Key Takeaways:

· Though we fall short of prognosticating on the immediate moves of the stock market, we think the near-term risk-reward of the broader market is growing more and more negative. Why?

o Market volatility is back due to Fed speak and poor data and pricing action from Asia. Typically, market hiccups signal that a change in price direction is near (we’re no longer going straight up).

o The significant out-numbering of poor scores on our stock-selection methodology, the Valuentum Buying Index, relative to good scores suggests to us that a higher degree of caution may be in order.

o According to Factset, the forward price-to-earnings ratio on S&P 500 constituents registers a 14.4x reading (as of last Thursday), above both its 5-year (12.9x) and 10-year averages (14.1x).

· Still, we remain very enthused about the resiliency of the US economic environment.

o Economic growth in the first quarter was supported by continued expansion in demand by U.S. households and businesses.

o Conditions in the job market have shown some improvement recently.

o An adjustment to the flow of purchases of long-term Treasuries and agency MBS as early as June may be a bit premature.

· However, declining manufacturing activity in China is one of the largest risks to the global economy.

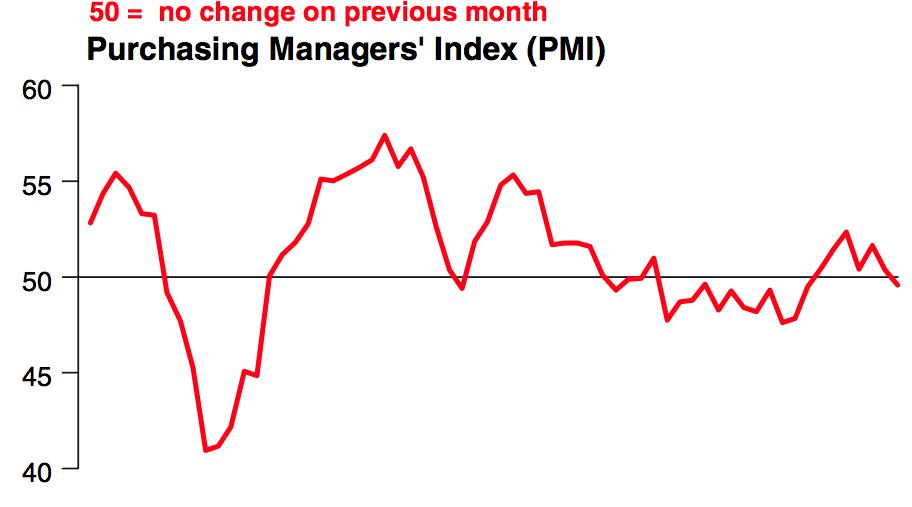

o The preliminary HSBC China Manufacturing PMI fell to a seven-month low in April, posting a contractionary reading of 49.6 (a negative change).

o The trajectory of growth in China has a material impact on almost every company in our coverage universe.

· We are re-evaluating our actively-managed portfolios.

o Dividend Growth Portfolio: We plan to sell our full positions in ConocoPhillips (COP), Republic Services (RSG), and Superior Industries (SUP). We plan to replace these positions in coming weeks with new ideas, shortly after the release of the June edition of our Dividend Growth Newsletter, June 1.

o Best Ideas Portfolio: We plan to open a put option on the broader market ETF, the SPDR S&P 500 Trust, (SPY) for added downward protection ($160 strike, Dec 2013 expiration). The performance of our Best Ideas portfolio continues to be best-in-class.

Missed the latest editions of our newsletters? Click here.

Ever wonder why we don’t remove a stock from our actively-managed portfolios immediately when its fundamentals turn sour? Click here.

Volatility Is Back

During the past few days, investors have seen something they haven’t seen in a while: volatility. The broader US equity markets, the NASDAQ, S&P 500, and the Dow Jones Industrial Average sold off yesterday and then took a large hit in morning trading Thursday as a result of poor news out of Asia (the US markets have largely recovered, however). Though we’re not panicking, we think now is as good a time as ever to re-evaluate some of the holdings in our actively-managed portfolios.

Typically, market hiccups like this signal that a change in price direction is near, though we admit it may take a couple months for any abrupt change to unfold. The significant out-numbering of poor scores on our stock-selection methodology, the Valuentum Buying Index, relative to good scores suggests to us that a higher degree of caution may be in order. And, according to Factset, the forward price-to-earnings ratio on S&P 500 constituents registers a 14.4x reading (as of last Thursday), above both its 5-year (12.9x) and 10-year averages (14.1x). Though we fall short of prognosticating on the immediate moves of the stock market, we think the near-term risk-reward of the broader market is growing more and more negative.

The United States

With that said, we remain very enthused about the resiliency of the US economic environment. For one, in Federal Reserve Chairman Ben Bernanke’s congressional testimony, released May 22, the chief had some very positive things to say (from Bernanke’s testimony):

Economic growth has continued at a moderate pace so far this year. Real gross domestic product (GDP) is estimated to have risen at an annual rate of 2-1/2 percent in the first quarter after increasing 1-3/4 percent during 2012. Economic growth in the first quarter was supported by continued expansion in demand by U.S. households and businesses, which more than offset the drag from declines in government spending, especially defense spending.

Conditions in the job market have shown some improvement recently. The unemployment rate, at 7.5 percent in April, has declined more than 1/2 percentage point since last summer. Moreover, gains in total nonfarm payroll employment have averaged more than 200,000 jobs per month over the past six months, compared with average monthly gains of less than 140,000 during the prior six months. In all, payroll employment has now expanded by about 6 million jobs since its low point, and the unemployment rate has fallen 2-1/2 percentage points since its peak.

Bernanke, however, still painted a rather mixed picture for future quantitative easing. On one hand, he mentioned during his congressional testimony that the Fed could ease off the gas with regards to bond buying (“to ensure that the stance of monetary policy remains appropriate as the outlook for the labor market or inflation changes”), but it remains unclear when the Board of Governors will be in agreement on timing. In the April FOMC minutes that were released yesterday afternoon, some members hinted at June as a time to start slowing bond (long-term Treasuries and agency mortgage back securities) buying, but the idea remains far from consensus (from the April minutes of the FOMC):

A number of participants expressed willingness to adjust the flow of purchases downward as early as the June meeting if the economic information received by that time showed evidence of sufficiently strong and sustained growth; however, views differed about what evidence would be necessary and the likelihood of that outcome. One participant preferred to begin decreasing the rate of purchases immediately, while another participant preferred to add more monetary accommodation at the current meeting and mentioned that the Committee had several other tools it could potentially use to do so. Most participants emphasized that it was important for the Committee to be prepared to adjust the pace of its purchases up or down as needed to align the degree of policy accommodation with changes in the outlook for the labor market and inflation as well as the extent of progress toward the Committee’s economic objectives.

One thing is clear, however: Bernanke is not completely convinced the labor market is on sound footing (see below), despite his acknowledgement of the recent improvements. This leads us to believe an adjustment to the flow of purchases of long-term Treasuries and agency MBS as early as June may be a bit premature (from Bernanke’s testimony):

…the job market remains weak overall: The unemployment rate is still well above its longer-run normal level, rates of long-term unemployment are historically high, and the labor force participation rate has continued to move down. Moreover, nearly 8 million people are working part time even though they would prefer full-time work. High rates of unemployment and underemployment are extraordinarily costly: Not only do they impose hardships on the affected individuals and their families, they also damage the productive potential of the economy as a whole by eroding workers’ skills and–particularly relevant during this commencement season–by preventing many young people from gaining workplace skills and experience in the first place. The loss of output and earnings associated with high unemployment also reduces government revenues and increases spending on income-support programs, thereby leading to larger budget deficits and higher levels of public debt than would otherwise occur.

From what we gathered via the Fed minutes and the Chairman’s testimony, we think the Fed is simply trying to keep its options open (without spooking the market too much). The end game of such aggressive and relatively untried policy will be hard to predict, and if we can count on anything with policy, it will have some unintended consequences. Either way, we believe investors will, at least initially, fear any sort of tapering.

Japan and China

As for Japan, the Nikkei experienced one of its worst-ever declines Thursday, falling 7.3% for the day. Though some of the stock-market drop likely came as a result of significant profit taking (the Nikkei is up 39% year-to-date, even after this large correction), recent manufacturing data from China may have triggered the massive decline in Japanese shares. Specifically, the preliminary HSBC China Manufacturing PMI fell to a seven-month low in April, posting a contractionary reading of 49.6 (not terrible, but certainly a change in trajectory).

Image Source: Markit Economics/HSBC, Business Insider

Declining manufacturing activity in China is one of the biggest risks to the global economy, in our view, as China already has a large laundry list of problems. Socially, the country has to deal with a large wealth gap, while pursuing measures to keep current leadership in place. And on the economic side, there’s little doubt that China’s real estate market is frothy at best (and bubbly at worst), and Chinese workers have been demanding higher wages, piquing corporations’ interest in finding lower labor costs elsewhere. With the large amount of fraud and uncertain socio-economic environment, we’re paying very close attention to the region as it has profound implications on almost every company in our coverage universe.

Time for Some Spring Cleaning

We’re not throwing in the towel on the US equity markets by any stretch of the imagination, but we think the recent volatility represents a good time for us to do some spring cleaning in our actively-managed portfolios.

Dividend Growth Portfolio

Let’s start with our Dividend Growth portfolio. We plan to sell our full positions in ConocoPhillips (COP), Republic Services (RSG), and Superior Industries (SUP).

ConocoPhillips’ cash-flow position has become more and more onerous in recent quarters (click here), and the company now posts poor scores for both dividend safety and dividend growth. We think it’s a good time for us to head to the exit, as shares are now trading at the high end of our fair value estimate range (further, it registers but a 3 on our Valuentum Buying Index). We plan to sell our full position at $62.81 per share (an excellent gain since our cost basis includes our full position in Phillips 66 (PSX), which has been a huge winner for us).

We’ve been patient with garbage-hauler Republic Services, and it has paid off greatly. Though the firm has had a variety of fundamental hiccups in the past number of months, not over-reacting to potential poor cash-flow news has allowed us to turn this investment into a big winner. We think being tactical in our trades—not rushing to sell when a fundamental driver turns sour—has been a large driver of the strong performance of our portfolio. Republic is now trading above our estimate of its intrinsic value, and its Valuentum Dividend Cushion score is not as strong as it once was (when we first added it to the portfolio). We plan to sell our full position at $34.81 per share.

Superior hasn’t been as strong a performer for us as we would have liked, though we are still up nicely above our cost basis. However, the firm’s decision to accelerate 2013 dividend payments into 2012 has left us at odds. We like its valuation upside potential, but we think there are better income opportunities out there. We plan to sell our full position at $17.67 per share.

We understand the importance of replacing these firms in an investor’s income portfolio, and we plan to do so shortly after the release of the June edition of our Dividend Growth portfolio. Dividend growth investors: stay tuned! We think we have some excellent ideas.