Source: US Department of Labor, Walmart

Walmart (WMT) is quite savvy. The big box retailer announced February 19 it would raise the minimum wage for all of its US workers to $9 per hour in April of this year and at least $10 per hour by next February. The move comes amid ongoing public scrutiny of its labor practices, elevated worker turnover, and general malaise among the ranks on social media platforms. At face value, the news headlines show Walmart caving to public pressure, and a win for big labor, but in reality, the retailing giant is merely doing what good businesses do – pleasing customers (which are its workers, too) and widening its economic moat.

Hiking wages accomplishes both.

By our estimates, Walmart will experience a negligible negative monetary impact from this act of “goodwill” that will affect several thousand of its employees. In fact, the effect may actually be a positive one. In a job market where skilled and dedicated labor is becoming more difficult to find, in hiking wages, the company will be better able to keep its best talent, and perhaps reduce training costs from the resulting lower turnover. The cost of a job position isn’t only measured in the wage for that position, but in all the time that supervisors spend in training the person for that role. Costco (COST) has put this concept into practice for some time, using higher wages to build worker loyalty, thereby reducing hefty recurring training costs.

Hiking minimum wage also widens Walmart’s economic moat. Walmart knows its greatest competitive advantage rests in scale and purchasing power, and the way to ensure such dominance long into the future is to make it prohibitively more expensive for new entrants to achieve the same thing. If federal lawmakers use Walmart’s expected future wage hikes as the baseline for new federal statutes governing minimum wage, franchisees and small businesses across the country may feel irreversible pain. The only ones that lose in this game are the small mom and pop businesses that can’t afford higher labor costs, or the start-up that can no longer compete due to its higher marginal cost curve. Innovation and competition are therefore stifled as the mandatory minimum wage is hiked.

But it’s only a few bucks per hour, right? How much could it possibly hurt?

A lot. One doesn’t have to look very far today to see disgruntled workers picketing and “striking” for $15 per hour wages, and it’s possible we may eventually get to a mid-teens minimum wage this decade, if not, the next. The strength of labor today has probably never been stronger given dislocations brought about by the Great Recession. Workers are staying in the job market longer, and as a result, millennials, disgruntled by the lack of opportunities, are resorting to social movements to alter the course of their wage profiles. Though employment levels are “full,” underemployment (employees not working a job in their field of expertise, for example) is still rather elevated.

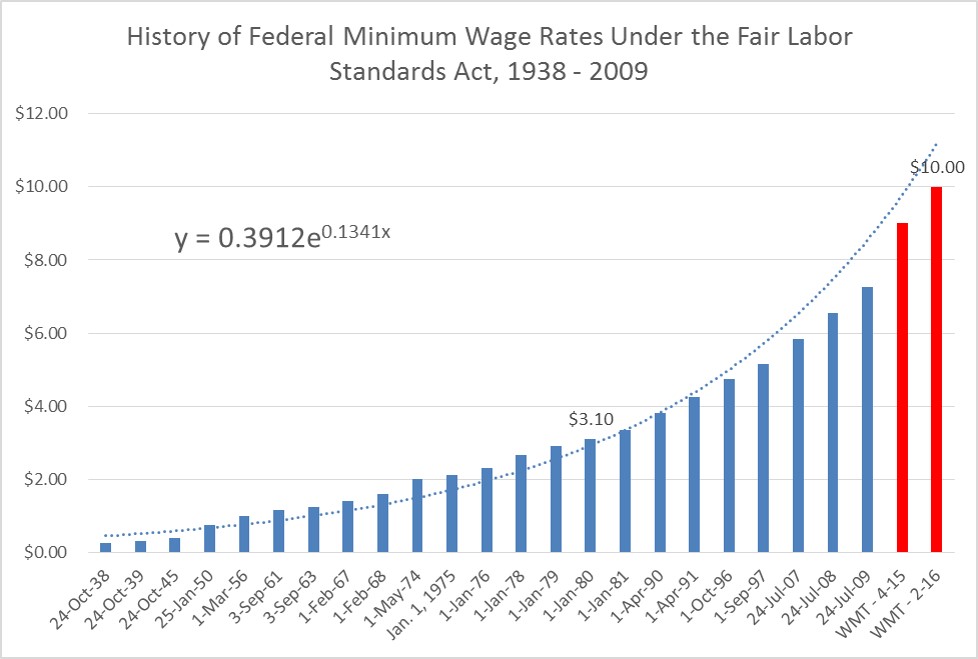

If increases in the minimum wage since the adoption of the Fair Labor Standards Act in 1938 truly fit an exponential curve going forward as they have in the past, we simply haven’t seen anything yet. Real inflation-adjusted minimum wage increases over the next 75 years or so will be staggering, and only then will we see the frightening path of labor costs that Walmart has set. If lawmakers choose to use its trajectory as a guide, restaurants and merchandise retailers and beyond will certainly feel the impact in the many decades ahead (and during the troughs of the economic cycle), even if they are spared of profit pressure during good times.

Only those entities with the strongest pricing power are best equipped to navigate such a market environment, and we’d only expect bigger companies to “get bigger” as entry barriers become incrementally more difficult to overcome for greenfield start-ups as a result of the higher labor expenses.

Food Retailers: CASY, COST, CVS, GNC, KR, RNDY, SWY, SVU, SYY, TGT, UNFI, VSI, WBA, WFM, WMT