Tuesday morning, a variety of retailers reported calendar second quarter results that were decidedly mixed. Let’s take a deeper look.

TJX Companies

TJX Companies (click ticker for report: ) posted second quarter results marked by top and bottom line expansion. Revenue increased 8% year-over-year to $6.4 billion with same-store sales growth of 4% while earnings per share improved 18% year-over-year to $0.66 per share. Both metrics exceeded consensus expectations. Year-to-date, the firm has generated free cash flow of $314 million, equal to 2% of total revenue.

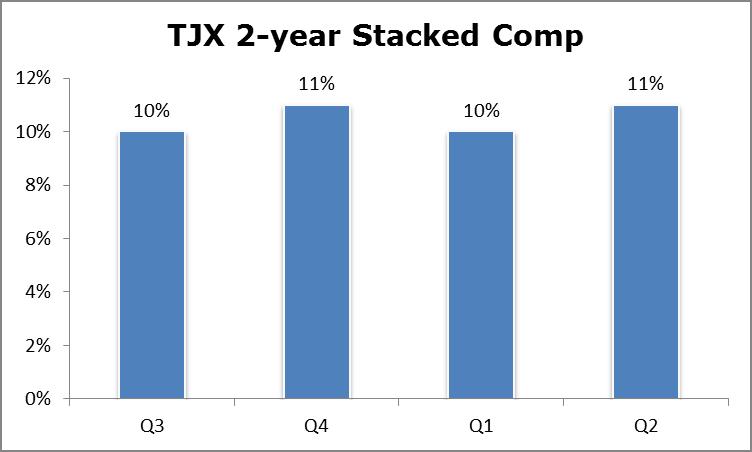

Though the company has 3,119 locations worldwide, the company continues to experience stable comparable same-store sales (“comp”) growth. TJX’s 2-year stacked comp has consistently hovered around 10-11% during the past four quarters.

Source: Valuentum, Company Filings

Because TJX survives on relatively low gross margins (28.8% during the second quarter), improving store productivity is paramount to the company’s profit expansion. We were encouraged to see same-store sales expansion remain relatively strong, particularly during a soft quarter for many retailers, including Wal-Mart (click ticker for report: ), Macy’s (click ticker for report: ), and even Nordstrom (click ticker for report: ).

SG&A expenses grew just 20 basis points compared to the same period in the prior year, to 16.7% of sales. The increase was largely driven by investments in the e-commerce channel, as well as higher marketing costs. At this time, we are not concerned with the slight increase.

The firm’s robust growth rate reflects positively on the basic tenets of TJX’s strategy: provide consumers with an interesting shopping experience (searching for deals) while allowing them to purchase popular brand names at a discount to full-priced retailers. We think the business model is somewhat insulated from online competition, but we are seeing the company invest in e-commerce channels as well. E-commerce could provide revenue upside in coming quarters, but higher shipping expenses will likely prevent material operating margin expansion.

Looking ahead, TJX raised its full-year outlook for same-store sales growth to 2-3% (was 1-2%) and lifted its full-year earnings per share outlook to $2.74-$2.80 (was $2.70-$2.78). We think the same-store sales guidance is a bit conservative given recent trends.

Dick’s Sporting Goods

Dick’s Sporting Goods (click ticker for report: ) also released second quarter results Tuesday morning. Revenue increased 6.6% year-over-year to $1.5 billion, while earnings per share (excluding special items) increased 9.2% year-over-year, to $0.71. Both figures fell short of internal and consensus expectations. Year-to-date, free cash flow stands at -$90 million (negative $90 million), but it is important to recall the third and fourth quarters are far more material free cash flow drivers than the first half of the year.

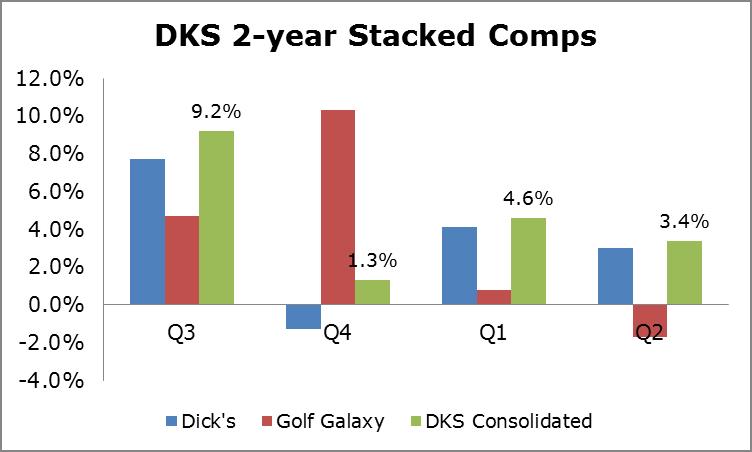

Source: Valuentum, Company Filings

Same-store sales growth, adjusted for 53 weeks in fiscal year 2012, looked particularly anemic at the core Dick’s Sporting Goods store. Shifted same-store sales growth during the second quarter totaled just 0.1% at the core Dick’s Sporting Goods store compared to the year prior, and by extension, the above chart highlights slowing comp growth at the company, both sequentially and on a year-over-year basis. Golf Galaxy’s second quarter comps were also weak, declining 6.1% year-over-year (last year’s second quarter measure cushioned the blow, helping its 2-year stacked comp decline not look as steep).

In our view, several factors are likely accountable for this weak performance. Sporting goods purchases can often be influenced by weather, and with cooler-than-average weather across the country, demand for heat gear from Under Armour (click ticker for report: ) and Nike (click ticker for report: ) was likely weaker than the year-age period. We believe these items are key traffic drivers, and without strong demand, traffic suffered.

The same goes for Golf Galaxy. Warm weather boosted golf sales during the first and second quarters of fiscal year 2012, but milder conditions during the first half of 2013 offset the prior-year’s sales gains.

Further, Dick’s faces fierce competition not necessarily from Sports Authority, but from its own suppliers, particularly Nike and Under Armour. Both companies have focused on increasing direct-to-consumer distribution in order to capture more margin dollars, and we think this competition is starting to impact Dick’s top-line growth. Nike, in particular, has been aggressively opening small stores in densely populated urban areas, with stores popping up near existing lululemon (click ticker for report: ) locations.

Under Armour continues to expand its distribution network, getting its products in more stores than ever before. This is good for Under Armour, as it is achieving greater customer diversity, but it is a negative for Dick’s because the firm will no longer have as much exclusive product.

On the bright side, Dick’s was able to increase its gross margins 14 basis points year-over-year, to 31.3%. Still, this gain was more than offset by fixed cost deleveraging of 47 basis points. Total operating margins declined 42 basis points year-over-year to 8.95% of sales.

Looking ahead, management significantly reduced the firm’s full-year adjusted earnings outlook, slashing its earnings per share guidance to $2.60 to $2.65, down from its prior forecast of $2.84 to $2.86. Same-store sales guidance for the year was cut to 0-1% growth from its prior guidance of 2-3% expansion.

Barnes & Noble

Barnes & Noble (BKS) also posted weak results for its fiscal year 2014 first quarter. Revenue declined 8.5% year-over-year to $1.33 billion, while the firm lost $0.86 per share (excluding items), both of which were slightly better than anticipated.

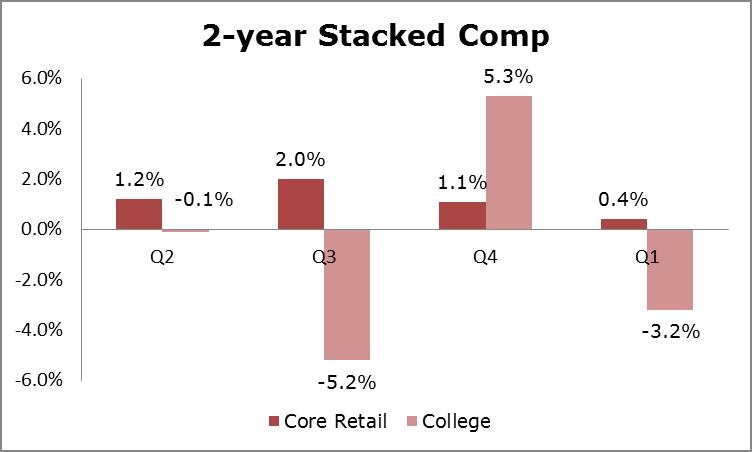

Source: Valuentum, Company Filings

First quarter same-store sales growth was weak at both the core ‘Retail’ and ‘College’ business, declining 7.2% year-over-year and 1.2% year-over-year, respectively. Still, the two-year trend at Barnes & Noble’s core ‘Retail‘ business remains marginally positive, though decelerating. Considering Barnes & Noble is essentially the last large national bookseller left, moderating same-store sales declines are not much of a surprise.

Nook content sales were also poor during the quarter, falling 16% year-over-year. Total Nook sales declined 20% year-over-year as device and accessory sales slipped 23% year-over-year. Once billed as the company’s savior, the ‘Nook’ segment is having a difficult time in a competitive marketplace that includes the Amazon (click ticker for report: ) Kindle, Apple’s iPad (click ticker for report: ), and various Android-powered devices.

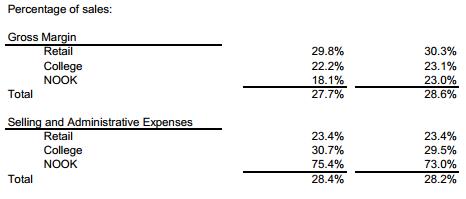

Image Source: BKS

With sales declining, the firm has been unable to maintain margins in any of its segments (shown above; most recent period is on the left). Competition remains fierce in all of the company’s segments, and we think margins, particularly in the ‘College’ segment, could experience additional downside. The ‘College’ segment formerly held a monopoly position as the primary means of textbook distribution, but online competition and a thriving used textbook market have disrupted the industry’s business model.

Valuentum’s Take

Tuesday exemplified the divergent performance across different retailers. We believe TJX Companies has some immunity against online competition, and we like its value-centric business model. And while it is one of our favorites in the clothing retailers industry, we’d still need a large margin of safety before considering shares for the portfolio of our Best Ideas Newsletter.

Dick’s Sporting Goods, on the other hand, must deal with the stark reality that its largest suppliers are quickly becoming rivals. By no means do we expect Under Armour or Nike to end their respective relationships with Dick’s, but we do believe the company may have to reconsider its store growth strategy. Shares look fairly valued at this time.

As for Barnes & Noble, the company’s future looks bleak at worst and uncertain at best. We aren’t interested in shares. We continue to point to opportunities in our Best Ideas portfolio and Dividend Growth portfolio as our favorite ideas.

Retail – Clothing: ANN, BEBE, BKE, CBK, CTRN, GCO, HOTT, JOSB, MW, PLCE, TJX, ZUMZ