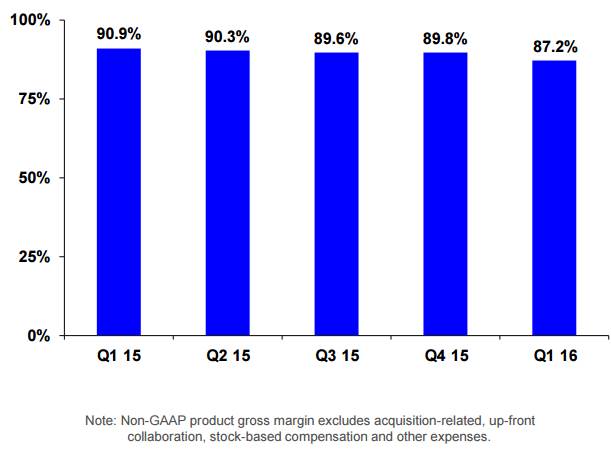

Shown: Pricing pressure continues to hurt Gilead’s gross margin; source: Gilead’s first-quarter 2016 presentation.

We’re still sleeping better at night knowing that we avoided the first-quarter blowup at Gilead (GILD), “Gilead Disappoints, Harvoni Sales Drop 16% (April 2016).” Sales of Harvoni in the US dropped like a rock from the year-ago period, and as Gilead throws away its cash at buybacks to bolster accounting earnings per share, no longer does it hold the balance sheet it once did. Sure, something can be said about having ~$21 billion in cash, but it kind of loses its luster matched up with a similar amount of liabilities, as is the case with Gilead. Remember – it’s net cash that matters. To a large degree, buybacks have obliterated the pharma giant’s once-fortress balance sheet, and the board keeps upping the ante with more and more buybacks as it whistles past the graveyard. We strongly suggest the executive suite take a hard look at the pace at which they are buying back their own stock, and whether it makes sense in the context of balance sheet erosion. The end game could very well be a substantially weakened balance sheet on substantially lower earnings and free cash flow in just a few years. That’s far from ideal. We think there needs to be more long-term planning and less near-term opportunistic thinking by top brass.

As Gilead’s Harvoni sales dip and setbacks continue to emerge in its pipeline, the latest in its oncology portfolio, “What Gilead’s Patent Miscue Means for Shareholders (March 2016)” any long-term thesis is making less and less sense — unless one truly has their heart set on the company overpaying for therapies via acquisition or uncovering the next viral cure in-house, the former very likely, the latter not so much. The reality is that buybacks and value-destroying acquisitions may very well set the stage for the next two years, as the company’s revenue-engine erodes after a huge growth spurt the past few years. Sure, one can expect some fits and starts as positive news regarding early-stage trials inevitably emerge from its pipeline, but commercial success of these drugs will be another story. Merck’s (MRK) release of Zepatier threw our thesis out the window, and we continue to believe Johnson & Johnson (JNJ) is a much better play than Gilead. We’d even pound the table on the view that J&J’s dividend is stronger, even as the company yields a much more attractive payout. Remember: “You Already Own Whatever Your Investment Will Pay You In Dividends.”

But what about Gilead’s single-digit price-to-earnings ratio? It doesn’t matter…really. Even as we say that Gilead’s shares are likely underpriced, the long-duration nature of our free cash flow model makes predicting the pricing environment and magnitude of demand for a hep-C cure 5-10 years out a very difficult proposition, or perhaps put more bluntly, one saddled with substantial forecasting risk. A single-digit forward price-to-earnings ratio doesn’t necessarily mean that Gilead is the buy of a lifetime, but instead it probably more appropriately implies that there is an incredible amount of risk related to the intermediate-term or long haul, perhaps best defined as the growing likelihood of hep-C related revenue being truncated, or at least materially reduced at some future date. Don’t fall into the price-to-earnings ratio trap – there’s enough misinformation around, read this: “Understanding the Price-to-Earnings (PE) Ratio.” Once you do, you’ll never look at valuation the same way again.

No stock is ever a perpetual buy and no stock is ever a perpetual sell, and there will be a price when Gilead becomes attractive…again. For the Valuentum investor, that will be the price far below the low end of our fair value range on strengthening technicals, or said differently, when Gilead is an undervalued stock with good momentum, more commonly known as a Valuentum stock. Think about it: Merck’s Zepatier is priced at $54,600 per regimen, below AbbVie’s (ABBV) V-Pak of ~$83,000 and Gilead’s Harvoni of $94,500. Though the Merck trial verdict played a role, product gross margins only dropped 4 percentage points in the first quarter of 2016 at Gilead, but Merck’s Zepatier is priced at ~60% of that of Harvoni! There’s more erosion to come, perhaps not wholly felt until a few quarters from now, in our view. Do Gilead investors finally have to face the music? Has the stock run its course…for now? What’s your long-term thesis? Overpaying for acquisitions and a longshot in the pipeline? Really? Merck has changed the game.