The upcoming deluge of earnings over the next couple of weeks offers a glimpse into the ongoing business prospects for the various companies in our coverage universe. Let’s discuss the recent news release of a few prominent names in the healthcare industry.

Alexander J. Poulos

Is There Trouble Brewing at JNJ?

Image Source: Johnson & Johnson

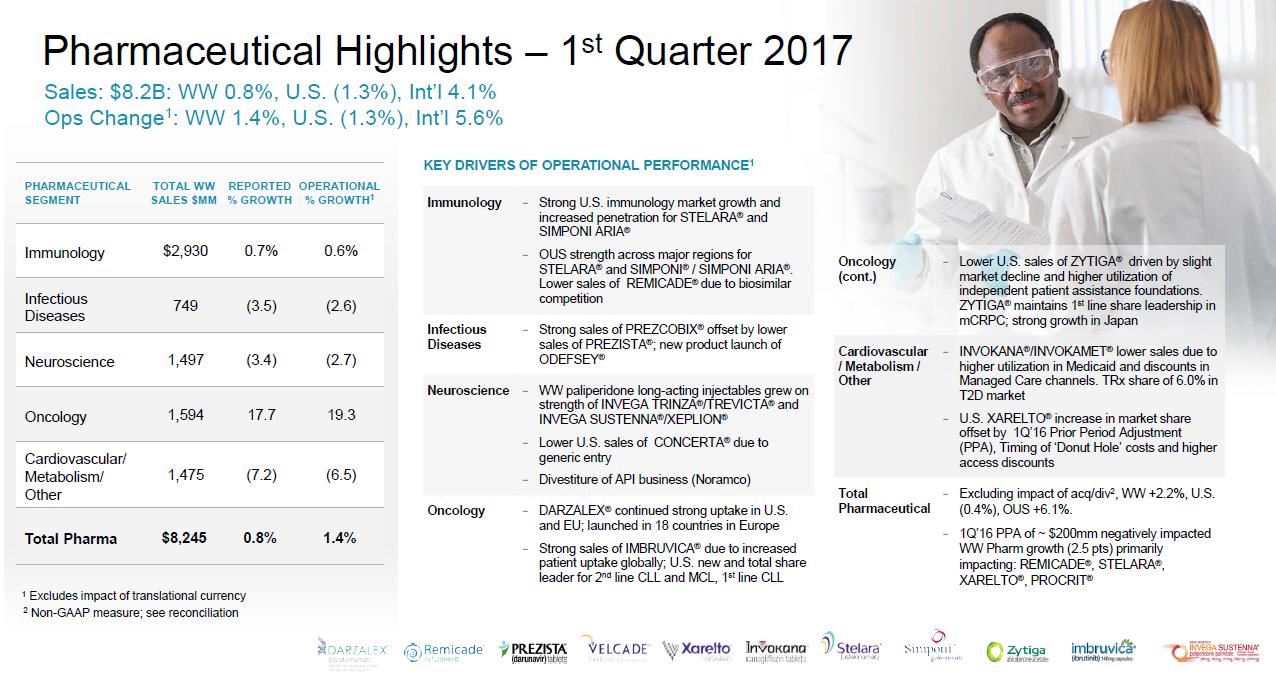

Shares of Johnson and Johnson (JNJ) faced modest share-price pressure following its first-quarter earnings results April 18. Though we still like J&J in both newsletter portfolios, we were somewhat concerned about its less-than-stellar showing during the quarter in the all-important Pharmaceutical division, which accounts for over 40% of JNJ’s sales.

During the period, revenue still increased in its Pharmaceutical division (+0.8 worldwide; 1.4% operationally) thanks to continued sales growth of Stelara, but we’re growing concerned that sales momentum of the drug will slow. Eli Lilly (LLY), for example, released head-to-head data demonstrating its competing product Talz achieved superior outcomes, a major selling point. We weren’t surprised by the anemic growth in Immunology as top-selling product Remicade continues to face a biosimilar challenger, and the importance of outcomes data manifested itself once again in Cardiovascular. JNJ’s top selling product Invokana, for example, suffered a notable drop in revenue as Jardiance (armed with data indicating a reduction in cardiovascular death) continues to steal market share. JNJ has concluded a cardiovascular outcomes trial for Invokana with a data read slated for mid-year, but Jardiance will continue to claw away market share. Further complicating matters is the continued sales erosion in Xarelto. We are surprised JNJ has ceded ground in this market to Eliquis which is co-promoted by Bristol-Myers Squibb (BMY) and Pfizer (PFE). Eliquis is the third player on the market with a less favorable dosing schedule but the aggressive marketing has led to rapid growth.

Management’s expectation of the notable sales slowdown in J&J’s investment-critical Pharmaceutical division, at least in the near term, likely underscored the need for an acquisition to bolster the current product lineup while allowing ample time for the clinical pipeline to come to fruition. We are optimistic the Actelion deal will go through and applaud the management team at JNJ for having the foresight to aggressively pursue and ultimately prevail in the bidding war for the company. The dividend remains secure buoyed by JNJ impressive ability to generate a copious amount of free cash flow. We continue to like J&J, “…Oncology Division a Force to Be Reckoned With (February 2017)”

Image Source: Johnson & Johnson

Generic Drug Deflation Continues to Wreak Havoc on Cardinal Health

Cardinal Health (CAH) remains mired in a deflationary spiral that continues to hamper profitability. Cardinal’s largest division remains the drug distribution segment which relies on favorable generic drug pricing to drive profitability. We were initially optimistic the deflationary tide is ebbing—but we were shocked with the bombshell dropped by management April 18. Let’s have a look.

Cardinal is now expecting low double-digit generic drug deflation for the current fiscal year, a notable worsening of expectations. Management is now guiding to the lower end of expectations while expecting fiscal 2018 non-GAAP earnings flat-to-down single digits, which dampens our enthusiasm for the industry. We applaud Cardinal for taking proactive steps to diversify its core business by purchasing assets from Medtronic (MDT), but the acquisition is not a panacea for what plagues Cardinal. Medtronic has likely gotten the better deal in light of Cardinal’s business difficulties (MDT is included in the Dividend Growth Newsletter portfolio).

We believe Cardinal’s updated guidance pertaining to generic drug deflation has negative implications for the entire industry with McKesson (MCK) and AmerisourceBergen (ABC) particularly vulnerable. Though in varying degrees, we expect each to face ongoing fundamental pressure in the near term, and while Cardinal is optimistic about fiscal 2019 (non-GAAP EPS is expected to grow at least high-single digits versus fiscal 2018), we view that time period as a bit too far away to bank on, especially in light of the magnitude of near term fundamental deterioration.

We still believe that “Cardinal Health: An Undervalued Free Cash Flow Generating Powerhouse (January 2017),” even as we plan to update our 16-page report on Cardinal Health in light of the recent news. We couldn’t get comfortable with pulling the trigger on Cardinal in Jaunary, and the company is still not included in either newsletter portfolio.

Abbott Labs Continues To Post Steady Revenue Growth

Abbott Labs (ABT) continues to post steady mid-single revenue growth in its core business lines as first-quarter results, released April 19, showed (+3.2% comparable operational basis; +29.7% on a reported basis, which includes acquisition-related sales). We remain impressed with Abbott’s ability to generate substantial free cash flow to fund the dividend, which remains the main attraction of the company.

The slow, steady growth Categories Member Articles