares faced notable selling pressure after comparable sales in the fourth quarter disappointed. Free cash flow generation at Domino’s averaged $253 million over the past three years (2016-2018), easily covering annual run-rate cash dividend obligations of $92 million. The company holds a sizable net debt position of $3.3 billion as of the end of 2018, which dampens our optimism over its long-term dividend growth potential, and shares yield a less-than-competitive ~1% as of this writing.

Waste Management Building Solid Dividend Growth Track Record

Shares of Waste Management are currently trading at ~$99, which is just above the upper bound of our fair value range.

Garbage hauler Waste Management (WM) declared a ~10% increase in its quarterly payout February 19, which adds to its 15+ streak of consecutive years with a dividend increase. Free cash flow at Waste Management averaged $1.7 billion over the past three years (2016-2018), which is more than double its annual run-rate cash dividend obligations of $802 million, but the company’s sizable debt load of nearly $10 billion (it holds only $61 million in cash and cash equivalents) weighs on its unadjusted Dividend Cushion ratio. Due to its utility-like status, we provide an adjusted Dividend Cushion ratio for Waste Management, and that measure sits at 2 at last check. Shares yield ~2.1% as of this writing.

Genuine Parts Company Adds to 60+ Year Dividend Growth Track Record

Shares of Genuine Parts Company are currently trading in the ~$110 range, which is well above the upper bound of our fair value range.

Auto replacement parts distributor Genuine Parts Company (GPC) has one of the most impressive dividend growth track records we’ve seen, and its ~6% increase in its quarterly dividend, announced February 19, marks its 63rd consecutive year of growth in the payout. The company’s solid free cash flow generation has enabled this impressive track record, and it averaged $785 million in free cash flow over the past three years, which covers annual run-rate cash dividend obligations of ~$416 million with room to spare. Genuine Parts’ Dividend Cushion ratio of 1.2 is bogged down by its notable net debt load, which checked in at just over $2.8 billion at the end of 2018. Shares carry a dividend yield of ~2.8% as of this writing.

Gildan Activewear Raises Payout in Big Way; Debt Load Not Ideal

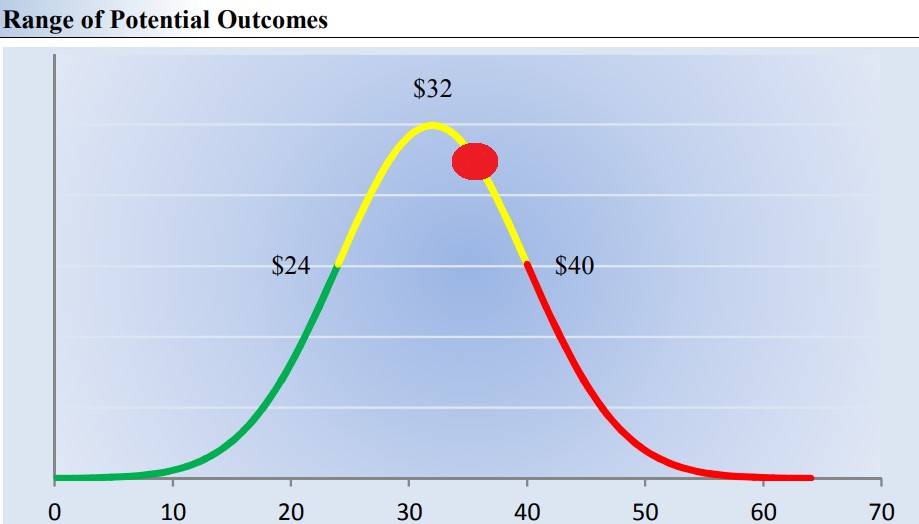

Shares of Gildan Activewear are trading at ~$34, which is just above our fair value estimate.

Gildan Activewear (GIL) declared a near-20% increase in its quarterly payout February 21. Free cash flow generation averaged $443 million over the past three years for the company, which easily surpasses annual run-rate cash dividend obligations of ~$95 million several times over. Hindering our optimism over its long-term dividend growth potential is the fact that Gildan holds a net debt position of $622 million as of the end of 2018, consisting of $669 million in long-term debt and ~$47 million in cash and cash equivalents. The company’s forward dividend yield is ~1.6% as of this writing.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.