Clothing retailer Urban Outfitters (click ticker for report: ) filed its 10-Q report for its relatively strong second quarter. Shares proceeded to drop heavily on Tuesday after a line from the quarterly regulatory filing revealed that third-quarter comparable store sales growth was decent, but not running at a near double-digit pace. Taken directly from the 10-Q:

“Thus far during the third quarter of fiscal 2014, comparable Retail segment net sales are mid-single-digit positive.”

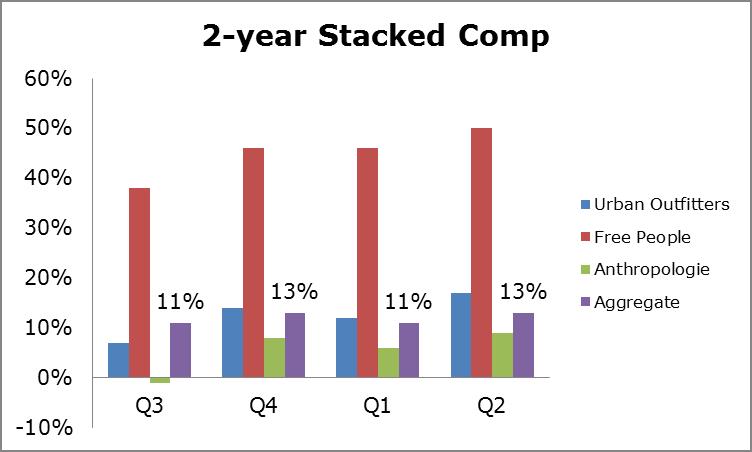

This “mid-single-digit” rate compares to the 8.5% growth rate the firm posted during its second quarter, driven largely by Free People and a recovery at Anthropologie, a name tied more directly to housing.

Source: Company Filings

Assuming the mid-single-digit growth rate is somewhere between 4-7%, Urban will post a 2-year stacked comp of 12-15% for the third quarter, which is in-line with current growth trends. In other words, to stay growth is slowing significantly is a bit of an exaggeration, and in our view, the news is no reason to panic. American Eagle (click ticker for report: ) and Aeropostale (click ticker for report: ) would love to have similarly robust comps.

More important than the comp growth rate is the composition of the sales growth. If recent improving trends in initial mark-ups (IMUs) and reduced reductions continue, Urban Outfitters’ gross margins should continue to improve, benefitting overall profitability. Gross margins jumped 170 basis points year-over-year during the most recent quarter to 39.3% of sales. This impact may be amplified if Free People and Anthropolgie remain the growth drivers.

Valuentum’s Take

A single mention of “mid-single-digit” same-store sales growth shouldn’t receive such a strong response from the market, but shares continue to trade in-line with our fair value estimate.