Medical technology companies have taken their share of lumps as of late, but the long-term may be too bright for investors to ignore Zimmer Biomet’s shares.

By Alexander J. Poulos and Brian Nelson, CFA

The medtech field offers an intriguing combination of high-margin growth coupled with defensive characteristics as the end product is considered recession resistant. To add context, an individual who requires a knee transplant may wait a bit before having the surgery, but as the joint disintegrates the need will hasten irrespective of economic conditions. The ebbs and flows of the economic cycle have little to do with such a decision, in most cases.

That said, the field remains fiercely competitive with many upstarts that have innovative technologies, presenting challenges for the larger players but also ample acquisition targets to drive top-line sales and growth and ultimately profitability. We like the space quite a bit, and we are strongly considering Zimmer Biomet (ZBH) for addition to the Best Ideas Newsletter portfolio. We currently include Johnson & Johnson (JNJ) and Medtronic (MDT) in the Dividend Growth Newsletter portfolio, at the time of this writing (J&J is also included in the Best Ideas Newsletter portfolio).

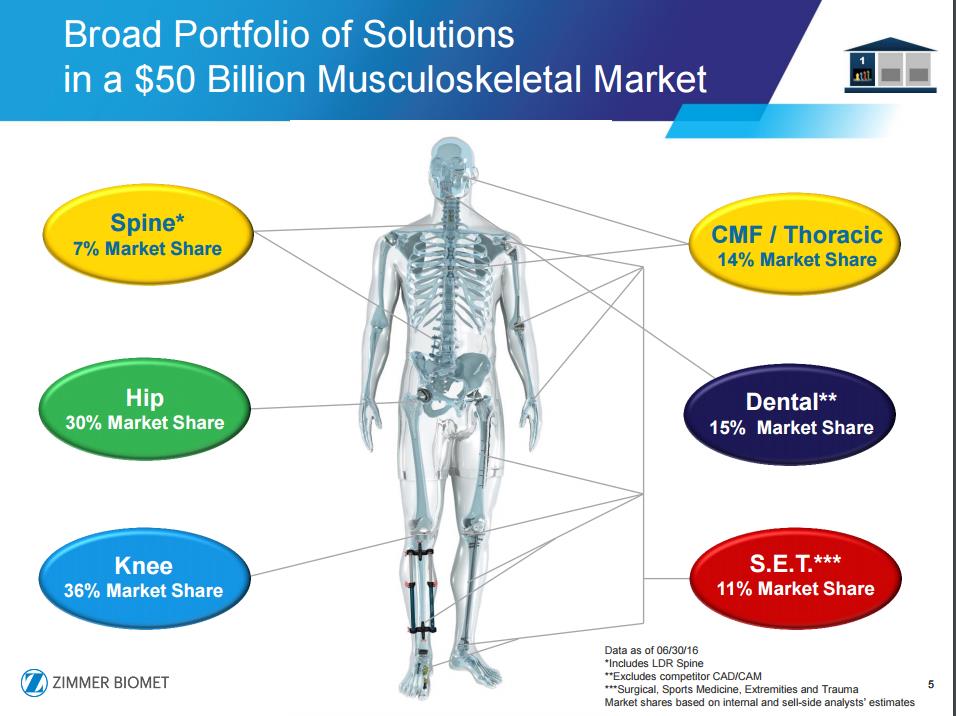

Zimmer Biomet Product Lineup

Image Source: Zimmer Biomet

Zimmer Biomet is the recently-formed entity that resulted after Zimmer acquired Biomet in early 2015 to significantly augment its product lineup to better compete with powerhouse Johnson & Johnson and rival Stryker Corp (SYK) in musculoskeletal healthcare. The Indiana-based company has been around for a long time, since before the Crash of 1929, but the acquisition of Biomet will take it to new heights, in our view. The deal is expected to generate $350 million in net annual operating synergies by year three of closing as the new company optimizes production and reduces unnecessary overhead.

Other areas of focus to drive consistent operating margin and earnings expansion from the transaction include strategic sourcing, shared services, a tax-efficient supply chain, and pursuing lean processes across the combined entity. We think management will be successful in achieving desired goals, even if it may have fits and starts along the way. By virtue of the deal, Zimmer Biomet has solidified its leadership position in orthopedic surgery. As the world population over 65 years of age increases (expected to be higher than 16% of total by 2050) and the availability of healthcare in emerging markets improves, Zimmer Biomet is going to be a large part of that growth story, no matter what happens during the uncertain Trump administration.

Mergers & Acquisitions

M&A remains a key feature of the medtech industry as top-line growth tends to trend in the mid-single-digit range due to the fragmented and highly competitive nature of the field. This isn’t a poor rate of growth, but to augment and consolidate the field, frequent M&A is often pursued, and Zimmer Biomet has acquired several smaller upstarts that have helped fill in the gaps of its product lineup.

Most of the established players in the industry, except for high-growth idea Edwards LifeSciences (EW) with its innovative Transcatheter Heart Valve Therapy, are expected to register single-digit annual revenue expansion, yet all outside of Zimmer Biomet support an above-average earnings multiple. We find this very compelling, and we believe the anomaly requires further investigation to determine if the market is offering investors an opportunity to consider a low-risk entry, or there are deeper problems with Zimmer Biomet that justifies the unfair treatment.

Most Recent Quarterly Performance

In late October, Zimmer Biomet updated its full-year 2016 constant-currency revenue and adjusted earnings per share guidance. Though we’re anxiously awaiting full-year results, to be released in the new year, the company estimates full-year 2016 revenue to have come in a range of $7.63 billion to $7.65 billion, an increase of approximately 27% on a reported basis, or 2.4% to 2.7% on an adjusted pro forma year-over-year basis.

Zimmer Biomet expects foreign currency translation to have hurt full-year revenue by ~0.3%, compared to its previous estimate of 0.5%. At the time, it modified its adjusted revenue growth outlook for the full year 2016, to the range of 1.65% to 1.9%. Previously, the company was expecting full-year revenue growth to be in a range of 2.5%-3% on a similar basis. The downward revision wasn’t very welcome.

Additionally, Zimmer Biomet expects its full-year 2016 diluted earnings per share to be in a range of $1.50 to $1.60, and $7.90 to $7.95 on an adjusted basis. Previously, the company had estimated diluted earnings per share to be in a range of $1.50 to $1.75 on a reported basis, and $7.90 to $8.00 on an adjusted basis. Though minor, the revision wasn’t in the direction we were hoping (Source).

The lowered revenue and earnings expectations for the full-year underscore some of the trouble Zimmer Biomet, and by extension, most of the medtech industry ran into during the third quarter. One of our favorite ideas, a holding in the Dividend Growth Newsletter portfolio, Medtronic also faced some trouble in the period, using the word “disappointing” to describe its performance, “Earnings Insight – Medtronic’s Free Cash Flow Story,” and moderating expectations:

Medtronic updated its fiscal 2017 guidance for revenue, free cash flow, and earnings per share guidance. The top line is expected to advance at a mid-single-digit pace (down modestly from its prior expectations), while non-GAAP diluted earnings per share is targeted in the range of $4.55-$4.60. Free cash flow during the fiscal year is expected in the range of $5-$6 billion; its annualized cash dividend run-rate is ~$2.4 billion, so free cash flow coverage is fantastic. Medtronic ended the quarter with ~$3 billion of cash and cash equivalents and ~$29 billion in long-term debt.

Peer Edwards LifeSciences also disappointed investors during its third-quarter report, results released late October. Performance from the structural heart disease and critical care monitoring company weren’t poor by any stretch, with revenue and earnings growing at a nice clip during the period, but the top line did come up a bit short. The company may have issued guidance that came in a little light for the fourth quarter versus whisper numbers, too, and it did mention at its annual investor conference December 8 that fourth-quarter sales were trending at the low end of its guidance range of $750 million to $790 million for the period, but the market may be overreacting.

In any case, the broadbased top-line weakness in all three medtech bellwethers indicates the quarterly troubles may be an industry-wide phenomena, perhaps mostly attributable to a delay in elective surgery, more than likely as the political process continued to its eventual conclusion in early November. We reiterate that a patient may be able to delay surgery for a bit, but the need remains as the underlying issue continues to erode/decline. Also, the long-term outlook as the aging population continues to increase and emerging-market penetration advances remains a compelling one.

Zimmer Biomet Fundamentals

The transformational move to acquire Biomet formed a leader in the field of orthopedic surgery with a notable market share in knee and hip replacements. As is custom with larger mergers of this nature, integration of legacy systems tends to be a challenge as this theme came into full view in the recent quarterly report.

Some of the weaker top-line growth was a direct result of too-little inventory in place to service the needs of Zimmer Biomet surgeon base. We suspect the lack of supply is a direct result of the integration of the two companies, with CEO David Dvorak pledging the issue has been corrected on a go-forward basis. Judging by the magnitude of the fallout from the announcement, the Street has a different view with Zimmer Biomet, and the company is clearly in the penalty box for now.

At its current quote slightly higher than $100 per share, the stock price is trading on par with levels not seen since 2014 as shown in the chart below.

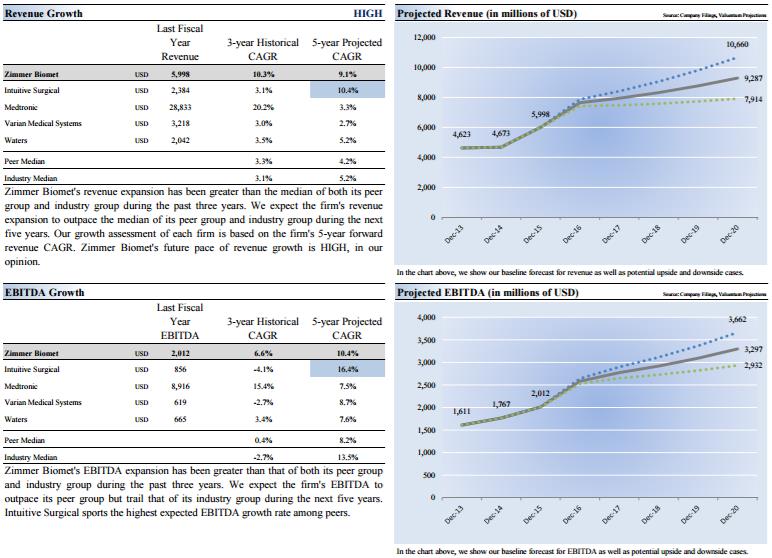

We’ve provided a number of metrics to help gauge the attractiveness of the equity, including our revenue growth and EBITDA expectations. Companies that generate high and resilient EBITDA margins tend to have “moaty” characteristics built into their businesses that prevent competitors from stealing share and depleting margins, and Zimmer Biomet’s numbers are quite attractive. As is often witnessed in the more-commoditized players, a new entrant can crush margins and often the stock price. That’s why we like companies with sustainable, competitive advantages, and Zimmer Biomet is one of them. The company’s Economic Castle rating is attractive.

Zimmer Biomet’s current debt load of $11 billion, as of the end of September 2016, results in a rather high debt-to-EBITDA ratio, but debt repayment remains a top priority of management with bolt-on acquisitions as the second use of cash. The debt is structured as long-term debt, and we think management should be applauded for taking advantage of low-interest rates to significantly bulk up the size of the overall company. Interest payments are roughly $300 million per year, a number the company can comfortably accommodate, in our view.

Further, the management team at Zimmer Biomet continues to lower the duration and net yearly interest paid on the debt with strategic exchanges and issuances of notes denominated in currencies other than the US dollar. In our view, the absurdly low-interest rates in the European Union offers an appealing opportunity for companies to issue lower-cost debt and monetize some of the assets held overseas for tax purposes while lowering the overall debt paid by the corporation. Zimmer Biomet is an excellent example of this trend, as it generates approximately 35% of its sales outside the US. That said, however, we tend to generally be debt-averse, all else equal.

Zimmer Biomet is also committed to its dividend program and returning cash to shareholders via buybacks. The company currently has a dividend yield of ~1%, which is roughly 15% of net profits leaving ample room for increases as the years progress. As for debt, it will continue to target an investment-grade credit rating, and we don’t have many worries on that front, especially as Zimmer Biomet pursues deleveraging initiatives.

Fair Value Estimate

Our fair value estimate for Zimmer Biomet is $123 per share at the time of this writing, substantially higher than the current share price. The medtech field along with healthcare sector as a whole remains deeply out of favor as the sector posted a loss during the year. The election of Donald Trump has done little to alleviate fears as analysts await the expected changes to the Affordable Care Act (ACA).

A notable change that is likely to happen that will benefit the medtech field, however, is a permanent repeal of the medical device tax (it is currently suspended), which should benefit existing newsletter portfolio holdings, Johnson & Johnson and Medtronic, as well. With Zimmer Biomet trading at attractive EBITDA and earnings multiples, the latter about 13 times on an adjusted basis, the company is offering investors a substantial discount to the overall market multiple (about 17 times forward earnings at present). We’re strongly considering adding Zimmer Biomet to the Best Ideas Newsletter portfolio, even as we note our existing exposure to the healthcare sector.

Disclosure: Alexander J. Poulos is long options on ZBH.