By Kris Rosemann

Recent quarterly performance had some naysayers doubting the true power of Apple (AAPL). The second quarter of fiscal 2016 (calendar first quarter) marked the first decline in sales in a quarter in thirteen years due largely to pressure on iPhone sales, and the third quarter of the fiscal year continued the year-over-year sales weakness.

As Apple hosted its company event September 7, shares remained under pressure as many anticipated ongoing weakness in demand for the iPhone, even with a new iteration being introduced. The declines continued in the days immediately after due in part to the firm’s decision not to release first-weekend estimates of pre-order sales volumes. Management indicated that it believes the measure is a meaningless statistic and is confident that the iPhone 7 will sell out as first weekend sales levels are often predicated by supply and not demand.

Statements from mobile carriers Sprint (S) and T-Mobile (TMUS) have reinforced Apple’s confidence that its newest iteration of the iPhone would be well-received by consumers. Pre-orders of the iPhone 7 and 7 Plus increased nearly four times at Sprint compared to pre-order levels of a year ago. According to T-Mobile, first weekend pre-order sales came in at levels that “shatter all previous iPhone pre-order records at T-Mobile.” The firm also noted that order volume was about 4 times that of the next most popular version of the iPhone over the opening weekend, and iPhone sales on Friday, September 9 marked the record for single day sales for any smartphone it has ever offered. Shares have bounced after sliding into the first weekend of pre-orders for the iPhone 7.

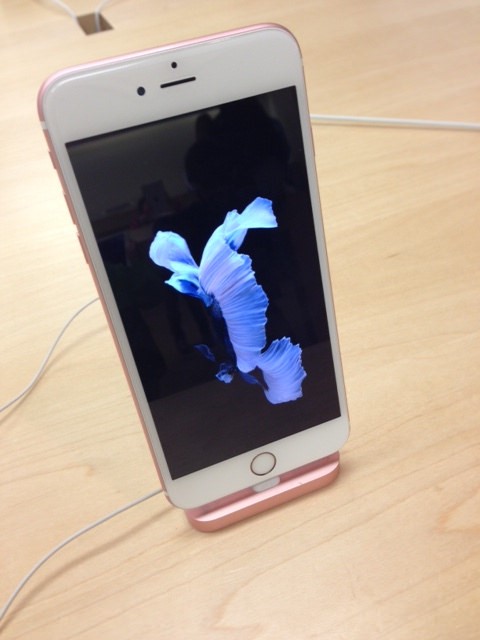

While it is important to note that the comparable weekend of 2015 was not a complete update of the iPhone–the iPhone released in September 2015 was the iPhone 6s and 6s Plus–the high levels of demand seen from carriers and on Apple’s own site should reinforce confidence in the brand strength of Apple. The firm was able to increase demand significantly for one of its versions of the iPhone 7 by simply adding a new finish for the phone. Orders for the ‘Jet Black’ model are currently pushed farther back than any other version of the new iPhones, a sign that Apple continues to be a form of a status symbol for consumers.

Apple continues to battle some negativity in its most recent upgrade of the iPhone as the removal of the headphone jack has created a stir amongst users and critics alike. The firm remains confident that consumers will adapt to the change and realize the benefits of using wireless ear buds, however. The iOS 10 has received its share of criticism as well, but Apple appears to be on top of the situation that has already caused some users headaches. Such a blip in the transition to a new operating system is not uncommon, and should not be seen as any sort of major setback at this point, in our opinion.

Even with the additional excitement surrounding the improved cameras in the iPhone 7 lineup, the apparent strong first weekend pre-order demand, and the new Apple Watch Series 2, perhaps one of the most important moves Apple made in the most recent roll out of its iPhone 7 series has to do with its choice of chip providers.

Apple traditionally has used exclusively Qualcomm (QCOM) modem components in past iPhones, but the firm has chosen to use Intel (INTC) chips in new 7 and 7 Plus models of the iPhone as well. The company has not done away with Qualcomm as a supplier, but instead has two different versions of the phones available. Some carriers are not compatible with Intel chips, including Sprint and Verizon (VZ), so keeping both on as suppliers makes sense in that vein. However, the move is far more strategic than carrier compatibility, as Apple has significantly reduced the leverage Qualcomm has over its supply chain. Apple now has increased bargaining power, something that could prove to be invaluable as it relates to the firm’s gross margins, which analysts continue to watch as it relates to pricing power and cost pressures.

While the longer-term implications of recent moves such as the addition of another modem chip supplier could turn out to be insignificant, we like the potential it has to reverse some of the negative narrative that has been following Apple in fiscal 2016. The apparent reinforcement of its brand popularity could ease concerns that outsize pricing pressure will persist in its flagship product, and hints of high demand have come at an opportune time as its main competitor Samsung (SSNLF) has been urging consumers worldwide to stop using the Galaxy Note 7s and exchange them as soon as possible as there has been widespread cases of exploding batteries.

All things considered, recent developments at Apple have been encouraging after months of volatility in shares. Management has reiterated its guidance for the fourth quarter of fiscal 2016 (ends September 30), which includes quarter-over-quarter revenue growth near the high end of Apple’s historical estimates. Our confidence in the firm remains high, and we currently value shares at $148, which are yielding ~2.1%.