The above is a trailing 15-month chart of the broad market index, the S&P 500 (SPY).

As you can see, the markets have gone nowhere fast. The fallout in the energy complex coupled with emerging market uncertainty and political unrest in the US is making for quite the choppy market environment. Interestingly, however, since the middle of last year, the Best Ideas Newsletter portfolio has quietly been distancing itself from this broad market benchmark, as strong performance from constituents coupled with a larger cash position in a generally weaker market have paid off.

Where indexers focus on controlling costs instead of focusing on generating strong returns with relatively low turnover (and commission and tax implications), the strategy powering the Best Ideas Newsletter portfolio continues to offer a viable alternative to traditional indexing, which is becoming a larger and larger component of the equity markets with each passing day. As more and more money chases average benchmark returns, by definition, the potential “alpha” generated by well-supported active strategies will become easier and easier to attain (good for active managers). I always like to say that the best way to guarantee that you’ll trail the market’s return every year is to buy into a “pure” indexing strategy. After fees, it is the only guaranteed loser. Why other active strategies fail is none of our business.

We think one of the more savvy moves recently implemented in the Best Ideas Newsletter was the round-trip move in Kinder Morgan (KMI). Many of you are following our moves with this company very closely as a result of our widely-documented and high-profile call at $40 that shares would collapse. Part of the reason why we’ve layered Kinder Morgan into the Best Ideas Newsletter portfolio is to capture an incrementally positive risk-reward in an energy complex that has finally breathed a sigh of relief as crude oil prices rallied the past several weeks. With the Energy Select Sector SPRD (XLE) included in the Best Ideas Newsletter portfolio and now Kinder Morgan, we’re ready for whatever the volatile energy markets may throw at us. If energy equities continue to bounce, that’s great. If the performance of energy stocks continues to be ugly, however, we have considerable diversification with the Energy Select Sector SPDR, and with most of the bad news already public at Kinder Morgan, shares should be more resilient. We can’t help but feel the executive team at Kinder Morgan had a good talk with the team at Berkshire Hathaway (BRK.A, BRK.B), now a holder of shares.

For those members just getting familiar with Valuentum, we actively manage two portfolios in two distinct newsletters, the Best Ideas Newsletter and the Dividend Growth Newsletter. Each is designed to meet their respective goals, but of course, no guarantees can be made to that end. We release the Best Ideas Newsletter on the 15th of each month and the Dividend Growth Newsletter on the 1st of each month, both delivered by email from our info@valuentum.com account (and both available for download on the website). The email transaction alerts regarding newsletter portfolio holdings are also sent from the ‘info’ email account, so be sure that your system is not blocking emails, sending them to the junk folder. We cover over 1,000 stocks in the form of 16-page reports and dividend reports, all accessible on the website, and we comment on even more, so it is not feasible for us to send all of our information out via email. Please be sure to visit the website on a daily basis, as we are frequently publishing content. If you haven’t seen our Ideas100, Dividend100, and DataScreener products, be sure to let us know.

There’s one question that comes up a lot, and I thought it would be good idea to include it in this edition of the Best Ideas Newsletter portfolio. What stocks should you buy right now? First of all, we can’t answer that question for you. One stock may be appropriate for someone, while it may be inappropriate for another. We can only tell you what we do in the newsletter portfolios, and what goals we’re seeking to achieve. The best way to assess the Best Ideas Newsletter portfolio is if it were a mutual fund. All of the holdings are constructed to achieve goals, and together, form a portfolio targeting a strategy. Though each idea in the newsletter portfolios is one of our best, readers should not expect every individual idea to excel without fail. For one, we may make tactical decisions in the portfolio context (e.g. put options on the market) that may make little sense on an individual basis. It’s important to note that the “next” idea we add to the newsletter portfolio may be the “best fit” for the portfolio, but may not be the best idea on a standalone basis. That idea could very well already be in the newsletter portfolios.

As for our general views on the market, we’re still very cautious. We can’t ignore the carnage in energy, that governments around the world are pursuing negative interest rate policy to prop up economies, that the high-yield default rate is expected to surge in coming periods, that emerging currencies such as the South African Rand are reeling, that Brazil may be entering its worst recession in 100 years, that China’s economic growth is slowing, that American politics could derail drug pricing, reshape the healthcare and insurance industries (again), and that geopolitical uncertainty from North Korea to Iran and beyond continues to dominate headlines. Of course investors should stick to the fundamentals, the earnings and free-cash-flow generating power of companies in their portfolio, but valuations are still stretched. According to FactSet, the S&P 500 is trading at 16+ times forward earnings, a full 2 “turns” higher than its 5-year and 10-year averages (~14-14.5x), with steady-eddy consumer staples entities trading at a whopping ~21 times forward numbers, approximately 4 “turns” higher than its 5-year and 10-year averages (~16.7-17x). The dividend growth craze is fueling the outsize multiple in consumer staples stocks; some income growth investors aren’t even paying attentions to share prices anymore – their focus is only on the income stream and yield.

Just as in every bubble before it, once investors start valuing things on a basis other than earnings and free cash flow bad things happen. Whether it was the tulip bulb craze (status) or the dot-com bubble (number of eyeballs) or the housing bubble more recently (unsustainable comps), the air eventually comes out. What we’re witnessing today across income-oriented equities can be explained by the ultra-low interest rates around the globe, but many prices on income-growth stocks have become disconnected from their intrinsic value. Asset flows may continue to pour into these stocks, however, and the companies themselves are buying back their own stock in droves. Bloomberg, for example, recently reported that S&P 500 constituents will repurchase $165 billion in the first quarter of 2016, the highest since 2007, while “clients of mutual and exchange traded funds…are on pace for one of the biggest quarterly withdrawals ever.”

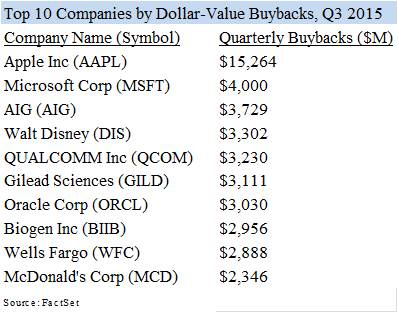

Are corporate buyers the foundation of this market? What happens when they stop buying? What most may be overlooking is that corporate buybacks themselves aren’t always great either. For repurchases to be value-creating for shareholders, the company’s share price would have to be below a discounted cash-flow-derived intrinsic value estimate. Underpriced firms such as Apple (AAPL) and Microsoft (MSFT) have been leading the charge with buybacks and we generally like their repurchases on the basis of their price-fair value comparison, but many of the companies with the largest share buyback programs are certainly not cheap. In the cases of McDonald’s (MCD) and Walt Disney (DIS), for example, buybacks are destroying shareholder capital. McDonald’s is trading at 20x fiscal 2017 earnings – that’s earnings for the trailing 12 month period approximately 20 months from now! We have an article that walks through why not all buybacks (PKW, IPKW, SPYB) are good for shareholders in this edition of the Best Ideas Newsletter.

We’ve included Part I of my pending three-part annotated commentary of Berkshire Hathaway’s recently-released 2015 annual report in this edition of the newsletter, and I think we’re off to a good start. Please be sure to check back to the website in coming days for the subsequent editions. On the basis of some of the recent technical strength at Berkshire, we’re considering taking a bite out of shares should markets remain strong, but we’ll talk more about this more in subsequent parts of the annotated commentary, to be published on the website soon. We put together a similar-type annotated commentary on Berkshire’s 2014 annual report in the April 2015 edition of the Best Ideas Newsletter, and we’ll continue to build year after year. By the way, the archived newsletters are a great resource of the evolution of our thinking over time, and I can only encourage you to read through them. They can be found on our website at any time.

Many of you are aware that we’ve been following Chipotle’s (CMG) fall from grace, and while the troubles are hardly behind it, the company’s stock has been acting quite well, and we think it may be a precursor to some comparable-store sales stabilization. At the core, Chipotle’s shares aren’t necessarily cheap and its technicals aren’t fantastic, but there’s something appealing about considering the purchase of a fantastic franchise at nearly a “fair price.” On very few occasions, especially in this overheated market, have we been able to find brand new ideas that are trading at vast discounts to intrinsic value that would augment the existing composition of the newsletter portfolios. This is partly why we continue to watch “fairly-valued” Chipotle with tremendous interest. The equity could also serve as a nice “beta” addition to the Best Ideas Newsletter portfolio in the event broader equity markets “test” new highs again.

As many of you are also aware, we’ve been watching shares of Netflix (NFLX) closely. We haven’t yet pulled the trigger on this “put option” idea, but the company’s valuation won’t stand up over the long haul, in our view, but that won’t stop aggressive growth investors from piling into the stock. Trust me, when growth metrics at the company break down, shares will collapse in a heartbeat. Though we may be spectators for some time yet, the best opportunity for our consideration of Netflix put options in the Best Ideas Newsletter portfolio may rest in the back half of the year, once the excitement surrounding Making a Murderer dies down. The market will soon start looking at difficult year-over-year comparisons, the likelihood of it creating more blockbuster original content, and why economics of its international growth prospects may not live up to profit expectations over the long haul. As easy money continues to “slosh” around, Netflix’s business model continues to be quite replicable for the next “big idea,” in our view, and given its somewhat sparse digital content film library, Netflix doesn’t have much that others can’t replicate with marketing dollars.

We haven’t forgotten about our open letter to Yahoo (YHOO), but anybody that knows this business knows that Yahoo is essentially an asset management firm and that Starboard wants the company for the financial flexibility that is offered via Alibaba (BABA) shares, at least from our perspective. In our open letter, we gave CEO Marissa Mayer a clear path to allow Yahoo to thrive in its current form, grow jobs, generate gobs of free cash flow and generate tremendous economic value via a combination with eBay (EBAY). We think Yahoo should do the deal and grow the combined entity into an Internet powerhouse. It can’t be a holder of Alibaba shares forever, and building an e-commerce giant may be the path forward for yet another combination in coming years. In good conscience, we continue to believe this is the right thing to do for all stakeholders. Don’t break up the company Marissa, Ken.

This March edition of the Best Ideas Newsletter, as with the editions before it, is jam-packed with forward-looking content and analysis. I hope you enjoy reading about our take on Intel’s (INTC) future, why we’re now bullish on Kinder Morgan, a looming threat across the airline space, and how the Dividend Cushion ratio helped to predict turmoil in the potash markets. And how can we forget about Medtronic’s (MDT) expected free cash flow generation – simply incredible! We’re always available for any questions. To health and happiness!

The March edition of the Best Ideas Newsletter will be released March 15, as originally scheduled.