Image Source: Sean Loyless

Coca-Cola and PepsiCo expect mid-single-digit organic revenue growth to continue in 2019, but currency headwinds are impacting reported figures. We’re less than enthused about the near-term free cash flow expectations of both companies, and tepid macroeconomic growth expectations and potentially elevated costs, such as freight, are weighing on near-term outlooks.

By Kris Rosemann

Coca-Cola’s Cautious 2019 Guidance Disappoints

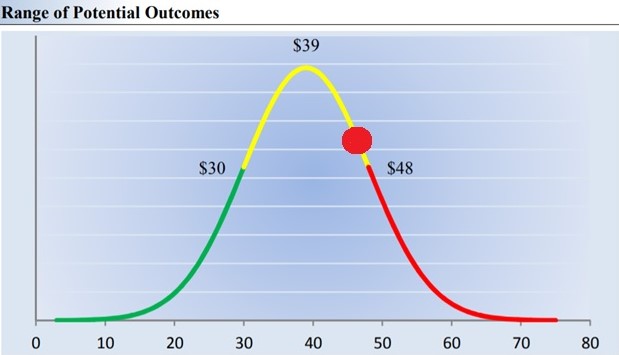

Image Shown: shares of Coca-Cola are trading in the ~$46 range as of this writing, which is just below the upper bound of our fair value range for shares.

Shares of Coca-Cola (KO) tumbled following its fourth quarter 2018 earnings report, results released February 14, as it issued cautious guidance for 2019 due to, in the words of CEO James Quincey, “multiple reductions in global economic growth outlook for 2019 and our own experience in some of the emerging and developing markets.” Organic revenue grew 5% on a year-over-year basis in the fourth quarter, but net revenues as reported fell 6% due to bottler refranchising and currency headwinds. Non-GAAP operating margin expanded 13 basis points in the quarter as the significant benefit of the divestiture of low-margin bottling operations and productivity initiatives were partially offset by the adoption of the new revenue recognition standard and currency headwinds. Fourth quarter non-GAAP earnings per share came in at $0.43, good for 10% growth from the year-ago period, but rising transportation costs and currency headwinds may continue to provide a drag on profits.

Coca-Cola delivered nearly 6% year-over-year growth in cash flow from operations in the full-year 2018, which helped drive free cash flow to just under $6 billion, a 12.5% increase over 2017 thanks in part to lower capital spending. However, cash dividends paid of more than $6.6 billion outpaced free cash flow generation, and the company repurchased $1.9 billion of its shares in the year. Net debt at the end of the year sat at $27.6 billion, up from $27 billion a year earlier. The company’s Dividend Cushion ratio was 1.3 at last check, but that score incorporates assumptions for materially improving free cash flow in the coming years, an assumption that has been challenged by Coca-Cola’s 2019 outlook. It did not announce a dividend increase, and investors must question whether the company’s 55-year streak of consecutive dividend increases will come to an end.

Management’s cautious guidance included 4% organic revenue growth thanks to positive volume and price mix expectations, but currency headwinds are expected to persist. Its 10%-11% currency-neutral operating income growth expectations for the full year excludes projections for a 6%-7% currency headwind, and comparable non-GAAP earnings per share from continuing operations are expected to be between down 1% and up 1% from $2.08 in 2018. Free cash flow generation is expected to be roughly flat from 2018 at $6 billion, implying Coca-Cola will fail to cover annual dividend obligations for the third consecutive year. We’re not interested on Coca-Cola for income purposes, and its Dividend Cushion ratio may face pressure once we roll the model forward and incorporate lower near-term free cash flow expectations. Our fair value estimate for shares, which carry a dividend yield of 3.4% as of this writing, is currently $39 each.

PepsiCo To Ramp Capital Spending in 2019

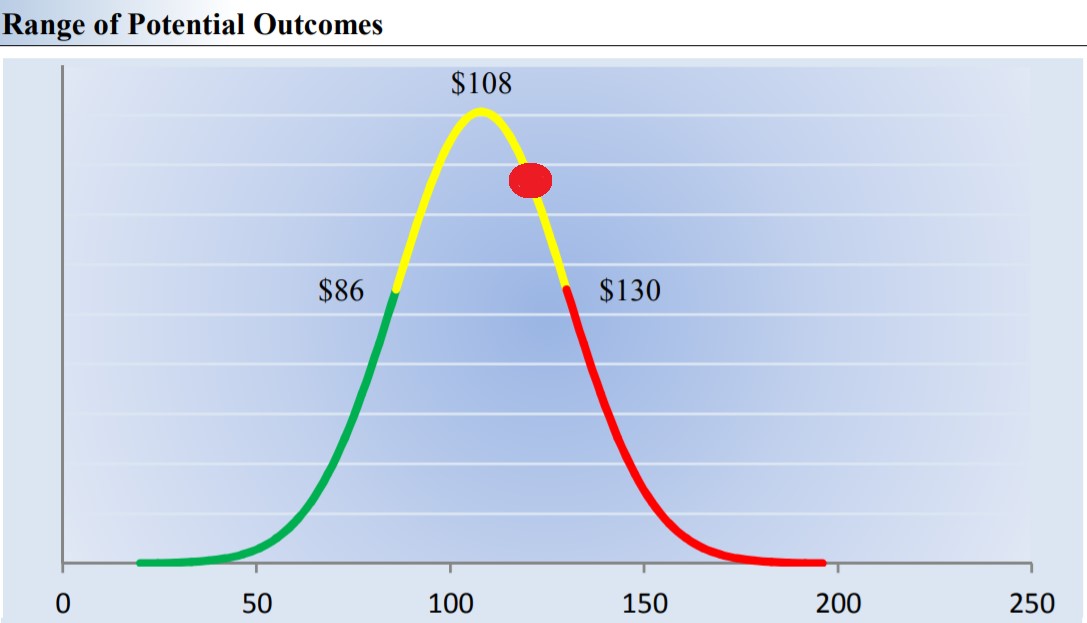

Image Shown: shares of PepsiCo are trading in the ~$116 range as of this writing, which is firmly in the upper half of our fair value range for shares.

PepsiCo’s (PEP) shares fared far better than Coca-Cola’s following the February 15 release of its fourth quarter results despite it issuing similar organic revenue growth and earnings per share guidance for 2019, likely due in part to expectations for a return to high-single-digit core constant currency earnings per share growth in 2020 and the message conveyed by management raising its annual dividend by 3%. The company reported 4.6% year-over-year organic revenue growth in the fourth quarter, but its top line was roughly flat from the year-ago period on an as-reported basis. Fourth quarter core operating margin expanded 53 basis points from the comparable period of 2017 after excluding one-time items that provided a drag on the reported figure, and core constant currency earnings per share jumped 17% on a year-over-year basis.

In the full-year 2018, Pepsi’s cash flow from operations fell more than 6% from 2017 levels, and free cash flow generation dropped more than 13% to $6.1 billion as capital spending rose ~10.5% on a year-over-year basis. Cash dividends paid in the year came in at more than $4.9 billion, implying sufficient dividend coverage with free cash flow generation for the time being. Net debt at the end of the year was $21.3 billion, up from $19.8 billion a year earlier. The company’s Dividend Cushion ratio was 1.1 at last check, and the 3% annual dividend hike that accompanied its fourth quarter report release makes 2019 its 47th consecutive year of annual dividend growth.

In 2019, Pepsi expects 4% organic revenue growth, and core earnings per share in constant currency is expected to decline by 1% from 2018 levels due in part to the prior year containing a number of strategic asset sale and refranchising gains and incremental investments in the business planned for 2019. Management anticipates cash flow from operations advancing to $9 billion, but a significant increase in capital spending to $4.5 billion will drag on free cash flow in a big way. This guidance implies free cash flow will come in at $4.5 billion in 2019, below its current annual run rate cash dividend obligations. While the elevated capital spending levels expected in 2019 may not be a reasonable assumption over the long haul, we’d like to see better free cash flow coverage of dividends paid in the near term. Our current fair value estimate for Pepsi is $108 per share, and its forward dividend yield is 3.3% as of this writing.

Beverages – Nonalcoholic: CCEP, KO, KDP, MNST, FIZZ, PEP, SODA

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.