Leading aluminum and alumina producer Alcoa (click ticker for report: ) posted decent third-quarter results Tuesday afternoon. Revenue declined 1% year-over-year to $5.7 billion, modestly above consensus estimates. Earnings per share, adjusted for special items, surged to $0.11 from just $0.03 during the same period a year ago. Free cash flow during the quarter was negative $36 million, a $3 million improvement year-over-year.

Focus on Cash Management

Image Source: AA

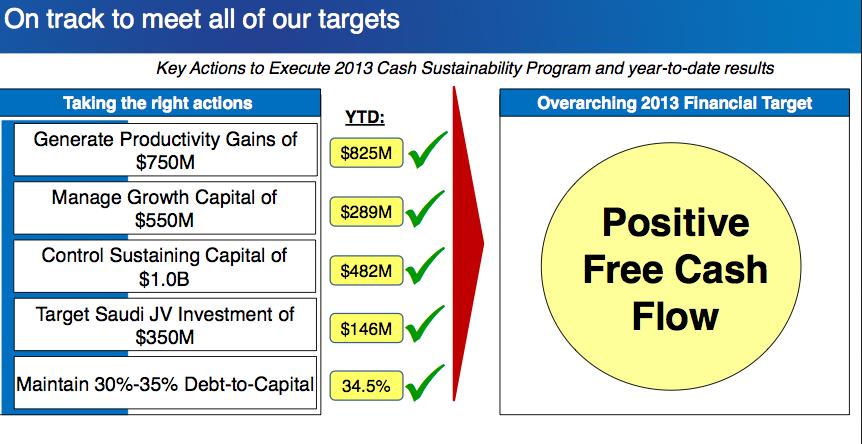

In our view, an owner’s earnings aren’t found on the income statement, but rather on the statement of cash flows. Alcoa agrees, and as such, the firm has focused extensively on improving its cash operations, targeting breakeven performance in seasonally-weak quarters. Thus far, Alcoa has achieved better-than-anticipated productivity gains while avoiding spending too much on capital investment.

Aerospace Lifting Engineered Products & Solutions

Image Source: AA

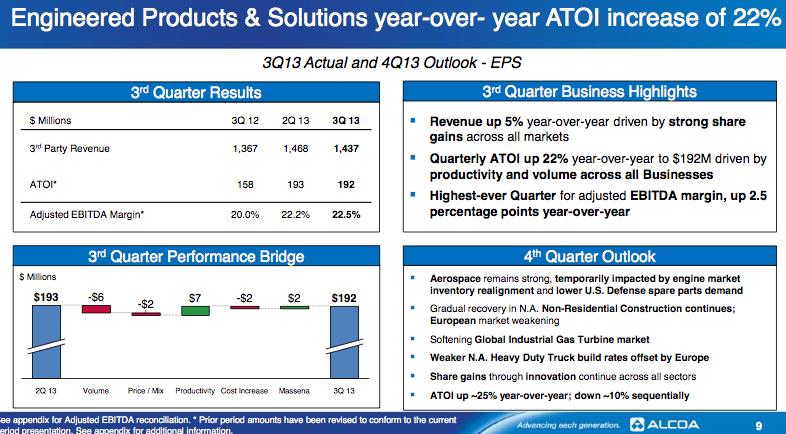

The firm’s ‘Engineered Products & Solutions’ segment continues to capitalize on robust aerospace performance, as revenue increased 5% year-over-year driving ATOI (after-tax operating income) 22% higher on a year-over-year basis. The segment achieved a record-high EBITDA margin of 22.5%. Considering the value-add business’ solid performance, we believe separating the business from the commodity alumina and primary metals segments could potentially unlock value for shareholders.

Strength in China

Interestingly, China (FXI) registered a second consecutive positive reading on the HSBC/Markit Services PMI. Along those same lines, Alcoa CEO Klaus Kleinfeld lifted the firm’s forecast for alumina and aluminum demand thanks to improved demand from the country, saying on the conference call:

“We have not substantially changed our view that market fundamentals are stable. We reaffirm aluminum demand will grow globally at 7% this year, 4% excluding China. However, we’ve made a few changes that I’ll highlight. First, we’ve increased Chinese demand from 11% to 12% due to stronger manufacturing growth numbers and strong aluminum semi-product production which is up 30% year-over-year through August.”

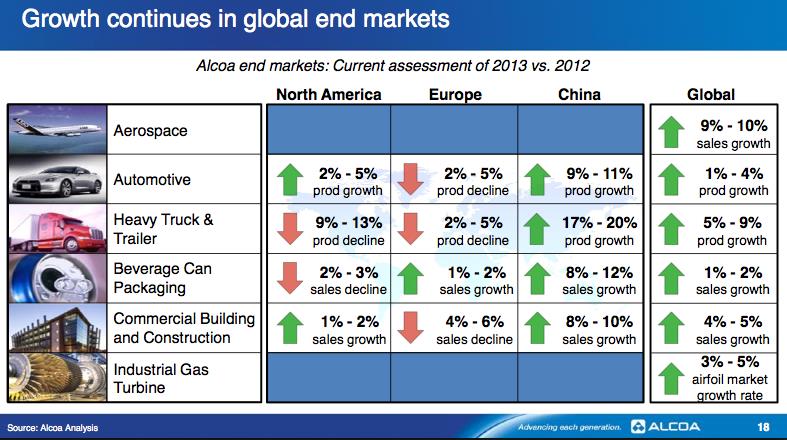

As conflicting as PMIs and growth figures can be, Alcoa provides strong, hard numbers revealing some underlying strength in Chinese manufacturing. It may be driven by secular growth in automotive, but it nevertheless counterbalances some of the more negative data we’ve received, including Nike’s (click ticker for report: ) most recent quarterly report.

Auto and Construction Growth Opportunities

Though the firm’s performance has been relatively strong in aerospace, Alcoa projects increased aluminum content in vehicles to save on weight and improve fuel efficiency. The firm is making strategic investments in the US and Saudi Arabia in order to capitalize on this trend.

Additionally, Alcoa believes it has a solution for improving building efficiency with its OptiQ Ultra Thermal Windows, which claim to offer a 40% thermal improvement over the industry standard. With buildings across Europe and the US demanding better energy efficiency, we think Alcoa has a profitable product opportunity. We like to see the firm branching out from its commodity product lines.

Valuentum’s Take

Though Alcoa isn’t necessarily the industrial bellwether that it once was, its quarterly report offers insight into a great number of markets (shown above). Aerospace, auto, and heavy truck & trailer all look relatively strong going into the fourth quarter, perhaps evidence that economic growth is not slowing. Regardless, shares of Alcoa do not look attractive at current levels; thus, we will not be establishing a position in the portfolio of our Best Ideas Newsletter. We prefer other opportunities.