By Kris Rosemann

Shares of newsletter portfolios holding General Electric (GE) and its rival Honeywell (HON) took a hit early July 22 after both conglomerates indicated a more difficult operating environment in their second quarter reports.

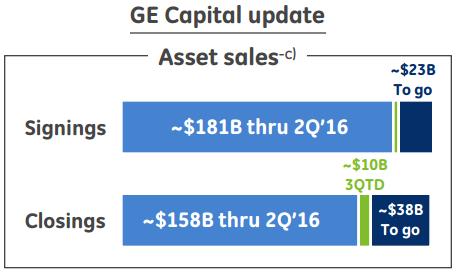

First, let’s address GE. The company has kept the momentum going in its GE Capital exit plan as it has now signed $181 billion in asset sales, completed its de-designation as a significantly important financial institution (SIFI), and closed GE Asset Management. In addition, the firm unloaded its GE Appliances business to Haier for $5.4 billion in the second quarter, a streamlining-oriented removal of a somewhat immaterial portion of GE’s overall business. We like what the progress in its exit plan and de-designation as a SIFI will do for GE’s financial flexibility.

Image source: GE earnings presentation

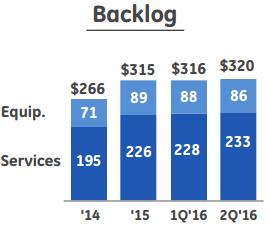

On the surface, GE reported a solid second quarter as a whole. Total revenues jumped 15% from the year-ago period to $33.5 billion, well above expectations, and its industrial margin expanded more than four percentage points on a GAAP basis. Strong performance in its non-GAAP measure of Industrial operating + Verticals EPS (65% growth) allowed the company to reaffirm its full-year guidance for the metric of a range of $1.45-$1.55. Most importantly, however, the firm’s backlog advanced 17% from the second quarter of last year.

Image source: GE earnings presentation

Nevertheless, it appears forward looking assumptions surrounding GE’s industrial-focused operations have been the source of investor concern. Though its backlog continues to climb, total orders fell 2% (partially buoyed by recently-acquired Alstom orders, services orders, and the growing GE Digital segment) in the second quarter from the year-ago period. Organic orders fell 16% in the quarter, as equipment orders were materially pressured by market weakness in its ‘Oil & Gas’ and ‘Transportation’ segments and its ‘Power’ and ‘Aviation’ segments’ reported order growth suffered from strong performance in the comparable period in 2015. Despite the weakness in its equipment orders, we love what we’ve seen from services orders at GE (up 9% in the quarter), which are the basis of its massive backlog and consist of attractive long-term contracts.

Honeywell shares have taken more punishment than GE’s following the release of their respective quarterly reports. The company revised its full-year sales guidance slightly lower to a range of $40-$40.6 billion from $40.3-$40.9 billion, representing core organic growth of ~1% compared to prior expectations of 1%-2% growth. This cut comes after sales grew ~2% in the second quarter on a year-over-year basis as weak demand in its ‘Performance Materials and Technologies’ segment and delays and completion problems in its ‘Aerospace’ business provided a drag on overall results.

Despite the reduction in revenue guidance for the year, Honeywell upped the lower bound of its earnings per share (ex-pension marked-to-market) guidance by five cents, resulting in a guidance range of $6.60-$6.70. Free cash flow guidance for the year was reiterated at $4.6-$4.8 billion as well, and the upper bounds of both of the above guidance ranges represent 10% from 2015. Operating margin expansion of up to 50 basis points will be a key driver in achieving such strong bottom-line results in the face of revenue pressure.

Honeywell also announced that it will split its ‘Automation and Control Solutions’ segment–a bright spot for the firm in the second quarter as sales advanced 9%–into two separate divisions: ‘Home and Building Technologies’ and ‘Safety and Productivity Solutions.’ Momentum in software-driven end markets and growth via acquisitions have caused the firm’s Automation and Control Solutions product portfolio to expand beyond the current construct of the segment. We view this as a prudent move that should allow the firm to more efficiently navigate changing end-market demand.

Though investors may not have been pleased with GE’s quarterly report, our thesis on the company is unaffected. The global industrial operating environment has not been a favorable one as of late, but we point to GE’s massive backlog as evidence that its businesses remain as durable as any other point in its 120+ year history. We think the company continues to make sense as a holding in both newsletter portfolios. There is still room for capital appreciation based on the $37 upper bound of our fair value range, and we love the shareholder-friendliness of management as it plans to return a significant amount of 2016 free cash flow and dispositions (targeted at $29-$32 billion) to shareholders via dividends (targeted at ~$8 billion) and share repurchases (targeted at ~$18 billion).

A slight blip in the GE’s orders hasn’t muddied the broader, brighter picture for us, and we’re going to keep milking this cash cow.

Related tickers: UTX, DOV