Let’s cover some ground on Medtronic’s (MDT) calendar third-quarter report, its second-quarter fiscal 2017 results.

By Brian Nelson, CFA

What management said:

“Q2 revenue was disappointing and did not meet our expectations. We faced issues that affected our growth, including slower than expected revenue as we await new product introductions, particularly in CVG and Diabetes,” said Omar Ishrak, Medtronic chairman and chief executive officer. “Despite this revenue shortfall, we produced a strong improvement in operating margins and double digit constant currency earnings per share growth.”

The scoop:

Medtronic probably did more to frighten investors with its use of the word “disappointing” in its fiscal second-quarter press release, issued November 22, than anything fundamental. Fiscal second-quarter revenue increased 4%, or 3% on a constant-currency basis, while non-GAAP earnings per share leapt 15% on a constant-currency basis. GAAP and non-GAAP operating margins increased 50 and 150 basis points, respectively, on a year-over-year basis in the period.

Revenue generated in the US (up 1%), non-US (up 5% on a constant currency basis), and emerging markets (up 10% on a constant currency basis) advanced during the quarter. Segment sales in Medtronic’s ‘Cardiac and Vascular,’ ‘Minimally Invasive Therapies,’ Restorative Therapies,’ and ‘Diabetes’ groups increased 3%, 4%, 3%, and 3%, respectively, on a constant-currency basis. Medtronic’s drug-eluting stents business in the US and Japan faced some pressure due to timing of approval for Resolute Onyx and its implantables revenue came in lower-than-expected in the UK, but there was more good news than bad in the quarter, in our view, particularly with respect to its ‘Diagnostics’ business (mid-teens growth) and its Spine business, the latter experiencing the best performance in seven quarters.

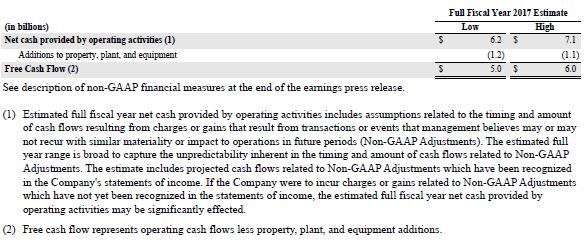

Medtronic updated its fiscal 2017 guidance for revenue, free cash flow, and earnings per share guidance. The top line is expected to advance at a mid-single-digit pace (down modestly from its prior expectations), while non-GAAP diluted earnings per share is targeted in the range of $4.55-$4.60. Free cash flow during the fiscal year is expected in the range of $5-$6 billion; its annualized cash dividend run-rate is ~$2.4 billion, so free cash flow coverage is fantastic. Medtronic ended the quarter with ~$3 billion of cash and cash equivalents and ~$29 billion in long-term debt.

Image Source: Medtronic

Insight from the quarterly conference call:

“Across all of our groups, our product pipeline remains robust. We have important new growth catalysts that we expect to lead to improved second half growth. Some of these products have already been launched and others are coming to the market in the coming months. We are confident we can drive sustainable growth of our new therapies growth vector and expect to be well within our 200 to 350 basis point goal in the back half of the year and over the longer term.” – CEO Omar Ishrak

“…we are modifying our free cash flow outlook methodology. Recall that last quarter, we were forecasting an adjusted free cash flow of $6.5 billion to $7 billion for fiscal year ‘17, a range that would exclude cash payments related to non-GAAP items that might occur during the year. Going forward, we will include these items to more closely align our free cash flow projection with the results we report each quarter. However, in light of the unpredictability of the precise amount and timing of cash payments, we are expanding the range. Given this, along with the revenue and net income expectations already discussed, we expect our free cash flow for the fiscal year to be in the range of $5 billion to $6 billion.” – CFO Karen Parkhill

Are we changing our mind with our position?:

No, but as we outlined in previous write-ups, we may look to take some profits off the top. Medtronic has been a huge winner in the Dividend Growth Newsletter portfolio, and its weighting had run away from us a bit, but it still resides below our mandatory 10% cap for any position.

We think CEO Omar Ishrak was a little hard on the team’s performance, as everything fundamental looks “fixable,” in our view, since most of it was timing-related. We also think that his thoughts may have been more near-term oriented than we would have liked as investors are looking at Medtronic as a long-term opportunity, not a short-term trade.

That said, we don’t think many investors liked the change in Medtronic’s free cash flow methodology, though we’ve always defined free cash flow as cash flow from operations less all capital spending, which for Medtronic continues to be substantially greater than cash dividend obligations.

Shares of the medical-device giant are trading at ~16.5 current-year earnings at the time of this writing and about ~14.5 times next fiscal year earnings. We don’t like its debt load, but we think it’s manageable given its robust free cash flow generating capacity, and we expect dividend growth to remain robust. Shares yield 2.3%.

Other related medical device companies: ABT, EW, BSX, SYK, BCR