Image source: GM first-quarter earnings report

The US auto behemoths continue to place a greater importance on efficient operations and the health of their bottom lines as the industry may be reaching a relative peak in terms of light vehicle production for this economic cycle and as the future of the auto landscape remains uncertain.

By Kris Rosemann

Key Takeaways

Both GM and Ford are keeping a keen eye on the future of the evolving auto and personal transportation markets.

We continue to like shares of GM relative to Ford, even as we say we like the direction in which Ford appears to be heading. GM’s shares are trading at an ultra-low earnings multiple, and it pays a very strong dividend with a nice 4% yield to boot. Our fair value estimate for GM is $45, and there even could be upside to that.

We believe GM is not getting enough credit for its early efforts in next-generation technology in autonomous vehicles and new mobility ideas like transportation as a service and other ride-sharing platforms.

All of GM’s operating segments were profitable in the first quarter of 2018, including record performance in China and GM Financial.

Ford will stop investing in sedans for North America and shift to production of only two cars for the continent–the Mustang and the all-new Focus Active crossover. By 2020 almost 90% of its North American portfolio will be trucks, utilities, and commercial vehicles.

Ford continues to work to achieve a 10% adjusted EBIT margin in the important North American market through its 2020 “Fitness Initiatives,” but GM believes it is on track to achieve such levels in full year 2018.

Shares of Ford are trading in the lower half of our fair value range, the midpoint of which is $15 per share, and its Dividend Cushion ratio is a healthy 2.1. Shares of Ford yield ~5.4% as of this writing.

General Motors Still Not Getting Respect in Autonomous

US auto bellwethers Ford (F) and General Motors (GM) reported first quarter 2018 earnings April 25 and April 26, respectively, and the two stocks moved in opposite directions (Ford rising, GM declining) during the trading session April 26. Both companies continue to evaluate their operations to maximize efficiency, strengthen their cores, and keep a keen eye on the future of the evolving auto and personal transportation markets. We continue to like shares of GM relative to Ford, even as we say we like the direction in which Ford appears to be heading. For a recent discussion on the future of the market, please read, “Who’s Driving Who: The Future of the Automakers” (March 2017).

Shares of General Motors felt the pressure of weak quarterly results that were impacted by a ~$940 million restructuring charge related to the closing of a Korean plant aimed at strengthening its core business, as well as planned production reduction related to a coming full-size truck launch. The company also updated on its progress in autonomous vehicles, stating that it expects “to achieve commercialization at scale in a dense, urban environment in 2019.” The company is building a new assembly plant to further consolidate and accelerate autonomous vehicle production. All the buzz surrounding Tesla (TSLA), despite its inability to hit production targets that are but a tiny fraction of the output GM is capable of, leaves us a bit perplexed by the market’s refusal to acknowledge the position GM could hold in the next wave of personal transportation.

We are of the opinion that GM does not get enough credit for its early efforts in next generation technology in autonomous vehicles and new mobility ideas like transportation as a service and other ride-sharing platforms. The company’s scale and expertise, along with what may be seen as a “first mover” advantage gives it a meaningful leg up in the coming autonomous vehicle market, which some estimate will grow to be as large as $750 billion. Though it does not have definitive long-term plans for its stake in ride-sharing business Lyft–Lyft also has partnerships with other key rivals (including Ford)–the investment should not be discounted as immaterial by investors as it is ultimately aimed at delivering a network of on-demand autonomous vehicles in the US.

Ford Giving Up On US Sedan Market? GM Puts Up Record Performance in China, GM Financial

Clearly Ford is taking note of the same trends as GM, and its first quarter report brought a number of updates to its strategy moving forward. It announced a number of “Fitness Initiatives” and has identified $11.5 billion in cost and efficiency opportunities, which drives its accelerated financial targets of an 8% adjusted EBIT margin by 2020, two years earlier than its previous target, along with ROIC in the high teens by 2020. The efficiency focus is also expected to reduce cumulative capital spending by $5 billion from 2019-2022.

Ford’s strategy shift is noteworthy as well. The company will stop investing in sedans for North America and shift to production of only two cars for the continent–the Mustang and the all-new Focus Active crossover. By 2020 almost 90% of its North American portfolio will be trucks, utilities, and commercial vehicles. Ford’s updated strategy consists of three more core tenets: 1) Committing to new propulsion options such as hybrid powertrains in high-volume and profitable vehicles; 2) Building a profitable autonomous technology business that offers human-centered ride-hailing and delivery services; and 3) Creating and scaling a mobility platform ultimately targeting the creation of a Transportation Mobility Cloud for cities and orchestrating digital connections from vehicle to street and business to home.

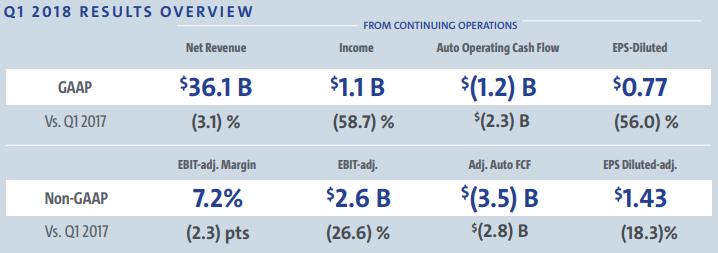

Table 1: Recap of General Motors’ Q1 2018 Results