By Kris Rosemann

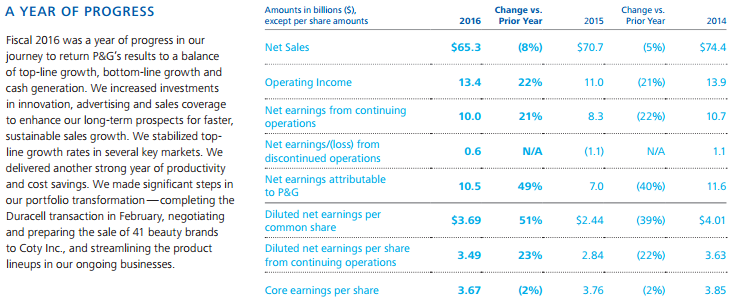

Procter & Gamble (PG) has been working through a massive portfolio transformation during the past several years, but with the last major step in the transformation taking place earlier this October, “Analyzing Procter & Gamble’s Exchange Offer,” the firm is preparing to retrain its focus on 10 categories where it holds leading market positions. We continue to hold shares of Procter & Gamble in the Dividend Growth Newsletter portfolio, even as we note the company is not what it once was after several years of revenue declines. Reported sales fell 5% in fiscal 2015 and another 8% in fiscal 2016, while both operating income and net earnings from continuing operations remain below fiscal 2014 levels.

We continue to give Procter & Gamble the benefit of the doubt as we monitor its business dealings. In the first quarter of its fiscal 2017, foreign currency exchange rates weighed on the consumer staples giant’s top line. Organic volume was up a healthy 3% from the year-ago period, as was organic sales, while all-in volume, which includes the impact of divestitures and lost sales, increased 2%, helping net sales on a reported basis come in flat when compared with the first quarter of fiscal 2016. That’s quite the improvement from prior-year trends, but still not stellar. In any case, organic sales grew in each of the firm’s five business segments, with ‘Health Care’ leading the way, and pricing impact was neutral on a company-wide basis.

Procter & Gamble’s core operating margin fared well in the quarter, increasing 20 basis points (120 basis points in constant currency), as core gross margin improvements driven by productivity cost savings and volume growth leverage were partially offset by currency headwinds and non-core restructuring charges. Core earnings per share increased a solid 5% to $1.03 in the quarter as a result, while currency-neutral core earnings per share leapt 12% on a year-over-year basis. However, free cash flow generation was pressured in the quarter as free cash flow productivity (free cash flow divided by earnings) fell to 85% from well over 100% in fiscal 2016 despite the boost in net earnings from productivity cost savings.

Relative quarterly disappointments in free cash flow generation and the pace of product price increases are not worth fretting about over for a company with a track record in both areas as strong as Procter & Gamble’s. These fundamental items, however, will be core factors in the firm’s investment proposition moving forward, as it is wrapping up its portfolio transformation and works to deliver more balanced top and bottom-line growth. Fiscal 2017 financial guidance includes organic sales growth of 2%, all-in sales growth of 1%, and core earnings per share growth in the mid-single digit range over fiscal 2016 core earnings per share of $3.67.

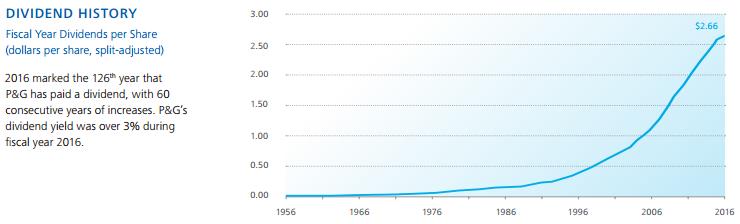

Shares of Procter & Gamble continue to trade above the upper bound of our fair value range, and we’re interested to see what November 18 holds for Procter & Gamble shareholders, as management has scheduled an Analyst Meeting in which it plans to update on its strategy. Our calendars are marked. We plan to continue holding shares in the Dividend Growth Newsletter portfolio, even if the company’s price may be a bit frothy, with the mindset that we could take profits should another idea surface. All-in though, we like the high-quality equity exposure shares of Procter & Gamble give us in the Dividend Growth Newsletter portfolio, and with shares are yielding over 3% at recent price levels, the company continues to be take interest from dividend growth investors. Procter & Gamble has paid dividends for 126 consecutive years, with 60 years of consecutive increases.

Images Source: http://www.pginvestor.com/Cache/1001215298.PDF?O=PDF&T=&Y=&D=&FID=1001215298&iid=4004124