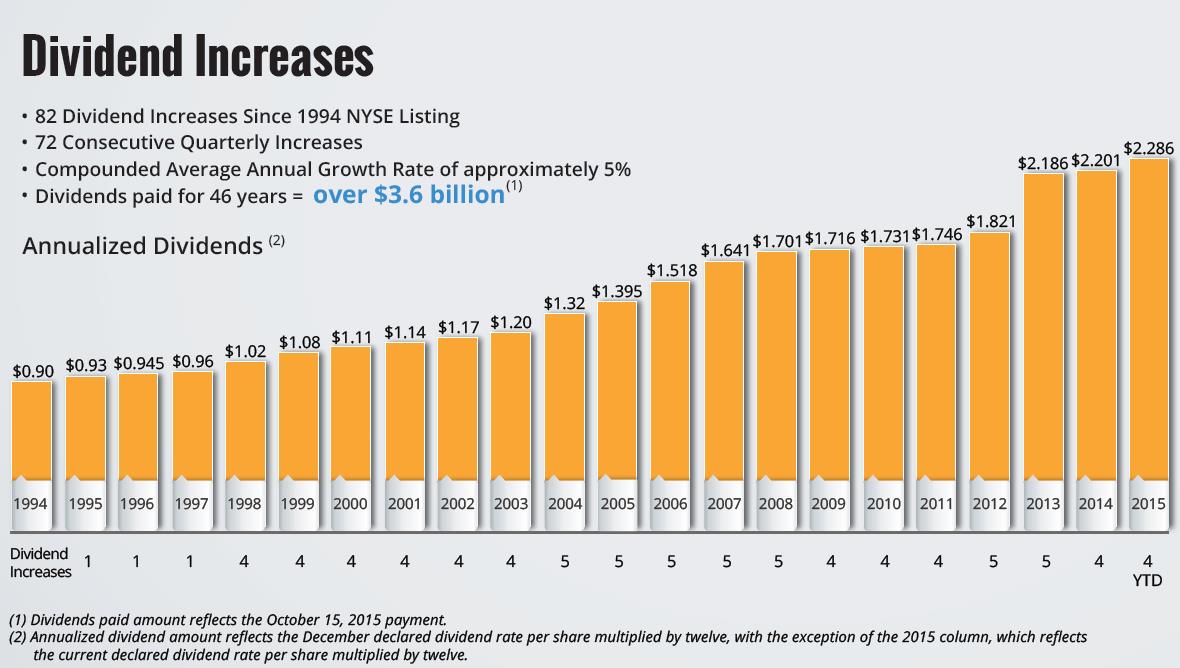

Realty Income’s (O) Dividend Track Record

Pictured: Income investors in Realty Income have been handsomely rewarded through the years. Source: Realty Income

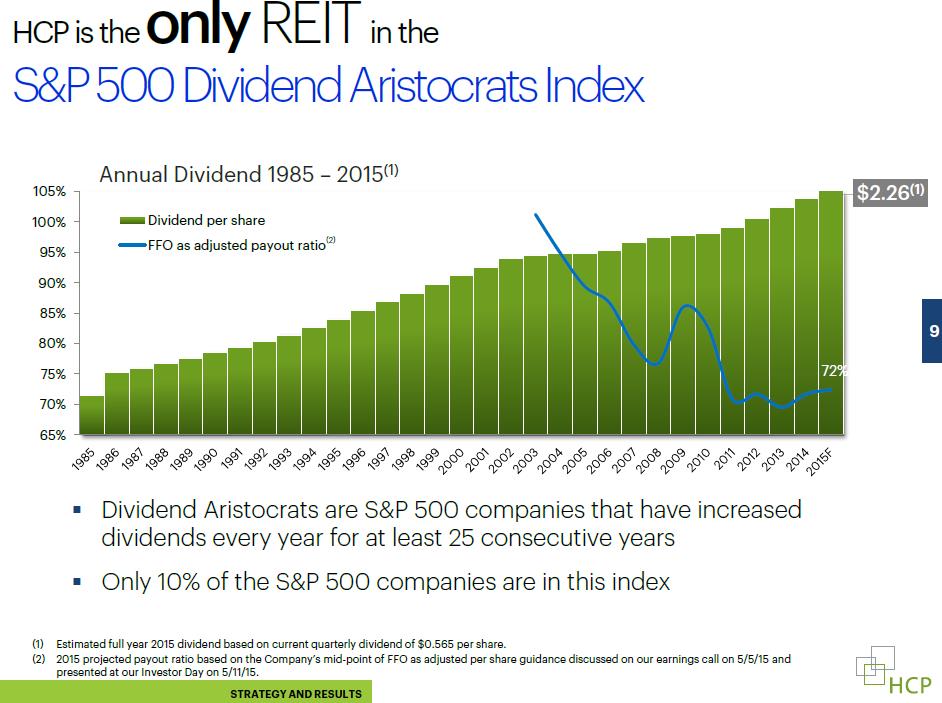

HCP’s (HCP) Dividend Track Record

Pictured: HCP has rewarded income investors in each of the past 30 years with consecutive annual dividend increases. Source: HCP

Let’s Talk Interest Rates

There’s a lot to think about these days with respect to REITs and rising interest rates.

In the equity valuation context, for one, a rising nominal interest rate, by itself, is negative. Increased borrowing costs translate into a higher discount rate applied to a REIT’s future projected net operating income (or a higher cap rate used in the valuation process), and by extension, results in a lower intrinsic value (fair value estimate) of the REIT on a universal level, all else equal.

REITs are not immune to this law of valuation.

A rising interest-rate environment, however, doesn’t occur in a vacuum. The conditions that result in a tightening credit cycle often signal increased economic stability or strength, real rent increases, higher occupancy levels and robust net operating income expansion. These positive factors, in turn, may mitigate the negative impact that a higher discount rate may have on a REIT’s intrinsic value altogether.

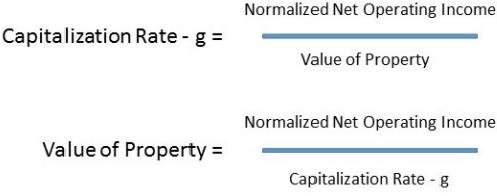

REITs can be appropriately valued within the context of a growing perpetuity equation, which factors in increases in normalized annual net operating income. Similar to applications in equity analysis, in a growing perpetuity equation, the denominator with respect to REIT valuation reflects the cap rate (discount rate) less the growth in annual net operating income. The impact on REIT valuations through the course of the interest rate cycle can most appropriately be explained by changes in the relationship between these two variables in the following function: cap rate – g.

For example, if incremental required rates of return, as measured by the cap rate, increase (in the event of rising interest rates) by a magnitude that is larger than the corresponding incremental increase in the normalized growth of net operating income driven by a strengthening economy, for example, the denominator gets larger, and the value of the REIT (property) will fall. On the other hand, if incremental required rates of return, as measured by the cap rate, increase (in the event of rising interest rates) by a magnitude that is smaller than the corresponding incremental increase in normalized long-term growth of net operating income, the denominator gets smaller, and the value of the REIT (property) will rise.

Equity values of REITs can theoretically increase in a credit tightening cycle that is slow, steady and properly managed, as long as the pace of net operating income expansion exceeds the incrementally higher required returns demanded by investors. Slow and steady rate hikes appear to be the environment that the Fed is promising during the back half of this decade, which is why we’re sticking with some REIT exposure in the Dividend Growth Newsletter portfolio. We’re not going overboard, however, and we’re sticking with the two best, the two that have the most to lose, in our view, from a dividend cut.

Realty Income: The Monthly Dividend Company

Realty Income, or the “Monthly Dividend Company” as the REIT calls itself, has a strong company philosophy, one of the reasons we are comfortable holding a small position in the firm in the Dividend Growth Newsletter portfolio despite its reliance on the capital markets to support its dividend.

The REIT actively manages its real-estate portfolio to grow its cash flow to distribute monthly dividends to shareholders. This is the company’s main draw; it is the most widely recognized monthly dividend payer on the market today. Its track record only supports its case, as it has increased its monthly payout in 72 consecutive quarters.

Realty Income has had success through the execution of long-term lease agreements–its weighted average remaining lease term at the end of the third quarter of 2015 was 10.1 years–which allows it to hold properties for long-term income production. This reliable revenue stream is one of the factors that enable the REIT to pay a consistent and growing dividend. These long-term leases facilitate the growth of existing relationships and more investment opportunities through those existing relationships.

To that point, Realty Income has a lengthy list of existing relationships. Its portfolio has significant geographic and customer diversity; the firm has 4,473 properties in 49 states with no state accounting for more than 10% of all rental revenue, and its largest client–which happens to be Walgreens (WBA)–makes up only 7% of total rental revenue. Further strengthening its portfolio is the fact that 44% of clients boast investment-grade credit ratings.

The REIT also has a solid lease rollover history. Since 1996, Realty Income has re-leased or sold over 2,000 properties upon the lease expiration. In the first three quarters of 2015, the firm has resolved 221 expiring leases in the form of 189 leases being resigned by the same tenant 32 properties being leased to new tenants, resulting in the recapture of 101.5% of expiring rent.

Through the first nine months of 2015, Realty Income has grown its revenue by nearly 11%, to ~$760 million. While the company’s occupancy rate has been flat at 98.3%, its economic occupancy, as measured by rental revenue, increased 20 basis points, to 99.3% from the same time a year ago. Same-store rents in the first three quarters grew by more than 1%, demonstrating ongoing pricing resiliency. The REIT’s bottom line grew in the period as well, as adjusted funds from operations (AFFO) per share advanced 7.3% to $2.06 on a year-over-year basis.

Realty Income continues to invest in high-quality real estate opportunities. In the first nine months of the year, the firm acquired $1.1 billion in new properties. These properties have a 100% occupancy rate, a weighted average lease term of ~16.7 years, and approximately 50% of the rental revenue generated from the properties acquired thus far in 2015 is from tenants with investment-grade credit ratings.

Looking ahead to the rest of the year, Realty Income expects to spend $1.25 billion in real estate investments for the full-year 2015. Management also raised and tightened its AFFO per share guidance after the third quarter to a range of $2.72-$2.74, up from $2.69-$2.73. For 2016, the firm anticipates AFFO per share to be in a range of $2.85-$2.90, representing continued solid growth in its operations.

Though we cannot fail to mention the inherent risk associated with the company being a REIT and the impending interest rate hike, we fully expect to continue holding the company in the Dividend Growth Newsletter portfolio and to continue reaping the benefits of its consistent and growing monthly dividend payout.

HCP Continues to Battle Uncertainty

HCP continues to be a lesson learned to us here at Valuentum.

The firm’s dividend track record had far too high of an influence on our decision making in establishing a position in the REIT in the Dividend Growth Newsletter portfolio. The fact that the company is the only REIT included on the list of Dividend Aristocrats was too attractive for us to deny, and we believe many investors feel the same way. This has been an important lesson learned, as we’re going to remain laser-focused on future fundamentals, where we’ve given great weight in every other case.

Since its addition to our Dividend Growth Newsletter portfolio, HCP has been an underperformer; there’s no way around it. One of the major factors in this underperformance has been the uncertainty surrounding the REIT’s largest tenant HCR ManorCare. HCR ManorCare is currently the subject of an ongoing investigation by the U.S. Department of Justice, the Department of Health and Human Services, Office of Inspector General, and certain state attorneys general offices for what amounts to fraudulent uses of Medicare. We highlighted the risks associated with the situation in this June piece, and there have been relatively few new developments since then.

As part of its plan to avoid the inherent risks associated with the HCR ManorCare investigation and to help account for the reduction in the tenant’s master lease, HCP plans to sell 50 non-strategic HCR ManorCare facilities. In the third quarter of 2015 the firm sold 12 of said facilities for a total of $130 million. Also related to HCR ManorCare was the $27 million, or $0.06 per share, impairment charge HCP recorded in the quarter related to the firm’s 9% equity ownership in HCR ManorCare. HCP cited a recent review of its tenant’s operating results, and market and industry data show a declining trend in admissions from hospitals at HCR ManorCare and “continuing trends” in mix and length-of-stay driven by Medicare Advantage and other managed-care plans.

Though the review led to an impairment charge, which has reduced the carrying amount of HCP’s equity investment in HCR ManorCare on the balance sheet, HCP is confident in its tenant’s ability to continue paying its current master lease obligations. For the trailing 12-month period ended September 30, HCR ManorCare’s normalized fixed charge coverage ratio was approximately 1.25x, when considering the master lease amendment and completion of facility sales. When not considering any benefit from the asset sales, the coverage ratio stood at 1.11x. We’re keeping a watchful eye on this situation.

HCP increased funds from operations (FFO) as adjusted 5% in the third quarter on a year-over-year basis to $0.79, but net income was more than halved to $0.25 per share from the year-ago period. Funds available for distribution (FAD) grew 3% in the quarter to $0.67, which was sufficient in covering the firm’s planned quarterly dividend of $0.565. HCP’s payout appears to be on solid ground, but uncertainty surrounding its major tenant HCR ManorCare has muddied the waters a bit, near the point to which we’re growing uncomfortable.

Along with its quarterly results, management changed its FFO as adjusted guidance for the full-year 2015 again. This marks the third time management has changed its guidance range in the year (lowering it, increasing it, and then lowering it again). The firm’s original FFO as adjusted guidance was a range of $3.15-$3.21 and was lowered after the news regarding the investigation of HCR ManorCare, only to be raised to within a penny of the original guidance after the end of the second quarter ($3.14-$3.20). The company now expects FFO as adjusted to be in a range of $3.12-$3.18 for the full year. We’re not sure management has a great handle on the recent developments in its business, and this has us quite concerned. FAD was also revised downward from the second quarter of 2015 to a range of $2.66-$2.72.

Given the developments thus far in 2015, our outlook on HCP has understandably become more cautious. Though we like the REIT’s fundamental strengths and its diverse portfolio–it has more than 1,100 properties–a large portion of its revenue, and ultimately cash flow, has become more unpredictable, making its dividend prospects more unstable. For those that know us well, this is certainly not a typical characteristic of a holding in the Dividend Growth Newsletter portfolio. We’ve given the company the benefit of the doubt up until now, but its equity performance is telling us a different story.

At less than 2% of the Dividend Growth Newsletter portfolio, however, we’re going to continue to wait out the storm, as we think management won’t give up its dividend growth track record without a die-hard fight. Shares currently yield 6%, and while the following may seem somewhat counterintuitive, we may “consider selling” if shares approach the 6.5%-yield threshold. At that level, the market, from our perspective, would implicitly be factoring in a potential dividend cut by this Aristocrat, and we certainly don’t want to stick around for that. We’re viewing HCP as a source of cash, and removing the firm may happen sooner than later.

REITs – Healthcare: HCN, HCP, HR, LTC, OHI, UHT, VTR

REITs – Retail: DDR, DLR, EQY, FRT, GGP, KIM, MAC, O, REG, RPAI, SKT, SLG, SPG, SRC, TCO, WPC