By Kris Rosemann

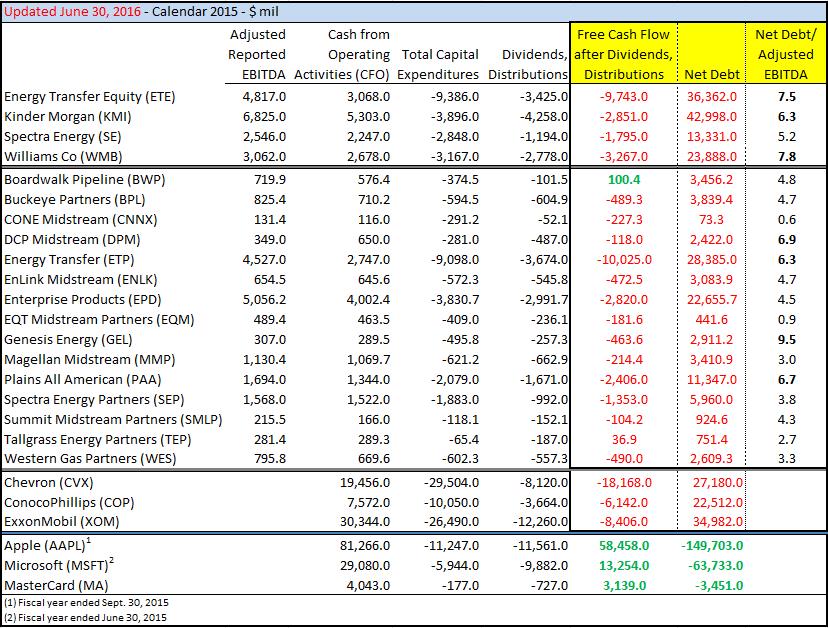

The recent merger break-up fiasco at Energy Transfer Equity (ETE) and Williams Companies (WMB) has put the master limited partnership (MLP) conversation back into the spotlight, after the two entities were unable to finalize a merger that had been announced in fall 2015 and would have created the largest pipeline company in the US. The deal between Energy Transfer Equity and Williams was officially terminated by Energy Transfer Equity June 29 after a court ruled that the firm was legally able to walk away from the agreement when it was unable to deliver an opinion on the tax treatment of the transaction that was required by June 28. Williams has since stated that it will seek monetary damages from ETE for the failed transaction.

We have been warning of the dangers of a tie up of the two entities that are both so overleveraged, and it has become evident that disagreements at the top of both Williams and Energy Transfer Equity have led to a significant shakeup in their management teams and boards of directors. On June 30, nearly half of Williams’ directors resigned after failing to oust CEO Alan Armstrong, who was an opponent of the merger, and Energy Transfer Equity CFO Jamie Welch, who has been quoted referencing the deal terms as “mutually assured destruction,” was released from his duties in early February. We can only imagine how much finger-pointing had been going on, and the activity by the Williams’ board following the failed transaction seems like mutiny, at least from our perspective. How can investors believe that a board that is so fast to dissolve is acting in their best interests? It’s very concerning from a corporate governance standpoint, and something tells us this isn’t the last we’ve heard about the ETE-WMB tie-up. Things could still get ugly.

Despite the news of the failed attempted merger, the near-term outlook for most midstream MLPs has improved since early 2016. The most transparent positive is improvement in the energy resource pricing markets, as the recent bounce in crude oil prices has alleviated some of the pressure pipeline operators had been experiencing. Remember when others were saying midstream equities were immune to commodity-price changes? How wrong they were. Additionally, the vast majority of midstream MLP firms are not exposed to the uncertainty surrounding ‘Brexit’ and ongoing concerns over economic growth in Asia, specifically China. Most recently, the former of these two concerns has had an impact on the yields on government bonds in developed countries across the globe (US 10-year Treasury bond yields fell to record lows July 1) as risk-averse investors attempt to avoid such uncertainty. This dynamic has only increased the demand for high-yielding stocks for income-oriented investors, and pipeline companies have traditionally fit this bill nicely, especially when considering their general lack of exposure to global economic uncertainty, even if energy market uncertainty is still prevalent.

Falling US Treasury bond yields coupled with the reduced probability of additional federal fund rate increases by the Fed in 2016 thanks in part to ‘Brexit’ uncertainty may provide more “hot air” to inflate those equities employing the MLP business model via the ongoing easing of access to the capital markets. Can you believe it? Spreads on some of the lowest-rated (highest-yielding) debt, for example, have improved drastically since the near term peak earlier this year. As we have been articulating for some time now, MLPs are far too dependent on the capital markets (i.e. issuance of new debt and equity capital) for them to be considered rock-solid, independently sustainable entities. However, as long as the debt and equity markets remain open to them to provide the financing cash flow generation to cover cash distributions, most MLPs will continue to be able to operate in their current form as dividend-hungry investors bid up shares on the basis of yield considerations, despite what we consider to be egregious business-model risk (promulgated by regulations that favor MLPs over traditional corporates).

Image source: PAA 2016 Investor Day presentation

Let’s take a quick anecdotal look at Plains All American (PAA) to illustrate what we mean, for example. The MLP expects its expansion capital spending to be funded by at least 55% new equity, as well as excess “cash flow.” However, excess “cash flow” may be hard to come by as it projects its distributable cash flow distribution coverage to be well below 1 for the second consecutive year. (The chart above provides a visual representation of the firm’s distribution “coverage,” or better yet lack of it.) You might say – “this is ridiculous.” How can Plains All American keep paying out this distribution when even its own measures of internal cash flow before capital outlays related to growth spending are coming up short?

The answer is quite simple – ever more debt, more equity. Plains All American is not only admitting it will issue more equity in a bid for growth, but it recently floated a sophisticated convertible offering, which also came to the rescue of the distribution. It’s almost as though operating performance doesn’t matter within the MLP universe as much as access to new capital does–if an MLP can float more debt and equity, all will be well. If it can’t, trouble is on the horizon. This is what makes handicapping the MLP space so difficult for investors; in many cases, credit access and energy resource pricing trump firm-specific operating fundamentals. Industry veterans have a hard time accepting this fact.

The question on most investors’ minds, however, is how long the MLP merry-go-round will last (i.e. how long MLPs will be able to continue such an external-capital, self-perpetuating cycle without a massive fallout). Executive teams of MLPs are aware of the vulnerabilities of their business models, perhaps punctuated by Kinder Morgan’s (KMI) roll-up many moons ago. More recently, however, Plains All American, acknowledged the many flaws of the MLP business model, if not explicitly then indirectly via a discussion of the viability of the long-term sustainability of the MLP model. In its 2016 Investor Day presentation, the entity stated that it will continue to evaluate structure simplification alternatives, specifically a simplification transaction between PAA and its general partner. To us, this in itself is an acknowledgement from a major player in the MLP space that changes are necessary in its corporate structure.

Even if energy resource pricing has offered a nice reprieve, the vulnerabilities of the MLP business model have been exposed. If the examples of Kinder Morgan and Plains All American weren’t enough, in late 2015, Targa Resources (TRGP) rolled up Targa Resource Partners, and around the same time, Sempra Energy (SE) backtracked on its plans to form an MLP. The path to recent distribution cuts across the MLP space have been devastating for many: NGL Energy Partners (NGL), American Midstream Partners (AMID), and Crestwood Equity Partners (CEQP) all cut their distributions in April 2016, and Southcross Energy Partners (SXE) cut its distribution in January 2016. More than 20 MLPs cut distributions in 2015, and most of those cuts came from smaller MLPs, which may be telling of the fragility and shaky future of this business model. Many know that Boardwalk Pipeline (BWP) cut its distribution in February 2014, and now-bankrupt LINN Energy’s distribution cuts were foretold by the entity’s abysmal Dividend Cushion ratio. Even the ALPS Alerian MLP ETF (AMLP) cut its quarterly dividend ~20%.

During its investor day, Plains All American also highlighted a number of changes it expects to come in its operating environment over the near-term and intermediate/long-term time horizons, both of which it expects to be very different from what we have seen in recent years. The energy boom following the Great Recession of late last decade drove unbridled growth in the businesses and assets in the MLP universe, causing the overall quality of the space to deteriorate significantly, and as a result of quantitative easing and lax monetary policy, a large number of MLPs became dependent on unrestrained access to low costs of capital. This is where things will begin to change. Relative to the “good old days,” it has become much more difficult for MLPs to fund their growth projects, forcing them to look elsewhere for sources of expansion. A renewed focus on rationalization and optimization can be expected, but this will bring increased competition, meaning that many of the smaller MLPs that benefitted from the ease of access to low costs of capital may become competitively disadvantaged as larger operators with higher-quality assets benefit from scale and capacity utilization on existing infrastructure.

Midstream pipeline MLPs are also expected to look to industry consolidation and asset acquisitions as sources of growth as large organic growth capital programs will become a thing of past the for much of the space. However, the recent implosion of the ETE-WMB tie-up brings the viability of such a strategy into question. While the two firms are among the most-leveraged in the industry, many others are not far behind (see chart at top of article). Perhaps the best-case scenario for MLPs then is exactly what Plains All American has hinted at in its Investor Day presentation: a consolidation of it and its general partner. Such a move would reduce its dependence on the capital markets, but it may be the best way for the firm to remain a legitimately healthy operator over the long term. After all, the very pioneer of the MLP business model, Kinder Morgan, has abandoned it. We have long been positive on the underlying businesses of the midstream space, but the MLP business/financial model fouls up the investment prospects of the industry, in our opinion.

We expect the MLP business/financial model to eventually be reevaluated at the highest regulatory levels and deemed an “unfair” structure. That MLPs can recirculate capital raised from the financial markets (financing section of the cash flow statement) to pay distributions, which are widely followed by “trusting” investors and often used to value their equities is incredible. How can you be sure that our perspective is worth considering? Ask one question: what would happen to MLPs if the capital markets shut down? The answer: They would have to cut their distributions as cutting off growth and investment would be a bonehead move in light of potential positive NPV projects. In any business seeking to generate value for shareholders, which all are, investment growth capital therefore will always be funded first and foremost through a company’s operating cash flow, and since most capital investment and dividends, collectively, overwhelm operating cash flow generation (as in the chart above), most all MLP payouts are in part financially-engineered (i.e. supported by the financing section of the cash flow statement). External capital is not the primary source of growth funding.

Though it may not happen anytime soon, we believe there will eventually be an “investor-led” crusade against this dangerous business model. Such opposition doesn’t necessarily have to come from investors either. It could come from a corporate coalition. There are many corporates, for example, that have decent balance sheets and cover their dividends with traditional free cash flow, but have much less sanguine credit marks by the agencies relative to those of such overleveraged, “cash-burning” (after dividend payments) pipeline MLP plays. Moreover, we believe the SEC should take a hard look at the industry’s definition of “cash flow,” which we believe is very misleading to even the most sophisticated investors. In particular, an MLP’s definition of distributable cash flow excludes the very growth capital spending that drives net income, which itself is included in the calculation of distributable cash flow. When analysts use distributable cash flow in valuation, they, by its very own definition, exclude a portion of the cash capital outflows (shareholder money) that are used to drive net income higher, a severe imbalance in the valuation equation.

Individual investors and financial advisors deserve better: the truth.

Pipelines – Oil & Gas: BPL, BWP, DPM, ENB, EPD, ETP, EVEP, HEP, KMI, MMP, NS, PAA, SE, SEP, WES