Image Source: Starbuck’s 2016 Annual Meeting of Shareholders

By Jessica Bishop

With coffee being an integral part of so many people’s daily routine, Starbucks (SBUX) has captured the hearts of coffee drinkers everywhere and has become the face of upscale, high-end coffee with its tremendous brand recognition. Along with its brand comes its unmatched loyalty program, as people just can’t seem to get enough of Starbucks. It has taken great strides toward mobile advancements such as My Starbucks Rewards (MSR) that has gained more than 10 million active members (grew 28% in fiscal 2015 from fiscal 2014) in the US with card loads in North America alone at $5+ billion in fiscal 2015. The strength of its loyal customer base has allowed the firm to increase its comparable same-store sales 7% and open 1,677 new stores across the globe in fiscal 2015. With 23,000+ stores already in place, Starbucks has shifted its focus from domestic store count growth to expanding internationally (mostly in China and Japan with China being the largest market outside of the US); 70% of its ~1,800 new stores in fiscal 2016 are expected to open outside of the US.

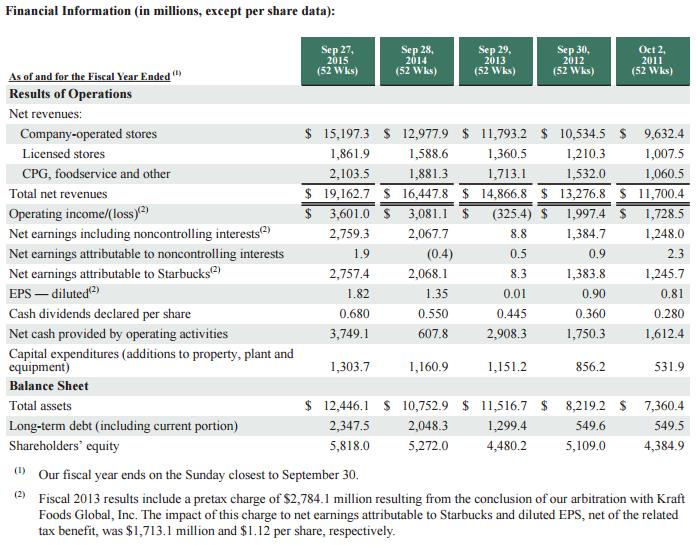

Starbucks’ brand strength also allows it to increase its prices while still retaining the vast majority of its customers. Not only are the prices of its products compratively higher than rivals, but so is its share price, as it is trading at a full valuation, both in terms of our fair value estimate and relative valuation. Based on our future forecasts, the company’s forward P/E is ~29, significantly higher than our estimate of its peer median of ~22.1 Competition from Dunkin’ Donuts (DNKN) may increase pressure as it works to pull marginally more value-conscious customers from Starbucks. For example, Dunkin’ offers lower prices such as its ‘Happy Hour’ of $0.99 any size iced coffee. We also note that Starbucks’ margin performance is in part tied to the cost of coffee, such as the price of Arabica coffee beans, which can be volatile and can be impacted by a variety of factors. Though with a company like Starbucks, it would take a substantial price fluctuation in its input costs to materially affect its financial strength. Starbucks has a net debt position of $700+ million as of the end of fiscal 2015 on the balance sheet, but with free cash flow generation of ~$2.45 billion in the year, we aren’t too worried about its financial health.

The potential to sell products such as coffee blends in grocery stores has risen, offering Starbucks the potential to tap into the market of consumers who primarily drink coffee outside of the coffee shop. The firm has done well in targeting this group as of late, as it has ~500 signature aisles in grocery stores and has become a top provider in the ‘Premium Roast and Ground’ space as well as a major provider of K-cups. This ‘CPG, Foodservice and Other’ segment generated ~$2 billion in sales in fiscal 2015, more than 10% of the total revenue of the company. Its acquisition of Teavana has also helped drive revenue growth, as it continues to generate large sales in US stores ($1 billion fiscal 2015, up 12% from the prior year). It has only just started to introduce its tea line to China and other international countries. Though it may be easy to conclude that this acquisition will be a major driver of sales in the Chinese market, cultural differences may cause differences in preferences of customers. We’re monitoring developments closely.

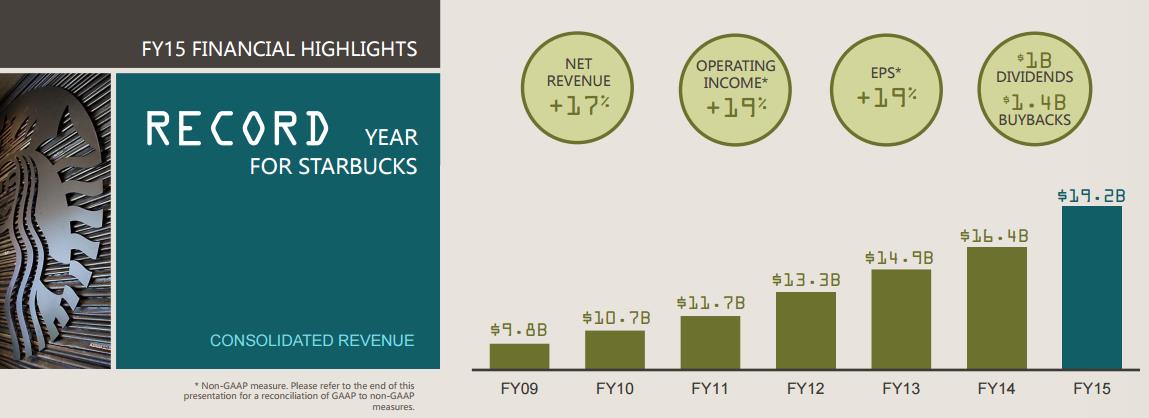

Starbucks continues its consistent year-over-year revenue growth, as it has achieved a record $19.2 billion in fiscal 2015 from $13.3 billion in fiscal 2012, representing a 13% compound annual growth rate (CAGR). The company has also experienced excellent annual growth in operating cash flow, as it has grown to over $3.7 billion in fiscal 2015 from $1.8 billion in fiscal 2012, a 29% CAGR. This strong operating cash flow growth has led to improved free cash flow generation; the firm reported ~$2.45 billion in fiscal 2015, compared to approximately -$550 million (negative ~$550 million) in fiscal 2014, mostly due to litigation charges over a dispute with Kraft (KHC). Since such charges are not recurring, we expect free cash flow generation to remain positive moving forward.

What a fantastic company Starbucks is, but investors are paying up for its earnings, just as consumers are paying up for its coffee. Many are betting Starbucks will grow into its lofty valuation, however, and it may very well do so (it has done so before). Savvy value investors may look for more of a meaningful pullback before considering shares in their portfolios, and that’s where we feel most comfortable. Shares yield ~1.5%.

Image Source: Starbuck’s 2015 10-K