A myopic view on the energy sector may lead one to ask the question whether the distributions of energy master limited partnership are safe. A broadminded view would answer that question in two words: absolutely not.

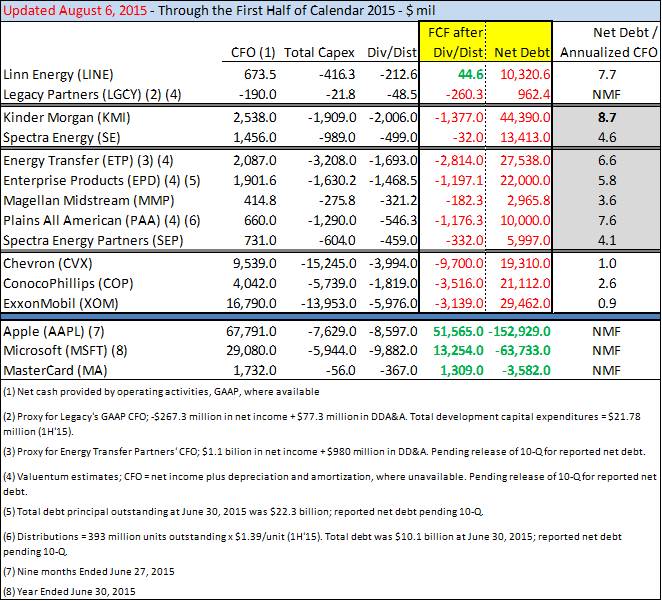

Through the first six months of 2015, almost every energy-related MLP has spent more in total capital expenditures and distributions than they generated in cash flow from operations. Business models with financials such as these cannot be sustainable over the long haul without infinite access to capital via the debt or equity markets. We learned that housing prices don’t always go up (and that they can fall on a national scale) during the Financial Crisis, and we’ll eventually learn that debt-infused business models that collectively spend more in capital and dividends than they generate in operating cash flow have limits, too.

From our point of view, dividend safety stems from significant free cash flow generation, as measured by cash flow from operations less all capital spending, and a pristine balance sheet that is flush with net cash. The financial structures of MLPs offer investors distribution risk, not distribution health. A view of the dichotomy we speak of is evident in looking at financial performance of asset-light, cash-rich entities such as Apple (AAPL), Microsoft (MSFT), and MasterCard (MA), as shown in the table above. If investors are truly looking for strong cash-flow generation and pristine balance sheets, such a combination that translates to dividend health is simply difficult to find within the energy sector.

We’re starting to see cracks in the business models of MLPs. Literally.

The Plains All American crude oil spill near Santa Barbara, California has garnered a fair share of news as of late, and it has become apparent that the pipeline was not in proper operating condition. The entity has reported that it will incur a net charge of $65 million in its second quarter related to the incident ($257 million in total offset by $192 million in insurance), but in its second-quarter earnings call, management stated that it would not raise its maintenance capital expenditures in 2015. This comes even after a second, smaller spill took place in southwest Illinois.

Plains All American (PAA) is not the only major pipeline operator to have its infrastructure fail in recent months. Most recently, Kinder Morgan (KMI) had a natural gas pipeline rupture—not its first major infrastructure failure this year–sending thousands of pounds of highly volatile gases into the air in rural Texas, and Energy Transfer Partners experienced a much larger natural gas rupture accompanied by a fireball shooting into the Texas countryside in mid-June. Despite these recent events, the companies have done little in their quarterly reports to acknowledge the developments, let alone plan an increase in maintenance spending to ensure they or a more serious event–like this one in 2010–do not happen again.

Investors like to champion the low maintenance requirements of pipeline operators, but are pipelines truly low maintenance? Or are operators just not spending enough to prevent such disasters? Our view is that investors really don’t know the quality of the assets in the ground, and we fear that they’re holding aged infrastructure in need of massive reinvestment in coming years. The events of just the past few months support this view.

Plains All American shocked MLP investors when it said on its second-quarter conference call that it may have to potentially defer distribution growth until 2017. The MLP had been targeting 7% distribution growth in 2015 (now 6%), but its $660 million in cash flow from operations through the first half of 2015 was far less than the near ~$1.3 billion in capex and ~$550 million in distributions it paid during the same period. Only Kinder Morgan has both a greater cash shortfall during the first six months of the year and more leverage on the balance sheet (net debt/annualized CFO). If Plains All American will have trouble sustaining a high-single-digit pace of distribution growth over the next two years, we think Kinder Morgan’s plans to fund 10% annual growth in its dividend through 2020 is a pipe dream.

We second Plains All American’s “desire to inject caution.” From our perspective, Linn Energy (LINE) changed the game MLPs were playing. Not only was Linn one of the only MLPs, if not the only MLP, that generated positive traditional free operating cash flow less distributions paid during the first half of 2015, but it was the only one on this list that suspended its distribution! We reiterate our opinion that the artificial valuation paradigm centered on debt-infused financially-engineered dividends won’t last, and we think bankers have already started to tighten the noose on overleveraged entities as losses on debt paper across the energy sector mount.

There is a limit to an entity’s debt capacity, and we’ve already passed it in this cycle with respect to most pipeline operators, in our view. The MLP business model is weakening, much like the walls of their failing pipelines, and we think the equity fall-out has only started to begin. Investors simply don’t know the quality of the assets in the ground, and the operators’ financials aren’t much to speak of in light of much safer dividend growth opportunities elsewhere. We prefer organically-driven dividends, not financially-engineered ones. Buyer beware.

Kris Rosemann contributed to this article.

Pipelines – Oil & Gas: BPL, BWP, DPM, ENB, EPD, ETP, EVEP, HEP, KMI, MMP, NS, PAA, SE, SEP, WES, WMB