Image source: GE website

Income investors cheered as Best Ideas and Dividend Growth Newsletter portfolios holding General Electric (GE) raised its quarterly per share dividend $0.01, or 4%, to $0.24 per share December 9. The move is consistent with its multi-year capital allocation strategy to have a dividend payout ratio of 45%-50% and then grow the payout in line with earnings once the targeted dividend payout ratio is hit. The increase, however, reflects a payout ratio above the upper bound of management’s target ratio based on consensus estimates for 2017. We like what the payout growth signals for income-minded investors, and management looks to be set in continuing its shareholder-friendly ways beyond its planned return of $30 billion in cash to shareholders in 2016 via dividends and share buybacks.

GE’s dividend hike comes near the end of a year in which the firm made material progress in its strategy to become a simpler, digital-based company with a more narrow focus on revolutionizing its industrial businesses. It now dubs itself the world’s ‘Digital Industrial Company,’ and a large portion of its transformation rests in the potential of the GE Store, where each business with which it partners is able to access the same technology, markets, structure, and intellect. We view the GE Store, and its potential, similar to that of Apple’s (AAPL) App Store, but instead of making the products in its store perceived necessities in the lives of consumers, as Apple has done, GE is looking to make the products in its store necessities for industrial and other companies to maximize the efficiency of the next generation of businesses.

With such lofty potential in mind, GE continues to invest in its future. Acquisitions of smaller firms in the avenues of digital, additive manufacturing, and renewable energy have become commonplace as of late. Two of the most recent examples of such behavior come in the form of Internet of Things startup Bit Stew Systems (purchased for ~$150 million) and cloud-based field service management firm ServiceMax (purchased for $915 million). We covered some of GE’s recent forays into additive manufacturing in this 3D printing roundup, “3D Printing: Can We Print Some Stability?”

Though smaller acquisitions have become a core part of GE’s digital transformation, the industrial giant made a splash recently with its merger agreement with Baker Hughes (BHI), “GE Positioning for Long-term Crude Oil Price Recovery.” As the crude oil market begins to show early signs of rebalancing, the deal is looking more and more prudent. Not only have OPEC-member nations agreed to cut production levels, but non-OPEC producers, led by Russia, have signed their first production cut agreement since 2001.

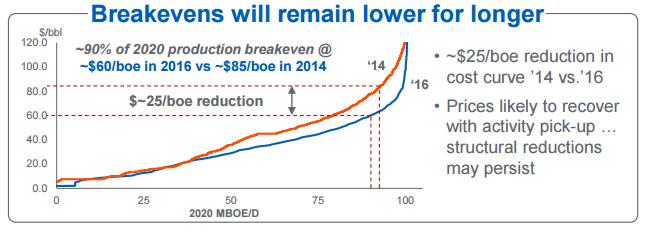

Despite the improved prospects for a recovery in energy resource pricing, volatility appears to have become a part of the new normal for oil and gas producers. Productivity initiatives across the space have improved the efficiency of the vast majority of operators, but recovery rates and well efficiencies have room for improvement. GE believes its deal with Baker Hughes will make it the leader in driving oil and gas productivity, which will help keep breakeven prices lower for longer. The aforementioned minor acquisitions are also helping to push GE closer to realizing its potential as a productivity leader. Additive manufacturing is expected to result in material cost savings across most end markets, including oil and gas, and automated drilling systems are beginning to look like a real possibility by 2020, according to management.