After becoming the newest member of the Dow Jones Industrial Average, athletic apparel giant Nike (click ticker for report: ) posted a fantastic start to its 2014 fiscal year. First quarter revenue jumped 8% year-over-year to $7 billion, roughly in-line with consensus estimates. Earnings per share, on the other hand, soared past consensus expectations, growing 37% year-over-year to $0.86. Free cash flow totaled $379 million, equal to 5.4% of net revenue.

Product Demand Remains Robust

The primary reason behind Nike’s continued strength in the athletic apparel space is the robust demand for its products. The firm continues to innovate, particularly in the running and basketball spaces, and the innovations helped demand remain strong across all geographies. Revenue in North America, by far Nike’s largest market, grew 9% year-over-year to $3.1 billion. While economic headwinds abound, revenue in Western Europe surged 8% year-over-year (excluding currency) to $1.3 billion, and revenue in Central and Eastern Europe grew 10% year-over-year to $366 million as the firm witnessed increased penetration in Russia. Even Japan managed 1% revenue growth (excluding currency).

CEO Mark Parker provided some additional commentary about Converse on the conference call, saying that the brand’s revenue grew 18% year-over-year while EBIT jumped 36% year-over-year. We think Nike’s ability to grow this mature brand at a brisk pace (albeit Nike re-acquired some Converse licenses from abroad) demonstrates what a marketing machine Nike is.

China and Emerging Markets Soft

Though Nike’s results were great in developed markets, its operations in China and ‘Emerging Markets’ struggled during the first quarter. Revenue in China fell 3% year-over-year (excluding currency) to $574 million driven by a 7% decline in footwear sales. Nike Brand’s new President, Trevor Edwards, provided some interesting commentary on the company’s plan to turn Nike around in the region going forward:

“First, we (are) segment(ing) and differentiat(ing) our points of distribution to create more targeted consumer experiences and to increase marketplace capacity. Second, we are sharpening our merchandising strategies…at the door level, focusing on the products and categories that the Chinese consumer wants most; and third we are working to create a more seamless operating platform, ensuring we get the right product to the right door at the right time. We continue to be aggressive in tak(ing) decisive action to reset this market, but we’ll do it the right way, creating a foundation for long-term sustainable and profitable growth.”

It sounds, to us, that Nike may not have had the right product in the market and that perhaps it was a bit pigeonholed with respect to how the brand is viewed in the area. Nike has strong competition in China from brands like Li Ning and Peak, but we think the firm’s roster of dominant athletes will translate into Nike leading the marketplace in the years ahead.

As for ‘Emerging Markets’, revenue was up 5% year-over-year (excluding currency), to $902 million. Though Nike isn’t posting the same 20%+ growth rate in ‘Emerging Markets’ that some investors have become accustomed to, we continue to like the long-term growth opportunity.

Margin Reflation

The one valid criticism of Nike during the past few years has been its margin compression. Much of the decline recently has been attributable to higher input costs and obtaining manufacturing process knowledge for new technologies such as Fuse and Flyknit. Management consistently remained optimistic about the gross margin profile over the long term, however. The executive suite’s expectation was finally validated during the period, as Nike’s gross margin jumped 120 basis points year-over-year to 44.9%. With the firm focused on increasing its direct-to-consumer business via NikeStores and outlets, we continue to think there is more room to the upside with respect to margins.

SG&A declined 230 basis points as a percentage of sales to 29.5% as the firm anniversaried high marketing expenses in the year-ago period. The savings from the lower spending in the most recently reported period was only partially offset by increased operating overhead and investments in technology. Overall, SG&A was flat year-over-year on an absolute basis.

The combination of stronger gross margins and improved cost controls led to significant operating margin expansion and robust earnings per share growth during the period at Nike.

Looking Ahead

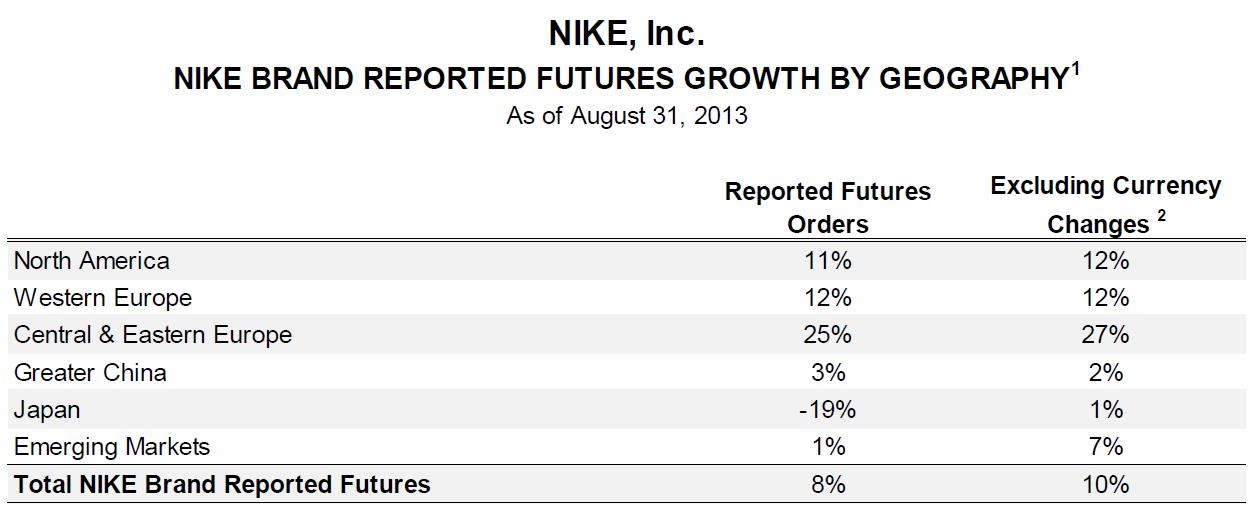

Nike provides a metric called Future Orders Growth that offers insight into order trends. Though the measurement doesn’t necessarily have a 1:1 correlation with revenue growth, it does provide a useful outlook.

Image Source: Nike

As we can see in the above chart, total orders growth improved 10% year-over-year (excluding currency), driven by 12% growth in both North America and Western Europe as well as 27% growth in Central and Eastern Europe. China and ‘Emerging Markets’ orders grew just 2% year-over-year and 7% year-over-year, respectively.

Valuentum’s Take

We continue to like Nike’s fundamentals. The firm’s brand power is unrivaled, and its continued shift towards direct-to-consumer sales and lower cost materials have created a strong gross margin tailwind. We remain ready to add the name to the portfolio of our Best Ideas Newsletter at the right price (the low end of our fair value range) on improving technical/momentum indicators (should the strength of the underlying business remain unchanged).