By Kris Rosemann and Brian Nelson, CFA

At Valuentum, we like slam-dunk, no-brainer investment opportunities–like Microsoft (MSFT) in the mid-$20s before it doubled, or Visa (V) prior to its strong equity price performance in recent years, or even cigarette-maker Altria (MO) in advance of its ongoing march higher since the dawn of the release of the inaugural Best Ideas Newsletter. Our members count on us to use our knowledge of valuation to sort out “investable” stocks from “uninvestable” ones; good stocks with fundamental promise from bad ones built on fantasy outcomes. Benjamin Graham calls what we do “investing,” while he may call readers that dabble in the two highlighted stocks in this piece “speculators.” There is a difference, and it’s a big one.

Don’t jump to conclusions–we don’t have an axe to grind against Twitter (TWTR) or Netflix (NFLX). They have a place in our social atmosphere (or is it blogoshere?), but investing has little to do with popularity or fads (sorry Peter Lynch), and entirely to do with the robustness, longevity, and predictability of a company’s future free cash flows. This is where Netflix and Twitter fall flat on their faces across the board (with all three prior considerations). In the past (and please access each company’s respective landing page on our website), we’ve expressed our grave concerns about the wide range of fair value outcomes for the shares of both Twitter and Netflix (think extreme but justified share-price volatility), and nothing has changed on that front. However, the market is starting to “build castles in the air” again with these two, and it has nothing to do with the operations of either firm. Takeover speculation has stolen the headlines at both companies. Though as imprudent for a suitor as it may be, Twitter could be the closer of the two to a sale, as reports have surfaced that the struggling social media (or is it now better described as a news) network could begin fielding bids as soon as this week.

Alphabet (GOOG, GOOGL) and Apple (AAPL) could be interested (some reports have already axed both as possibilities, however), but it’s more likely that Salesforce (CRM), Disney (DIS), or another media giant such as Comcast (CMCSA), News Corp (NWSA) or 21st Century Fox (FOXA) could be much more interested. We can’t forget about Facebook (FB) either – could you imagine if Facebook and Twitter tied the knot, the optimization of the latter that would prevail? In many ways, Facebook may be the best fit, especially if it can improve Twitter’s “follower” performance for advertisers and facilitate a better experience for users (most can’t even find friends or colleagues on the system). How is that social? Though less likely, Alibaba (BABA), Tencent (TCEHY), or Baidu (BIDU) could be considerations, and even Verizon (VZ) may have taken a look in light of its recent interest in accumulating the struggling businesses of AOL and Yahoo (YHOO) and apparent disregard for its own massive debt load.

Several companies mentioned could consummate the acquisition of Twitter (currently a ~$16.6 billion market cap) more easily than what has become the most probable rumored suitor of the bunch, Salesforce, but its CEO Marc Benioff has been looking to make a headline-grabbing purchase of a strong consumer brand with loads of data, a profile Twitter fits to a t. How can we forget that Salesforce recently lost a bidding war to Microsoft over LinkedIn (LNKD), “What?!?! Microsoft Acquires LinkedIn; NO!” which had a similar kind of appeal to the enterprise-focused cloud software provider that Twitter does. Benioff referred to Twitter as an “unpolished jewel,” indicating that he feels Salesforce has the power to extract the hidden potential in Twitter, a power current and former management of the firm has not been able to harness. But he has also said that, while he looks at a lot of deals, he mostly passes. Could he now be on tilt after losing LinkedIn though, and could the draw of empire-building be growing within Benioff, much like it sucked in Microsoft CEO Satya Nadella to overpay for LinkedIn? Having avoided the “winner’s curse” by losing LinkedIn, will Benioff make an even bigger mistake?

That said, there is some foundation to a Salesforce-Twitter tie-up. Twitter’s brand and the idea that “Data is the currency in software’s new world order,” are two key factors behind the Salesforce CEO’s desire for the company. In essence, the attractiveness of Twitter is that its massive consumer data library could be used to provide unique insights for Salesforce’s corporate customers. In other words, the acquisition would not be pursued with confidence in its operations, but rather would be based on extracting information regarding its users’ tendencies and preferences. The idea that this could cost Salesforce well over a third of its market capitalization may be troubling to shareholders, and Microsoft set a dangerous precedent with the $26+ billion purchase of LinkedIn for similar reasons. As we would expect, shares of Salesforce have reacted unfavorably to the news of the potential acquisition of Twitter. There’s no way to confidently estimate Twitter’s intrinsic value – it is “uninvestable,” and therefore “unbuyable” by a prudent suitor, in our view (emphasis on prudent).

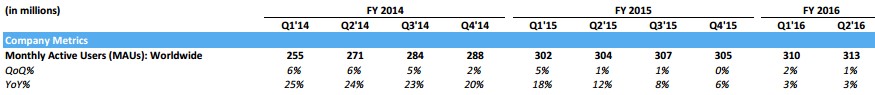

Image source: Twitter quarterly results

Twitter’s business model is unproven, too, and the social media network has been battling concerning user growth trends in recent quarters as it struggles to turn a profit on a GAAP-basis, “Facebook Flying, Twitter Tumbling.” Compare the growth and MAU figures in the above chart to Facebook’s 22% year-over-year growth in daily active users, to more than 1 billion in the second quarter of 2016. Though Twitter management continues to throw around strong positive language in its quarterly reports such as “confidence in our product roadmap” and “progress on priorities,” the long-term picture for the company is cloudy at best. We’ve seen many social media platforms come and go over the past decade or so, and why couldn’t Twitter go the way of MySpace and others before it and since? A takeout may be the best case scenario for the company.

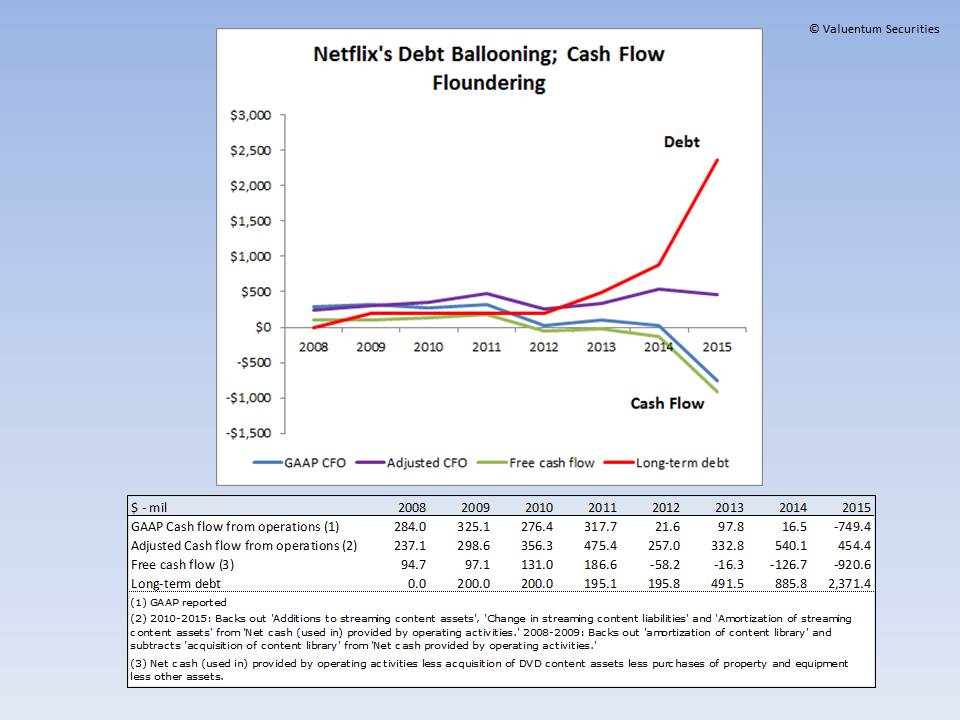

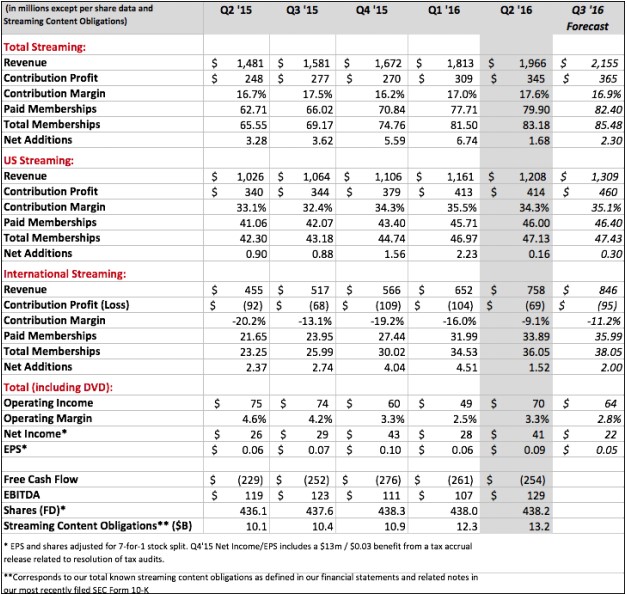

Shares of Netflix have also found some favor among investors more recently–not because of its fundamentals but due to takeout speculation, just like Twitter. Disney has again been cited as a potential suitor, and Apple had been rumored to be interested in the streaming service provider earlier in 2016, but both of these deals seem far-fetched in light of Netflix’s extreme overvaluation, in our opinion. Also similar to Twitter, Netflix has had a difficult time executing its growth plan as of late. The firm missed its own expectations for subscriber growth in the second quarter of 2016, and we believe the market continues to overestimate its long-term international growth potential, if not steady-state subscriber numbers at full penetration then certainly the costs at which it will take to ramp to such performance. Netflix’s credit rating is rightfully junk status, in our view.

Image source: Netflix quarterly results

Competition from the likes of Amazon (AMZN), Hulu, and YouTube will only intensify in coming years, and both established and new entrants will bring fresh and innovative products to the market, some that we can only imagine at this time. Recent price hikes for Netflix’s service, albeit minor by most measures, have not been met favorably by consumers, and original content development, in our view, has generally been underwhelming, with Making a Murderer perhaps arguably marking a peak in in-house originality. With little room for future price hikes and content costs skyrocketing (and necessary to retain existing members), the outlook is growing less exciting with each passing quarter. The costs to grow its international business aren’t optimal either–brand strength is lacking outside the US, and Netflix is paying for it (it’s all in the numbers, contribution margin). Management has yet to face the kind of challenges that we think it will have to sooner than later, even if sooner is still several quarters or years away (as we outlined in our original thesis).

In this light, the takeout rumors surrounding Netflix are the largest positive the stock has going for it, and we continue to believe that a purchase of the company near its current market capitalization would be among the best-case scenarios, especially in the context of our opinion of its intrinsic value. Unlike Twitter, however, Netflix has yet to express serious interest in being acquired, and we haven’t seen anything of substance that would indicate a purchase of the firm is on the near horizon. Netflix CEO Reed Hastings may still believe that Netflix’s future is bright on a standalone basis, but we maintain that it is rather ominous. Netflix can’t compete on original content with the big studios, and we believe content is where the value lies in the value chain – if not, then how can one explain Netflix’s foray into generating its own original content?

No matter what though, Netflix shareholders are in for a wild ride, and we can point to its wide range of fair value outcomes as the basis for such a view. On a fundamental basis, Netflix’s future free cash flow stream is difficult to predict given pricing leverage, variable content costs, the uncertain long-term economics of its international operations and its ongoing efforts to reinvent itself. Regarding the latter, on October 5, for example, Netflix signed a deal with luxury theater chain iPic Entertainment in a continued effort to take its streaming service to the big screen. Under the terms of the deal, Netflix original movies will be screened in iPic’s luxury theaters in New York and Los Angeles, and potentially its 13 other locations, the same day they appear on Netflix’s streaming service. While Netflix and iPic view the partnership as the beginning to a disruptive force in the movie industry, we’re not sure such a move will be the savior Netflix needs.

Obviously, we continue to prefer stable, cash-rich entities whose shares are not dependent on sentiment surrounding speculative news flow. You got it–Twitter and Netflix aren’t our cup of tea. Can you blame us? Instead, we prefer readers look to the Best Ideas Newsletter portfolio to find our best ideas to consider for long-term capital appreciation. We’re going to be spectators of Netflix’s and Twitter’s stock, not speculators in them. Hope you understand.