Image Source: GE, Baker Hughes

Newsletter portfolio holding General Electric has agreed to merge its Oil & Gas business with Baker Hughes.

By Kris Rosemann

General Electric (GE) is betting big on energy these days, even as orders continue to decline in its ‘Oil & Gas’ segment as a result of continued pressure on energy resource pricing (USO, NGAS). The industrial conglomerate on October 31 agreed to merge the business with energy services giant Baker Hughes (BHI) to create a powerhouse in the sector with estimated $32 billion in annual revenue. Although we’re very cautious on the deal based on the current operating environment and uncertainty in the energy markets–GE is expecting operating income in its Oil & Gas business to be down 30% in 2016–we think both companies are taking the right approach when considering the reasonable expectations embedded in the transaction. We continue to like GE’s sprawling industrial portfolio.

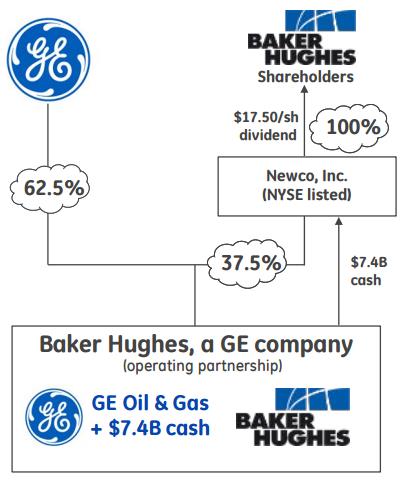

GE has agreed to pay $7.4 billion in cash for a one-time special dividend of $17.50 for each share of Baker Hughes, and the merger proceedings are expected to result in GE owning 62.5% of the new, publicly-traded company with Baker Hughes’ shareholders owning the remaining 37.5%. The deal is expected to close by mid-2017, and GE anticipates earnings accretion of $0.04 per share by 2018 (and $0.08 by 2020). It has projected ~$1.6 billion in run-rate synergies by 2020, ~$1.2 billion of which are expected to be of the cost savings variety. Such cuts are anticipated after GE completes more than $1 billion in cost reductions in its ‘Oil & Gas’ business in 2015 and 2016, and synergies are expected even with the continuation of a challenging outlook for crude oil prices, “Commodity Price Pressures Dinging Industrial Bellwether Expectations.” Proforma EBITDA margins are anticipated at ~23% by 2020 on ~$34 billion in revenue.

With GE assuming crude oil prices in the $45-$60 range through 2019 in its evaluation of the merits of the deal, we think the tie-up is based on rational assumptions. Though downside risk related to energy resource pricing is still very much a reality, we would have been considerably more concerned about the benefits of such a transaction if it hinged on crude oil prices returning to triple-digit levels, not seen now for some time. There’s no guarantee crude oil prices will ever reach those levels again either. In any case, the prospective company figures to take full advantage of a potential recovery in the price of crude oil over time, as it will be the second-largest oil field service company in terms of revenue behind only Schlumberger (SLB). GE is not expecting a recovery to take place overnight in Baker Hughes’ operations though; it anticipates the firm returning to only ~60% of its peak EBITDA (achieved in 2014) by 2020.

Generally speaking, we like the deal for both sets of shareholders, but let’s talk Baker Hughes first. Baker Hughes’ shareholders will receive a special dividend of approximately 30% of Baker Hughes’ share price prior to the deal announcement in addition to 37.5% equity ownership in a new, stronger company with material opportunities for synergies. The financial backing of GE is also quite the asset should tough times in the energy-services space ensue. Though rig and well counts have improved slightly in recent months, activity across the energy sector remains well below that of years past, as US rig and well counts in the third quarter of 2016 were about half that of the comparable period in 2015. Still, the combined entity is expected to provide top-notch productivity solutions as digital capabilities become an increasingly important part of energy resource exploration, production, transportation, and refining. The risk for both sets of shareholders largely rests in the event the combined entity falls short in extracting estimated synergies (as both are beholden to the energy resource pricing environment under any condition). We like that the ‘new’ Baker Hughes will not have to take on any additional debt to complete the transaction.

General Electric, on the other hand, will use debt to finance the $7.4 billion cash special dividend to Baker Hughes shareholders. While we are not particularly fond of the application of leverage in the transaction, a cash-rich conglomerate such as GE can do so without materially affecting its credit quality. Presentation materials suggest that there will be no anticipated credit rating impact from the transaction, and the divestitures of a number of its financial assets have given the industrial giant additional financial flexibility (GE is no longer a SIFI, or a systemically important financial institution). Because GE will be borrowing from GE Capital, its captive financing arm, the debt associated with this transaction is anticipated to be at no incremental cost to the firm through 2019. Additionally, GE expects free cash flow conversion of the new company to be ~90% by 2020 and an incremental ~$1 billion in free cash flow by 2019, revealing considerable potential for meaningful long-term value creation.

Along with a transaction of this nature come restructuring and integration efforts, which place an additional amount of attention on GE’s ongoing capital allocation plans. The industrial giant plans to sell GE Water, and it is currently in talks with prospective buyers, targeting a mid-2017 closing. The gain from the sale will fund restructuring and integration costs for the Baker Hughes deal, which could be up to $1 billion. Outside of the asset sale, GE remains committed to its capital allocation strategy. It continues to target the sustenance of an attractive dividend with a yield greater than that of peers, and it will continue to allocate dividends from GE Capital to its buyback program through 2018. Management remains very shareholder friendly.

That said, we’re not jumping to conclusions just yet. It is prudent to note that the completion of the deal is not yet set in stone, as regulatory approval is not yet finalized. Close followers of Baker Hughes’ stock recently saw its deal with Halliburton (HAL) nixed by the US Department of Justice as a result of its perception of the deal’s impact on competition across the energy services industry (OIH, XES, IEZ, PXJ). However, a much more limited amount of product overlap is present in the proposed GE-Baker Hughes tie-up, suggesting that the deal has a greater likelihood of consummation (in the event the deal is not completed, GE would have to pay Baker Hughes $1.3 billion). Halliburton ended up paying Baker Hughes a $3.5 billion termination fee.

From a long-term value-creation point of view, we generally like the deal for GE shareholders. Combining assets in similar end markets, extracting cost savings from such assets, reducing some competition, and setting the stage for improved energy-service pricing makes a lot of sense, even if the future path of crude oil pricing may play the most important role in how much we like transaction over the long haul (something out of both companies’ control). GE retains its well-diversified industrial portfolio, including its very valuable aerospace business, and will now have a material equity interest in an energy services powerhouse to nurture as it puts its SIFI-designation behind it. Though GE’s reported results will continue to be “messy” in light of all the corporate transactions of late, we continue to like shares of the company in the newsletter portfolios. Its free-cash-flow-supported dividend yield north of 3% is very hard to pass up. Our fair value estimate of GE is $32 per share.

Energy Equipment & Services (Large): BHI, FTI, HAL, NBR, NOV, SLB, TS, WFT

Energy Equipment & Services: CLB, DRQ, FI, HLX, HP, OII, OIS, PDS, PTEN, SPN, TDW

Energy Equipment & Services – Offshore Drilling: ATW, DO, ESV, NE, RDC, RIG, SDRL