By Kris Rosemann

Commodity resource prices, while suppressed, are said to be stabilizing, but stabilization at low levels does little good for many operators tied to commodity-based end markets. Such is the case for several industrial giants General Electric (GE), 3M (MMM), and Caterpillar (CAT), all of which have seen their worldwide operations impacted by the effect that a prolonged trough in commodity prices has had on global economic growth, “Industrial Bellwethers Hit by Global Economic Growth Concerns.” We recently highlighted the organic growth pressures industrial bellwether Honeywell (HON) has been experiencing, “Honeywell’s Stock Up 170% Since End of 2009; GE a Better Bet?” and its peers have been echoing its concerns.

GE reported third-quarter earnings October 21, and while the report itself was decent, the company trimmed its 2016 revenue outlook. We’re still huge fans of GE’s business transformation, and the company remains a core holding of both newsletter portfolios, “GE Continues Transformation; Steady Growth at Honeywell (April 2016).” No longer is GE held back by its financials business, and its industrial assets and cash-flow generating capacity are some of its greatest attributes. It still wasn’t great to see a shift in the trajectory of internal expansion at the industrial behemoth. Organic revenue for the firm as a whole in 2016 is now expected to be in a range of flat-to-up-2% compared to previous guidance of growth in the 2%-4% range, not a huge change, but directionally significant in light of peer performance.

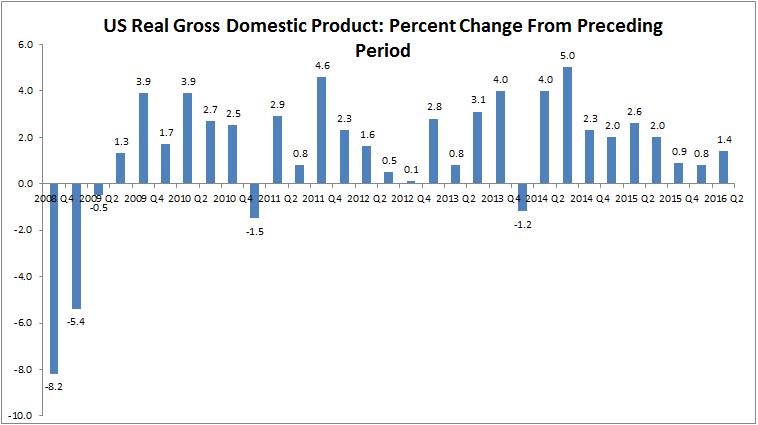

The culprit? You guessed it – low commodity prices as “challenges continue in the resource sector.” GE continues to pump its acquisition of Alstom’s power business, which is on track to meet expectations in 2017 and 2018, and the industrial giant continues to report a burgeoning backlog (~$320 billion) thanks in part to performance of its ‘Aviation’ and ‘Healthcare’ segments, but it expects a more challenging environment to persist for its ‘Oil & Gas’ segment and related end markets. With energy resource prices, namely crude oil, still lingering around a third of the levels seen prior to the Financial Crisis, the operating environment isn’t as easy as it once was (organic revenue in its ‘Oil & Gas’ division dropped 20% in the third quarter). That’s a pretty steep decline that will ease a bit in the fourth quarter, per management’s guidance calling for a 10% slip, but it’s also worth mentioning that organic revenue growth across the remainder of GE’s businesses continues to be solid, up 4% through the first three quarters of the year (if we exclude the much-beleaguered ‘Oil & Gas’ division).

Despite the reduction in organic top-line growth expectations, GE maintained the $1.50 midpoint of its earnings per share guidance for full-year 2016, though it narrowed the guidance range to $1.48-$1.52 from $1.45-$1.55. The resilient bottom-line in the face of a slowing pace of sales expansion continues to be helped by GE’s ability to extract cost savings in the ‘Oil & Gas’ segment, with the company now expecting to deliver between $700-$800 million in savings in 2016 compared to initial expectations of $400 million. However, the aggressive cost cutting in 2016 may leave little room for further cost optimization in 2017, in which management is not expecting a material recovery in energy resource pricing.

Industrial conglomerate peer 3M is experiencing very similar dynamics in its global industrial operations. 3M reported third-quarter results October 25. Each of the innovative firm’s operating segments generated revenue growth on an as-reported basis, except for its ‘Electronics and Energy’ segment, where energy-related sales fell 9% on a year-over-year basis. The company reduced its expectations for full-year 2016 organic revenue growth for the second time in as many quarters, as it now expects organic revenue to be approximately flat compared to previous guidance of growth in a range of 0%-2% and initial guidance of 1%-3%. Nevertheless, 3M was able to deliver its 100th consecutive year of paying a dividend and has now increased its payout in each of the last 58 years as of the third quarter of 2016.

Equipment manufacturer Caterpillar has probably been the poster-child of companies punished by the ongoing slump in commodity prices during the past 18-24 months. In 2016, the firm expects to report its fourth consecutive year of sales declines for the first time in its history, and it reduced its guidance for the year after another weak quarterly report October 25. In its third-quarter report, released October 26, the equipment maker said that it now expects 2016 revenue to come in at ~$39 billion compared to previous guidance of $40-$40.5 billion, and profit per share excluding restructuring costs guidance has been reduced to $3.25 from $3.55. Caterpillar is not expecting the challenges it is facing to disappear in 2017, and we can’t say we are either. Management does not expect a significant difference in 2017 performance compared to 2016 performance, and CEO Doug Oberhelman plans to retire in March 2017.

All things considered, not a lot has changed with respect to our outlook on the global industrial operating environment and how we’re playing it. The diversification of GE’s sprawling digital industrial portfolio provides ample downside protection in our minds (not to mention its dividend yield), and we love the upside potential that exists in its investments in clean energy and 3D printing, though the latter has come into question of late. The most recent quarterly report was a direct example of this diversification, as management reiterated its $2 per share earnings target for 2018, despite materially weaker performance from its ‘Oil & Gas’ segment than was anticipated in April 2015 when the target was initially set.

GE continues to be at the forefront of this generation’s version of an industrial revolution as the adaptation of digital capabilities in manufacturing spreads. With its financial segment no longer a material headwind during tough times of credit, GE’s dividend remains on solid ground, in our view, with a yield of ~3.2% and a raw, unadjusted Dividend Cushion ratio of 1.6. Our fair value estimate of GE is $32 per share, and we plan to keep the positions in both the Best Ideas Newsletter portfolio and the Dividend Growth Newsletter portfolio intact. The company’s performance, however, will continue to ebb and flow with the industrial and commodity cycle.

Conglomerates: DHR, GE, HON, MMM, SIEGY, TYC, UTX

Related: DE, XLI, RYCEY

3D Printing Related: VJET, MTLS, PRNT, DDD, SSYS, AA, PRLB, HP, EADSY