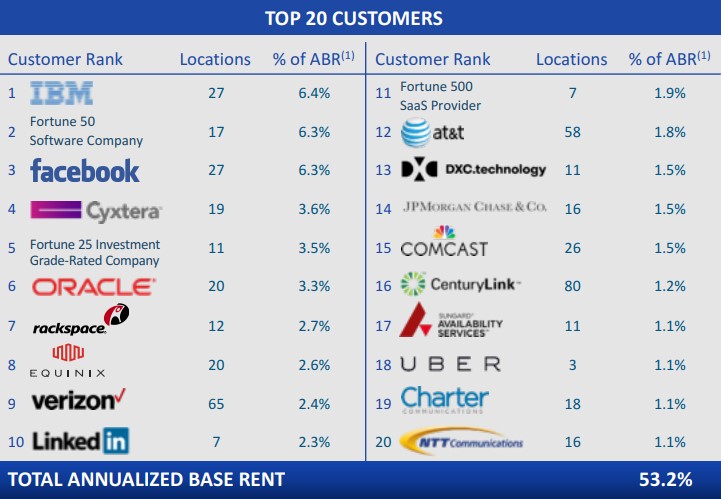

Image shown: Digital Realty’s top 20 customers by annualized base rent. Source: Digital Realty investor presentation.

Digital Realty expects weakness in rental rates on renewal leases on a cash basis in 2019, which is indicative of negotiating power held by large cloud operators, but the REIT expects top-line growth to continue thanks in part to ongoing growth in leasing volume.

By Kris Rosemann

Shares of simulated Dividend Growth Newsletter portfolio idea Digital Realty Trust (DLR) faced selling pressure following the release of its 2019 guidance January 9. The update revealed expectations for a high-single-digit decline in rental rates on renewal leases on a cash basis and core funds from operations (FFO) guidance of $6.60-$6.70, the latter of which came in below the market’s expectations. However, cash-releasing spreads being expected to decline in 2019 is indicative of the pricing environment for wholesale datacenter capacity across the industry as releasing rates become increasingly dependent upon moves made by large cloud operators such as Amazon (AMZN), Apple (AAPL), and Alibaba (BABA).

According to the Cisco Global Cloud Index report, hyperscale datacenters will account for ~53% of all installed datacenter servers by 2021, which is a material increase compared to an estimated ~38% at the end of 2018, and such a concentration makes the current 24 global hyperscale operators of high importance to datacenter landlords such as Digital Realty. Fortunately for such landlords, however, is the generally impressive credit quality of these operators and the long-duration leases that help to mitigate the negative impact of poorer pricing power.

As of the end of the third quarter of 2018, Digital Realty’s top 20 customers accounted ~53.2% if its total annualized rent, and 64 of its 205 data centers were occupied by single customers as of the end of 2017. Its largest customers are subsidiaries of IBM (IBM), an undisclosed Fortune 50 software company, and Facebook (FB) with 6.4%, 6.3%, and 6.3%, respectively, of annualized base rent at the end of the third quarter of 2018. The image at the top of this article provides a breakdown of the REIT’s top 20 customers.

As a result of the expected increase in concentration among hyperscale operators, tenant concentration is not anticipated to decrease materially for datacenter landlords, and Digital Realty is no exception. In addition to the industry-wide trend of concentration, the REIT increased its tenant concentration with the 2017 acquisition of DuPont Fabros, but the move also increased its presence in the important Northern Virginia datacenter market. Key risks for Digital Realty include concentration and the resulting weakness in pricing power and near-term lease expirations as leases expiring in 2019 accounted for 22.5% of the REIT’s annual rental revenue as of the third quarter of 2018.

Nevertheless, Digital Realty expects 2019 revenue to be in a range of $3.2-$3.3 billion compared to expectations for 2018 revenue to be $3.0-$3.2 billion. Its adjusted EBITDA margin guidance for 2019 (57%-59%) suggests it will be roughly in line with 2018 expected results, and year-end portfolio occupancy rates are also expected to be approximately flat compared to 2018 results (guidance of +/- 50 basis points). Increases in leasing volume thanks in part to new growth projects, should help offset pricing weakness among the REIT’s largest tenants.

Digital Realty holds investment grade credit ratings (BBB/Baa2/BBB), so it should continue to have adequate access to capital markets to fund expansion initiatives and dividend growth moving forward. We’ll be watching developments related to its largest tenants closely moving forward, but its outlook benefits from its global footprint, which should benefit from its recent move in the growing Brazilian market, and diversified product suite that includes shorter term leases in co-location and interconnection.

We’re sticking with our current fair value estimate for shares of $96 a piece for the time being, and the REIT’s adjusted Dividend Cushion ratio, which gives it credit for access to capital markets, currently sits at 1.8. We expect to continue highlighting shares, which yield ~3.8% as of this writing, in the simulated Dividend Growth Newsletter portfolio for the foreseeable future.

Related – CONE, COR, EQIX, IRM, QTS

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.