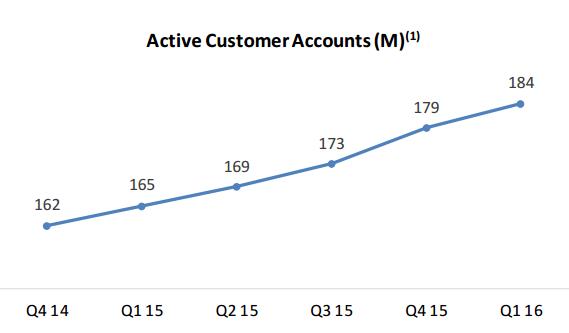

Image: PayPal continues to add millions of active customer accounts each quarter. Source: PayPal’s Q1 2016 Investor Update.

By Brian Nelson, CFA

Revenue up 23%, excluding foreign exchange rate fluctuations. GAAP operating margin up 90 basis points. GAAP earnings per share up 43%, to $0.30. Operating cash flow of $738 million. Free cash flow of $605 million, up 70% year-over-year. 1.4 billion transactions processed. Ended the quarter with 184 million active customer accounts, up 4.5 million. These were just a few headlines in PayPal’s (PYPL) first-quarter report, released April 27.

PayPal is mainstream – it’s no longer just a way to send money between friends, if it truly ever was just this. The secular trend toward a cashless society is benefiting the credit card networks in tangible plastic, but PayPal’s growth engines online continue to fire. No longer is PayPal taboo. The company’s global payments platform is one of the most important options for any business to have for its customers, arguably as important as credit card functionality itself. We talked about the importance of the network effect as a source of a competitive advantage, “Facebook: It’s All about the Vanity of the User,” and PayPal’s business model is yet another illustration of this: as more customers use PayPal, more merchants are attracted to the platform, which drives new users, and so on.

Ways to pay online will continue to proliferate as the industry pie grows, but PayPal continues to gain market share, processing $81 billion in volume (TPV), FX-neutral growth that was materially faster than the pace of e-commerce expansion. Merchant services TPV growth accelerated in the quarter to 39%, while mobile payment volume and TPV on the company’s social media platform (Venmo) jumped 54% and 154% on a year-over-year basis, respectively. We’re watching the rollout of Venmo closely as it may eventually become a preferred way to tap into the millennial payment cycle via apps and other social platforms.

PayPal added a number of high-profile merchants in the period, including Air France (AFLYY) and Panera Bread (PNRA), the latter’s comparable store sales incidentally shining during the first quarter of the year. Relationships with Alibaba (BABA), Facebook (FB), and Spotify were also enhanced. Looking ahead, net revenue growth, excluding foreign exchange fluctuations, of 16%-19% in 2016 offers PayPal investors a nice pace of top-line expansion, and the company reiterated its GAAP earnings per diluted share in the range of $1.09-$1.14 for the year. PayPal continues to work toward becoming an everyday part of its customers’ financial lives, and with switching costs for merchants relatively high, the company has a lot of wiggle room to test innovation to drive further growth without worrying too much about churn.

We continue to like PayPal as a holding in the Best Ideas Newsletter portfolio, and as with Visa (V), it allows us to capture the trend toward a cashless society as well as e-commerce proliferation. We like these “kinds of plays.” When it comes to PayPal or Visa, it doesn’t matter which retailer wins, per se, these companies are going to get their cut. For those investors that may not be interested in PayPal or Visa, recently-initiated Global Payments (GPN) may be worth a look.