No changes to simulated newsletter portfolios.

By Brian Nelson, CFA

Hi everyone,

Today was busy.

A stock we have stayed far away from, NVIDIA Corp (NVDA) tumbled aggressively today, down nearly 14%. Shares of the equity are starting to bump against the low end of our fair value estimate range, but we expect a downward revision in the coming days. When it comes to semiconductors, we continue to prefer Xilinx (XLNX) and Intel (INTC). My colleague Kris Rosemann wrote up Intel’s recent quarterly report, released January 24, and you can find that write-up here (login required).

Caterpillar (CAT) also released a doozy of a fourth-quarter report today, with shares trading off more than 9%. We don’t include any direct metals and mining exposure in the simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio, and we don’t expect that to change anytime soon. Commodity prices are notoriously difficult to forecast and play a critical influence on the magnitude of the economic profit creation that such entities can generate. Though the cost structure is vital, when it comes to estimating equity value, the price at which commodity prices can be realized is absolutely vital.

Today, I hosted a conference call walking through our methodology and website. More recently, we put together a walk-through of financial statement analysis, but this one goes into how to use the website from the Symbol search box to the Home page, to why we include some companies in one portfolio and how or why we may remove one and keep another. As consumers of our own research in the simulated newsletter portfolios, we eat our own cooking. Tune into that recording here.

It’s going to be a cold one this week. From all of us at Valuentum, please stay warm!

——————–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

—–

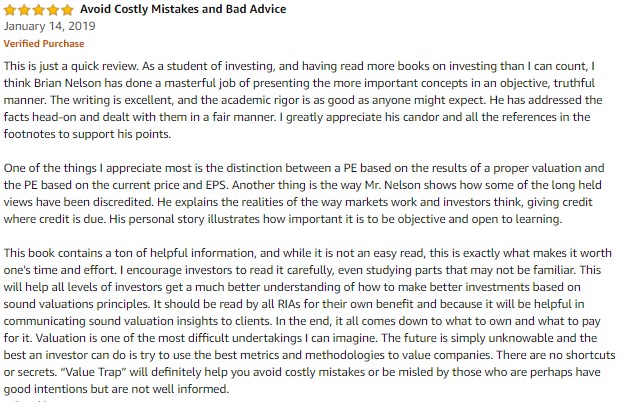

Pasted below is the first review of Value Trap on Amazon. Please be sure to leave yours here. The more buzz you create, the better.

———-