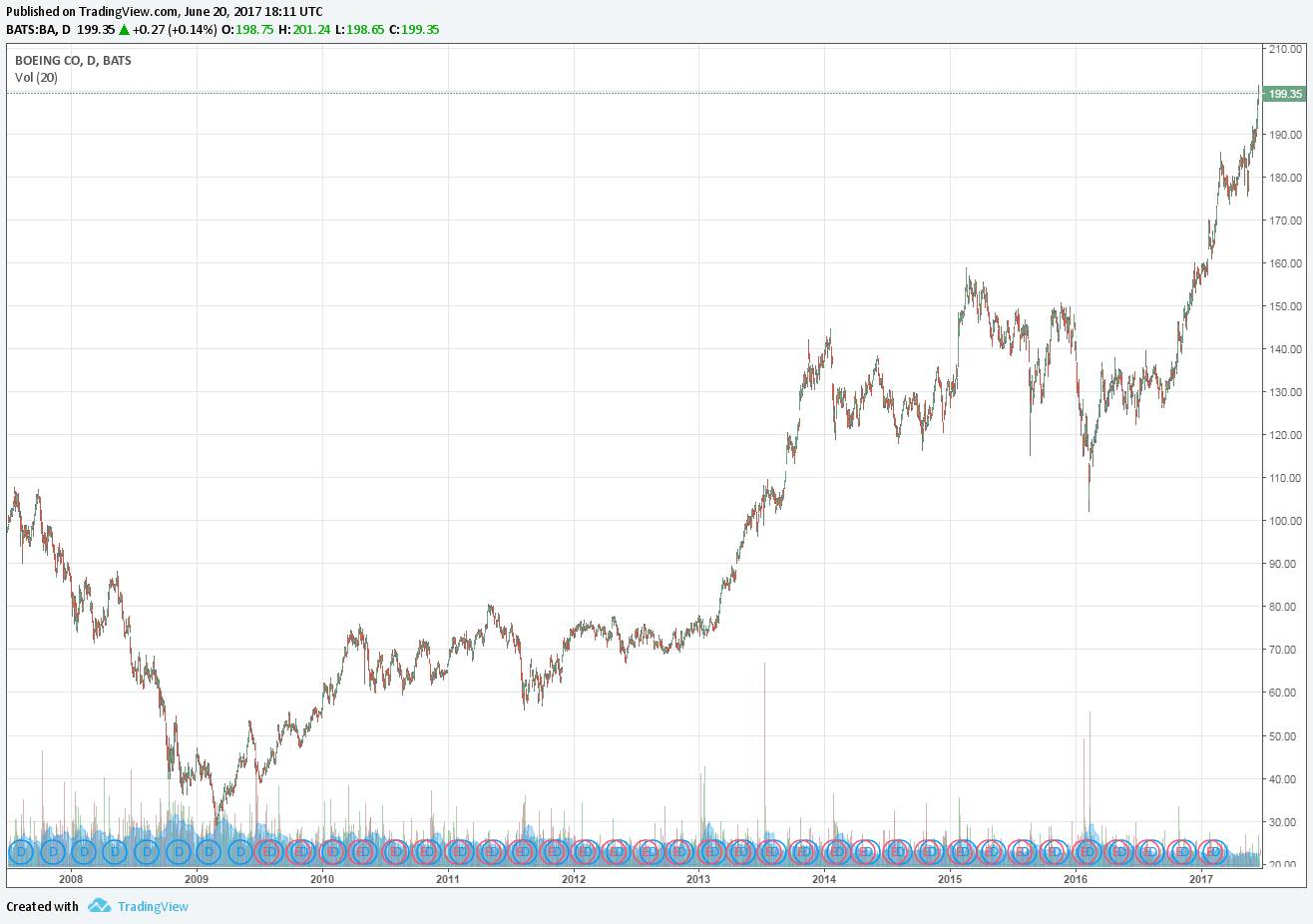

Image Shown: The stock price performance of Boeing.

Let’s take a look at recent news from newsletter portfolio holdings. We’re also parting with a “trade” we never should have made in the first place, and we’re letting go of one of our favorite restaurants in light of deteriorating technicals. This and more…

By Brian Nelson, CFA

Aside from predicting the ongoing inflation of the current equity market bubble in the US so far in 2017, we also thought crude oil prices (USO) would continue their recovery. Unfortunately, this hasn’t exactly worked out, and US crude oil prices have now entered a “bear market,” now falling below $43 per barrel. Are we saying that we know where crude oil prices are headed next? Not precisely. But it does mean that we are going to remove the Alerian MLP ETF (AMLP) from the Dividend Growth Newsletter portfolio. Energy midstream players and energy resource prices are fundamentally tied at the hip.

We added the midstream-heavy ETF to the Dividend Growth Newsletter portfolio in January, and it hasn’t worked out as a trade. We are now hitting the “remove button” after having our finger on it for the past many months (something we noted when we added it). On a fundamental basis, we continue to dislike the master limited partnership business model, and we continue to be very concerned about their capital market dependency. Our thesis on MLPs is that the group finances its distributions from the financing section of the cash flow statement, as traditional free cash flow calculations (cash flow from operations less all capital expenditures) is often considerably negative (after distributions paid). Without continued capital market access, trouble looms. We’re out for good at $11.13 per share!

We’re also letting go of one of our favorite restaurants in the Best Ideas Newsletter portfolio Buffalo Wild Wings (BWLD). The company was a huge winner the first time we added it to the newsletter portfolio, but the second time we added it back, it hasn’t worked out. Shareholder activism, executive turnover, less-than-desirable comparable store sales, and increased competition in the “wing space” from Wingstop (WING)–not to mention an increasingly more difficult traffic environment–have become too many fundamental headwinds for us to stay comfortable. Consistent with the Valuentum Style of Investing, its technical breakdown suggests it’s time to move on…for now. We’re removing the full position from the Best Ideas Newsletter portfolio at $134.10 per share, even as we think we may be able to re-add this long-term idea back at a lower price once fundamentals get back to where we think they should be. In light of broader market valuations, we just can’t be too careful.

There’s some very good news happening, too. One of the more recent additions to Dividend Growth Newsletter portfolio Boeing (BA) is now a ~$200 stock, up from the add price under $170 per share. The company recently showcased its 737 Max 10 (the largest 737 variant) at the Paris Air Show to much fanfare, and many in the industry are talking about a brand new plane altogether, the 797, which is expected to “take back market share from Airbus’ A321neo.” Read more on the 797 here. We love Boeing’s huge backlog of unfulfilled deliveries on its books, the company’s strong free cash flow, healthy balance sheet, and capacity and willingness to keep raising its dividend. Though we note shares are starting to bump up against the high end of its fair value range, we like what we are seeing fundamentally quite a bit. As it relates to air travel in particular, Best Ideas Newsletter portfolio holding Priceline (PCLN) continues to hover near all-time highs, too.

If you recall, in January 2016, in the Best Ideas Newsletter portfolio we swapped Gilead (GILD) for Johnson & Johnson (JNJ), and since then, Johnson & Johnson has hit a 52-week high (yesterday), while Gilead continues to languish in the mid-$60s. Though we may have made the mistake of adding Gilead to the Best Ideas Newsletter portfolio at the wrong time in the first place, doubling down on Johnson & Johnson has more than offset that miscue, in our opinion. J&J’s shares are now exchanging hands at ~$135 each, and while it, too, is bumping up against the high end of its fair value range, there’s a lot we like about the company from a fundamental standpoint, “Johnson & Johnson Oncology Division A Force to Be Reckoned With (February 2017).” For those keeping score, in January 2016, in the Best Ideas Newsletter portfolio, Gilead was removed at $83.37 while Johnson & Johnson was added at $104.18–not a bad alpha-generating move. J&J has been included in the Dividend Growth Newsletter portfolio since the mid-$60s.

The top weighting in the Best Ideas Newsletter portfolio, Visa (V) continues to be a high-flyer in the mid-$90s, up from its cost basis under $30 per share. PayPal (PYPL), another Best Ideas Newsletter portfolio holding, has also rocketed higher and is now trading above the half-century mark at last check. The Best Ideas Newsletter inherited shares of PayPal when eBay (EBAY) split it off a couple years ago. If you recall, in July 2016, we reiterated our $50 per share fair value estimate of shares on PayPal, and it has been a nice winner for the Best Ideas Newsletter portfolio. We mention the payment-processor duo of Visa and PayPal together as there has been considerable talk of cryptocurrencies lately, namely surrounding the price performance of Bitcoin and Ether. It is far too early to guesstimate the long-term implications of digital currency on established payment processors, but we believe Visa’s and PayPal’s business models have tremendous room for expansion regardless, even if digital currency adoption proliferates. The market is big enough for many, many players, in our view.

In other news, we’re watching the retail and pharmacy market closely in light of Amazon’s (AMZN) purchase of Whole Foods (WFM). We don’t like it at all as it relates to the position in CVS Health (CVS), but we also think the grocery space may do whatever possible to keep Whole Foods from falling into the hands of the online retailer. We think a higher bid for Whole Foods may even be in the works, suitor unknown. We liked what we saw from Verint’s (VRNT) most recently-reported quarter, especially in its Cyber Intelligence division, and we trust our write-up helps to explain why we focus more on cash-flow based analysis than GAAP or even non-GAAP income-statement accounting measures. The diversified idea for utilities exposure, the Utilities Select SPDR (XLU), has performed well this year in light of ever-declining interest rates, and tech exposure in both newsletter portfolios has helped to power performance, despite some selling pressure of late. We’re also not reading too much into the previous “emissions-related” news from General Motors (GM), and we think the car maker’s valuation and dividend yield remain compelling considerations.

That’s it for now. If you have any questions, or if we can be of any assistance, please just email us. Also, in case you missed it, the Dividend Cushion ratio caught another dividend cut, the latest Mattel’s (MAT). Thank you.