Image Source: PayPal 2Q presentation, page 10

By Brian Nelson, CFA

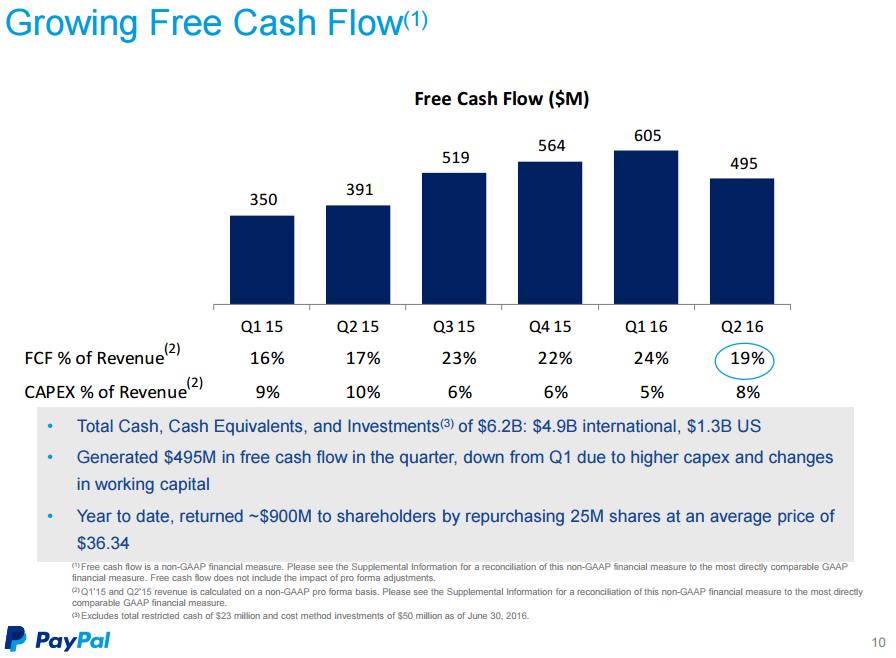

A quarterly “beat and raise” and a new agreement with Visa (V) weren’t good enough to drive shares of PayPal (PYPL) higher July 22, but we’re not worried. Revenue growth of 19% on a foreign-currency neutral basis and non-GAAP earnings per share growth of 11% wasn’t bad at all. Operating cash flow and free cash flow generation of $696 million (up ~12% year-over-year) and $495 million (up 27% year-over-year) in the quarter wasn’t too shabby either. Through the first six months of 2016, the company has generated $1.1 billion in free cash flow, better than the $740 million mark generated during the same period a year-ago. Active customer accounts advanced 11% in the quarter, and the company processed an impressive 1.4 billion transactions (up 25%) on $86 billion of volume (up 29% on an FX-neutral basis). PayPal continues to gain share, growing much faster than the broader pace of e-commerce expansion.

The good news keeps coming. The e-commerce payments giant raised its full-year 2016 revenue guidance, to the range of $10.75-$10.85 billion (was $10.5-$10.7 billion), and we think ongoing momentum toward the back half of the year may make such a revision conservative. Non-GAAP diluted earnings per share for 2016 is targeted in the range of $1.47-$1.50, tightening the previous range of $1.45-$1.50 issued in April. PayPal may be trading at 25 times current-year non-GAAP earnings, but in the context of consumer staples entities, for example, fetching similar-sized multiples in this overheated equity market on mature or slowing growth, PayPal is a relative bargain. PayPal holds a solid net cash position, with cash equivalents and investments tallying ~$6.3 billion at the end of June 2016 (or ~14% of its market capitalization).

The deal with Visa seems to have investors on edge, however:

PayPal and Visa announced a strategic partnership to expand their long-standing relationship that will result in an improved and more seamless shopping experience and greater choice in how consumers pay. This agreement is a significant step towards offering greater customer choice and flexibility for PayPal’s customers.

PayPal will also gain access to Visa’s tokenization services, starting in the United States, for in-store PayPal transactions. This will expand acceptance for PayPal’s digital wallet to all physical retail locations where Visa contactless transactions are enabled. The partnership’s benefits will include greater accessibility and volumes for Visa payment instruments in the PayPal digital wallet.

PayPal also will ensure that data provided to issuers and their cardholders for Visa-funded transactions will be consistent with the information that each receives with a traditional Visa card transaction, providing greater transparency and enhancing payment system security.

The agreement affords PayPal certain economic incentives, including incentives for increased Visa volume, and greater long-term certainty on fees paid to Visa, and further removes the threat of any fees or Visa network rules being targeted solely at PayPal.

We’re still sifting through the details, and while many are pointing to margin pressures at PayPal due to pressure from the Visa agreement, we expect growth potential from the deal to more than offset any profit squeeze. More importantly, however, we think it is worth noting that PayPal had been rumored to be talking with MasterCard (MA), and the Visa announcement is a huge development for long-term holders. The end game for PayPal may very well be a merger with one of these two credit card processors. We’re keeping the position in PayPal in the Best Ideas Newsletter for the foreseeable future. Our fair value estimate of $50 for PayPal remains unchanged at this time.